SPX is Testing Support

Stock-Markets / Stock Markets 2016 Jun 09, 2016 - 03:02 PM GMT The SPX Premarket appears to be challenging the shelf of support at 2111.00. Today is a double Pivot day and 21 calendar days from the May 19 low. A reversal today would create a very left-oriented Cycle, which is bearish.

The SPX Premarket appears to be challenging the shelf of support at 2111.00. Today is a double Pivot day and 21 calendar days from the May 19 low. A reversal today would create a very left-oriented Cycle, which is bearish.

ZeroHedge reports, “Please do not adjust your screens: that off-green color you are seeing, that is not a malfunction. Yes, for the first time in six days, global stocks are lower with the MSCI all-country world index dipping from a 6 month high dragged down by lower European and Japanese equity markets, as the USDJPY dropped to a fresh five-week low while Treasury yields continued to hit new record lows because, as Bloomberg explains,"traders assessed the outlook for the global economy." It is unclear if that means that the outlook is suddenly much brighter. After all, it was last Friday's recessionary payrolls that sent the S&P soaring to just shy of all time highs, so in this bizarro, centrally-planned "market", we need more clarification.”

VIX futures are higher and may be challenging or above the 50-day Moving Average at 14.54.

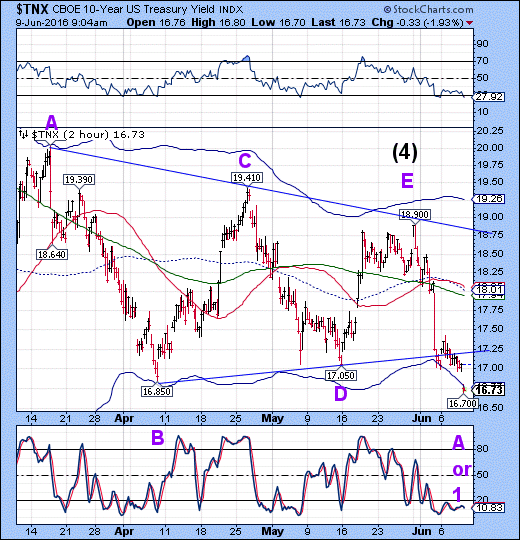

TNX declined beneath its April 7 low at 16.85. The decline appears complete for the moment and TNX may be due for its Master Cycle low in the next week. However, the current Master Cycle may stretch to the end of June, if the Pi date on July 3 is active.

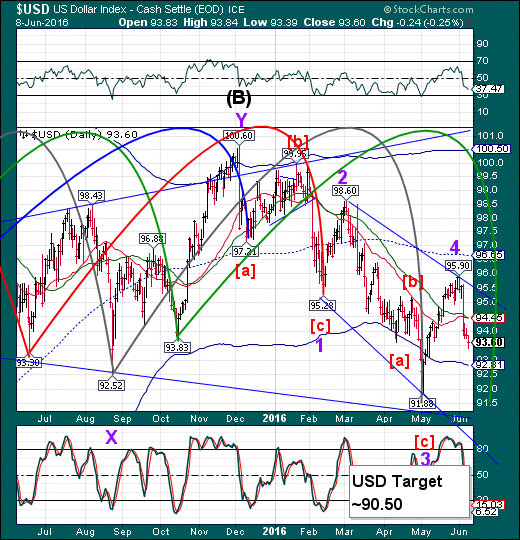

USD is having its bounce that I mentioned in the Mid-Week Report. It may seek the double resistance at 94.45 before resuming its decline.

Commentators are blaming the SPX decline on the Dollar bounce. They have it wrong. The weaker dollar may be causing overseas investors to pull money out of the market.

This may e especially so with the SPX vs. Yen. If the Yen continues to rally and SPX weakens, this may be a trigger for the sell-off in domestic equities.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.