Bonds, Stocks, Gold and Silver ‘Inflation Trade’ Alive and Well

Stock-Markets / Financial Markets 2016 Jun 04, 2016 - 04:10 PM GMTBy: Gary_Tanashian

I don’t write the title because the precious metals took off today on the bad jobs report. Far from it. That is what gold is supposed to do under such circumstances as its fundamentals got a boost and the perceptions of a hawkish Fed got repelled.

I don’t write the title because the precious metals took off today on the bad jobs report. Far from it. That is what gold is supposed to do under such circumstances as its fundamentals got a boost and the perceptions of a hawkish Fed got repelled.

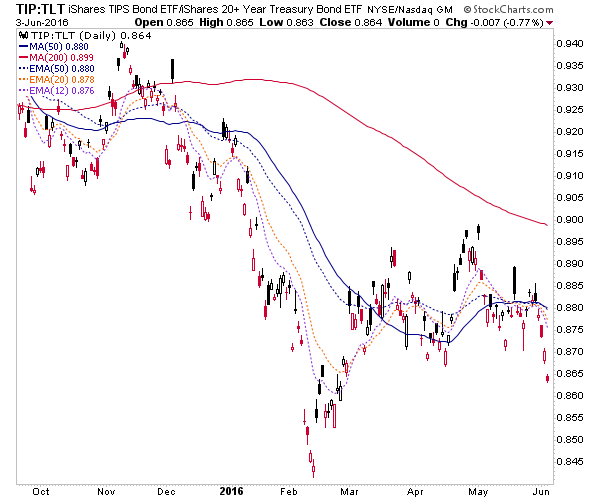

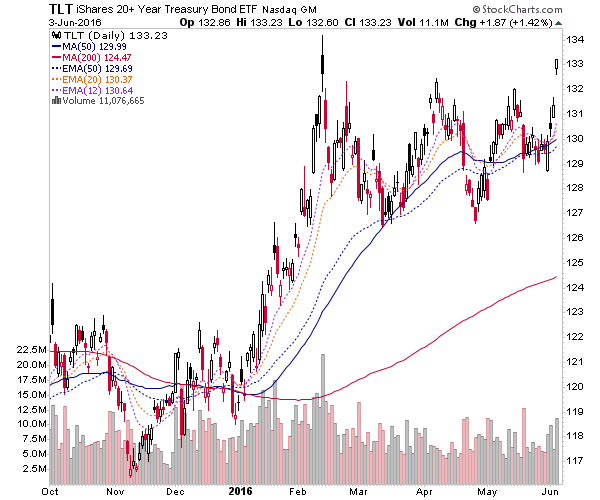

I write the title despite the fact that the inflation barometer, TIP/TLT, tanked and commodities were moderate, post-jobs. Yesterday we noted: Inflation Expectations Sagging, including a declining TIP/TLT and a bullish looking TLT (each a form of non-inflationary signaling). Today they got bearisher and bullisher, respectively.

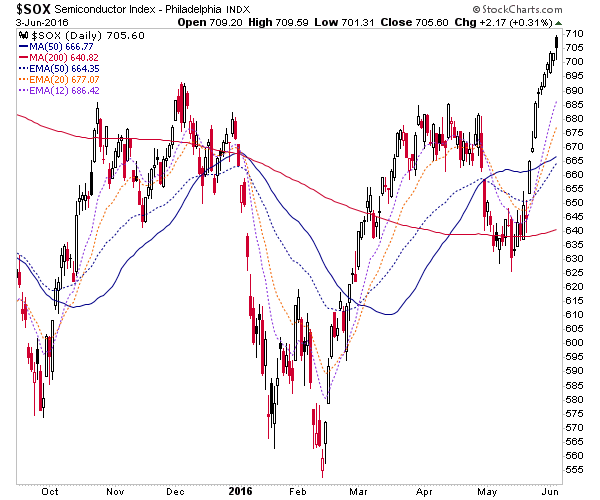

What happened today put Janet Yellen back in a box. But despite a somewhat down day in the broad market (after recovery from the opening downside shakeouts) the Semiconductor index continues apace. What does it know? Maybe what we have known and bull horned about far and wide for a couple weeks now? Maybe the Semi equipment sector is looking forward as we have shown it has done before.

So the Fed is in a box, the Semis are gaining with their own improving fundamentals and the seeds are sown for a coming next phase in the ‘inflation trade’.

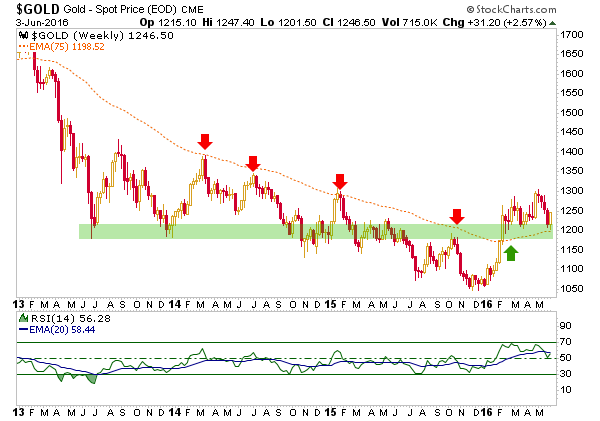

Among several other charts and time frames, we noted in an update yesterday morning gold and silver’s decline to what had been key ‘re-test’ support all along. Had I been a resolute and assured gold bull all along? Yes (I have a gold position that is nearly 1.5 decades old) and no (I made the overly conservative decision to be partially hedged on my miner positions into the Payrolls report). From the update…

“The weekly chart we have reviewed for many months however, has made a nice touch of the key moving average. We have made a big stink about the fundamentals taking a turn for the worse lately and they have. But that is the point, things change and sometimes quickly. Technically, gold is simply making a test that it was always going to make. We’ll continue to track the funda situation but this is a classic retest and so far it is successful.”

Things changed rather quickly I’d say. Here is the current status of the chart from that update.

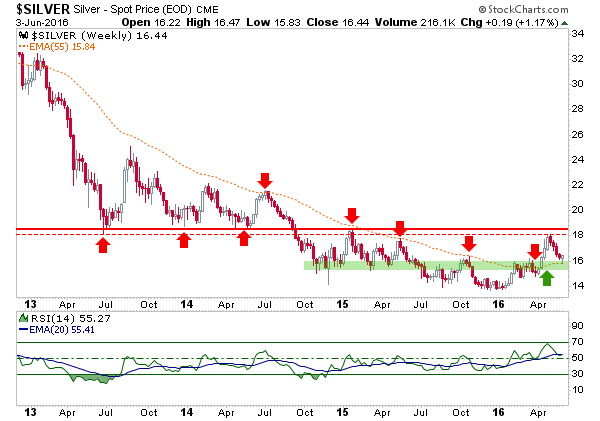

Silver as well was noted to be at key retest support.

“Silver daily is interesting as it has touched the projected support area. It can settle further and our target ranges from 15 to 15.75. But a lot of good corrective work has been done here. Silver weekly makes that point as well. A near perfect touch of the EMA 55.”

The bottom line is that in a span of a week we have gotten key positive data on the Semiconductor sector, the ‘equipment’ segment of which is a leading indicator and speculated this could come with an inflationary growth phase. We have also gotten very negative May employment data following up a poor April report.

This puts the Fed on hold at a time when an economic indicator is actually going positive beneath the surface. Think about it; how many people watch the Semi equipment sector? You? Me? The other guy? How many people (and machines) watch Payrolls? The world?

As always, we should watch the interplay between gold and silver. The Gold-Silver ratio held firm today in line with the non-inflationary signals of the first 2 charts above. But silver would resume leadership if inflation (and a wider range of investments) is to be the play. Alternatively, gold stocks would be the ‘go to’ sector if we slide back into economic contraction and a deflationary backdrop. That is not currently favored.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.