Former Bank of England head Mervyn King joins Alan Greenspan in advocating Gold Ownership

Commodities / Gold and Silver 2016 Jun 07, 2016 - 03:44 PM GMT In The End of Alchemy, Mervyn King, the former head of the Bank of England, writes of central banks’ frustration in dealing with the stagnant global economy. “Central banks,” he says, “have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced.”

In The End of Alchemy, Mervyn King, the former head of the Bank of England, writes of central banks’ frustration in dealing with the stagnant global economy. “Central banks,” he says, “have thrown everything at their economies, and yet the results have been disappointing, Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced.”

Similarly, former IMF chief economist, Olivier Blanchard was recently quoted in the Financial Times as saying: “And so the question is why is it, that with no fiscal consolidation and banks in decent shape, at least in terms of lending, and zero interest rates, we don’t have an enormous demand boom? That is now the puzzle.”

Alan Greenspan, in a recent interview with Fox Business News, offers the beginnings of an answer to Blanchard’s question – a question which happens to be on the minds of not just policy-makers but ordinary investors as well. “Our problem,” he said, “is not recession which is a short-term economic problem. I think you have a very profound long-term problem of economic growth at the time when the Western world, there is a very large migration from being a worker into being a recipient of social benefits as it is called. And this is legally mandated in all of our countries.” The western world, he concludes, is headed to “a state of disaster.”

Alan Greenspan, in a recent interview with Fox Business News, offers the beginnings of an answer to Blanchard’s question – a question which happens to be on the minds of not just policy-makers but ordinary investors as well. “Our problem,” he said, “is not recession which is a short-term economic problem. I think you have a very profound long-term problem of economic growth at the time when the Western world, there is a very large migration from being a worker into being a recipient of social benefits as it is called. And this is legally mandated in all of our countries.” The western world, he concludes, is headed to “a state of disaster.”

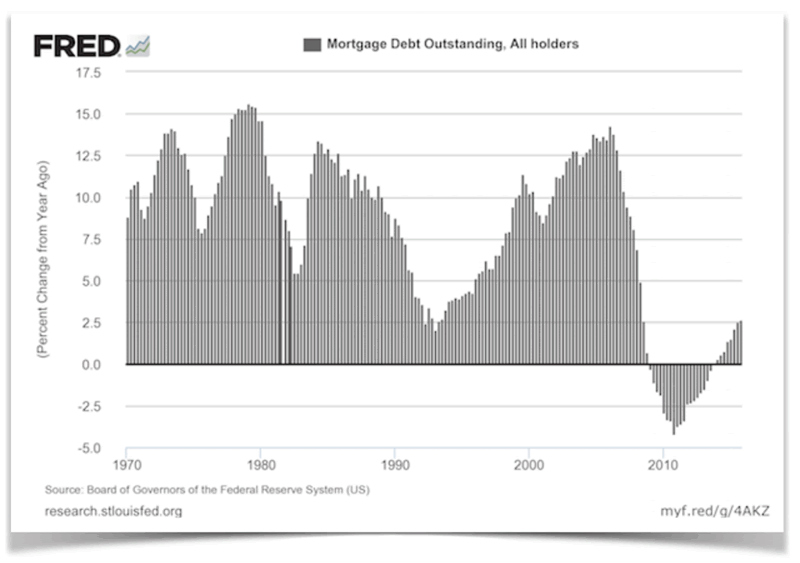

The problem at its core is demographic. Retiring baby boomers are paying off debt, not borrowing more. As time goes by, they willl increasingly become consumers of government largesse, as Greenspan points out, rather than its suppliers. The Millennials and GenXers are struggling with student debt, low incomes and paltry savings. For them, owning a home, the traditional means to stimulating overall demand, is more a future consideration than anything imminent. (In 1960 62% of 18 to 34-year-olds lived in their own households. By 2015, that number had dropped to just under 32%.) Outstanding mortgage debt, as a result of these demographic shifts, has gone into a free-fall. (See chart immediately below.) Simply put, the problem for the global economy, as King’s successor Mark Carney recently pointed out, boils down to the lack of demand – for goods and services and for money itself in the form of credit.

_____________________________________________________________

![]() Reader note: This article is reprinted from the June, 2016 issue of USAGOLD’s NEWS & VIEWS. For open access to the rest of this month’s issue, we invite you to register here. In addition, you will also receive e-mail notification when future issues are published. Free subscription. Over 20,000 subscribe to this widely-read newsletter.

Reader note: This article is reprinted from the June, 2016 issue of USAGOLD’s NEWS & VIEWS. For open access to the rest of this month’s issue, we invite you to register here. In addition, you will also receive e-mail notification when future issues are published. Free subscription. Over 20,000 subscribe to this widely-read newsletter.

_____________________________________________________________

Fiat paradigm falling apart

In short, the whole fiat paradigm of lending money into existence is falling apart, and no one seems to know what to do about it. If you would have told me in 2007 that within a decade we would be facing the possibility of a deflationary breakdown, I would not have believed you. King concludes that “without reform of the financial system, another crisis is certain… sooner rather than later.”

King’s use of the word alchemy in connection with central banks’ policies conjures all sorts of allusions. As we all know, the purpose of alchemy was to transform base metals to gold. Likewise, the contemporary central bank is alchemic in nature in that it professes to replace gold-backed money with sound and effective monetary policies. Those who believe that the central banks are capable of delivering consistently on that promise are not likely to become gold owners. Those who question it will continue to own gold and silver in their investment portfolios as a countermeasure, and in fact add to those holdings as circumstances require.

It is quite clear that the former Fed chairman and the former governor of the Bank of England are in agreement that the global economy is tacking against some heavy headwinds. The demographic shift Greenspan cites and King’s admission of policy-makers failure in dealing with it point to continuing long-term demand for gold and silver not just among private investors, but among funds, institutions and central banks as well. In addition, it is the failures (or potential for failure) in policy, as cited by both King and Greenspan, that will give pause even to those who most ardently profess undying faith in the central banks. Along these lines, it is interesting to note that Greenspan has already suggested gold as “a good place to put money these days given the policies of governments.” Mervyn King may not be far behind.

Post publication editor’s note (6-7-2016): No sooner had the ink dried on the June issue of our newsletter (of which this article was a part) than Mervyn King was quoted in the World Gold Council’s Gold Investor magazine as advocating gold ownership at a time of what he calls “radical uncertainty.” Some might think that we had an inside track on the World Gold Council interview released this morning, but we did not. Though we have a relationship with the World Gold Council that goes back decades, it does not send us advance copies of its publications. The similarities between King’s views and those of his old friend, Mr. Greenspan, were striking thus the conclusion that logically the former BoE governor might be headed in gold’s direction.

“If we don’t quite know what the future holds,” says King, “there is little point in getting carried away by very fancy mathematical calculations of optimal portfolios. Don’t rely on past data to be a good guide. Try to think through what mix of assets gives you the best chance of surviving some big event. That must mean including assets that are negatively correlated or uncorrelated in your portfolio.”

“And I am very struck by the fact that over many many years, central banks, governments and individuals have always, despite the protestations of economists, held some gold in their portfolio. Obviously, there is no high running return, but when unexpected things happen, particularly when governments rise and fall, then gold is a means of payment that everyone is always prepared to accept. And I think that’s why even central banks have always had a role in their portfolios for gold,” he adds.

I might add that the very same logic applies to gold as part of the private investment portfolio. For the full article, which includes some of Mr. King’s prescriptions for the global economy, we recommend the World Gold Council’s Gold Investor magazine. There you will find more good reading on current happenings in the gold market.

____________________________

Reader note: You just read the lead article for the June, 2016 issue of USAGOLD’s NEWS & VIEWS. For open access to the rest of this month’s issue, we invite you to register at the link below. You will also receive e-mail notification when future issues are published. Free subscriptions. Over 20,000 subscribe to this newsletter . . . Please register here.

June issue: What’s behind gold’s recent sell-off? What is the real reason why central banks can’t get the economy moving and what does it for future gold demand? Is there a major run on London’s massive gold vaults and where did all the gold go? What do 17th century Dutch tulip bulbs have to do with your portfolio today (the nature of financial mania)? And more.

___________________

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.