George Soros Buying Gold On BREXIT, EU “Collapse” Risk

Commodities / Gold and Silver 2016 Jun 10, 2016 - 02:50 PM GMTBy: GoldCore

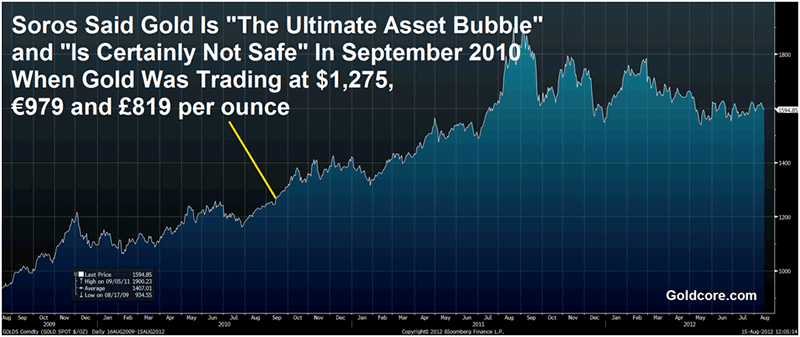

George Soros is again buying gold and selling and going short stocks due to BREXIT and EU “collapse” risk, after a six year hiatus from the gold market.

George Soros is again buying gold and selling and going short stocks due to BREXIT and EU “collapse” risk, after a six year hiatus from the gold market.

The multi-billionaire hedge fund manager, the man who “broke the Bank of England” and one of the richest and most powerful men in the world has now publicly warned that inflation is likely soon and is voicing concerns about BREXIT, the disintegration of the EU, a Chinese financial crash, global contagion and a new World War.

Soros Fund Management, which manages around $30 billion for the Soros family, is now aggressively selling and going short stocks and diversifying into gold and shares in gold mining companies, due to his now even “gloomier” view of the global financial system and the global economic outlook.

Soros has become more involved in trading at his family office, due to his many concerns and the risk that “large market shifts may be at hand”, according to a person familiar with the matter as reported by Bloomberg.

Soros recently warned that the EU is “on the verge of collapse” because of its handling of the Greek economic crisis and refugee crisis and said the prospect of a BREXIT from EU Superstate posed a fresh threat to the EU.

Soros, 85, has been spending more time in the office directing trades and recently oversaw a series of big, bearish investments, said the person, who asked not to be identified discussing private information. Soros Fund Management LLC sold stocks and bought gold and shares of gold miners last quarter, anticipating weakness in various markets, according to a government SEC filing. The Wall Street Journal earlier reported Soros’s decision.

The smart money such as Soros, old money such as Berenger Bank, large institutional money such as Munich Re and Blackrock, who understand diversification and gold’s function as a store of value continues to diversify into gold. There is an awareness with these smart, “insider” money of gold’s benefit as a hedging instrument and safe haven asset but also an awareness that the outlook for prices is very positive, at these depressed levels.

The less informed money continues not to appreciate the risks that are again building in the system. Risk appetite remains high and there is a distinct lack of awareness regarding how risks, such as BREXIT and contagion in the EU, may impact financial markets and traditional assets such as stocks, bonds, property and indeed deposits.

Governments, economists, financial advisers, brokers and of course bankers did not see the first crisis coming in 2008 and they are not seeing it now. Some are simply not informed or aware of the risks and others choose to ignore them and spin the illusion that all is well and there is nothing to be worried about.

The cosy consensus and groupthink of economic recovery continues and there is a remarkable lack of a plurality of opinion and lack of debate regarding the risks posed to savers and investors today.

The real risks of another global financial crisis as warned in recent days by Martin Wolf and Japanese Prime Minister Abe are largely being ignored again – as was the case before the first crisis. A few market observers are warning about and again they are largely being ignored

The inability to look at the reality of the global financial and economic challenges confronting us today will see investors suffer financial losses again. In the coming crisis, depositors and savers are also exposed due to the new bail-in regimes.

Real diversification and an allocation to gold bullion coins and bars remains the key to weathering the second global financial crisis.

Gold and Silver Prices and News

Silver Acting Like ‘Gold on Steroids’ as Assets Near Record High (Bloomberg)

UK clients “seeking to buy gold amid increased risks of a Brexit vote…” (Examiner)

Gold holds near 3-wk high, set for second weekly rise (Reuters)

Euro zone at risk of suffering lasting economic damage – Draghi – (RTE)

Gold near three week high as German bond yields hit new low (Guardian)

3 Reasons Why Gold Won’t Tank – UBS (CNBC)

Commodities super cycle is gathering steam (Marketwatch)

Ireland in ‘frontline’ as Brexit fear sparks sell-off (Examiner)

Unsustainable Debt will Melt most Paper Assets (CTM.com)

Read More Here

Gold Prices (LBMA AM)

10 June: USD 1,266.60, EUR 1,121.07 and GBP 876.87 per ounce

09 June: USD 1,258.35, EUR 1,107.98 and GBP 870.53 per ounce

08 June: USD 1,252.40, EUR 1,101.61 and GBP 851.65 per ounce

07 June: USD 1,241.10, EUR 1,091.42 and GBP 851.02 per ounce

06 June: USD 1,240.55, EUR 1,092.67 and GBP 859.08 per ounce

03 June: USD 1,211.00, EUR 1,086.63 and GBP 839.34 per ounce

Silver Prices (LBMA)

10 June: USD 17.32, EUR 15.33 and GBP 12.01 per ounce

09 June: USD 17.05, EUR 15.03 and GBP 11.79 per ounce

08 June: USD 16.75, EUR 14.73 and GBP 11.50 per ounce

07 June: USD 16.31, EUR 14.36 and GBP 11.18 per ounce

06 June: USD 16.40, EUR 14.46 and GBP 11.39 per ounce

03 June: USD 16.10, EUR 14.45 and GBP 11.17 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.