Now Japanese Prime Minister Abe Predicts Imminent Global Economic Catastrophe

Economics / Economic Collapse Jun 01, 2016 - 12:32 PM GMTBy: Jeff_Berwick

We continue to report on important mainstream investors, professional and private, who have warned about an impending, global financial catastrophe. Now, add Japanese Prime Minister Shinzo Abe to that list.

We continue to report on important mainstream investors, professional and private, who have warned about an impending, global financial catastrophe. Now, add Japanese Prime Minister Shinzo Abe to that list.

George Soros, Stanley Druckenmiller, and Carl Icahn among others have all made dire statements. They’ve also reconfigured their portfolios and taken positions in gold and silver and shorted the market.

The latest to join this list of doomsayers is Japanese Prime Minister Abe. This past Thursday at the G7 meeting he warned about the upcoming global crisis.

Abe was trying to generate support for global fiscal stimulus, according to reports. He told G7 members that the present times reminded him of the “post-Lehman era” in 2008. Lehman went bankrupt in September of that year and by the end of 2009, stock markets lost as much as half their value.

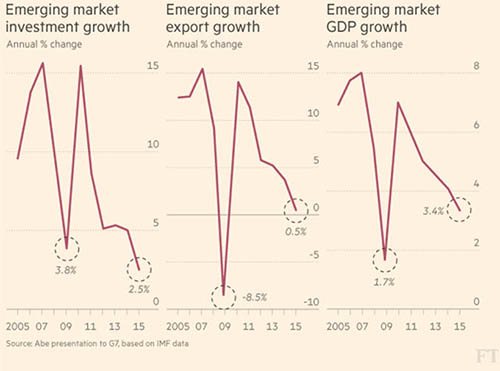

He even displayed a number of charts supporting his position that we are on the cusp of a massive collapse.

He showed how commodities have now sunk 55%, the exact same amount they fell during the last crisis, during the Shemitah year, 2008.

He also showed how indicators in emerging market growth have slowed to near 2008 levels as well.

Abe wanted the rest of the G7 to issue a public warning about what he believes is going to happen to his country and to the world from an economic standpoint.

Instead, Abe’s comments received a near media blackout. Some media mentioned it but certainly not as headline news. We didn’t even hear about it until today, five days later.

You’d think this would be pretty big news. The Prime Minister of one of the biggest economies in the world just made a presentation saying we are on the brink of collapse not only in Japan but worldwide and it was mostly swept under the rug.

Mainstream media explained that Abe actually needed to raise the alarm because he wanted to put off a significant tax increase in Japan. But as we pointed out recently, billionaire bond investor Bill Gross concurs with Abe, certainly when it comes to Japan. He said in an interview that Japan is not really solvent anymore and that Japan’s central bank needs to buy Japanese public debt and retire it. You can see that report HERE.

Imagine if Barack Obama made a dire plea at the G7 that everyone should prepare for economic Armageddon and even brought up facts and data to support his position… it’d send world stock markets plunging. Instead, Barack touts that anyone saying the US economy is doing poorly is “peddling fiction”.

But when the Japanese Prime Minister says it, it is barely reported. There’s a reason. The same globalist elites who are orchestrating the coming collapse own all the major media companies. They don’t want Joe the Plumber and main street to get an inkling that something is wrong until it is too late… just like in 2008.

It makes perfect sense within the context of what we understand about Shemitah Trends and Jubilee 2016… as Jubilee 2016 is a year meant to put the building blocks of global government into place. The last thing G7 leaders want is to overly alarm people and thus come under pressure to prepare for an economic catastrophe.

The idea is NOT to prepare for economic catastrophe.

It could even be that Abe’s role was somehow pre-planned to warn leaders and thus generate headlines that would show discussions at the highest levels. The IMF and the World Bank have also warned of an impending crisis… even Alan Greenspan. Post-collapse, they can always point to Abe’s warnings to say they understood what could happen, but that none of these warnings were picked up in a meaningful way.

Now, if an ape gets shot after a zombified mother accidentally drops her toddler into a gorilla cage… well, that’s news that everyone must know! But, the coming biblical-level economic collapse that Jim Rogers says could wipe out millions of Americans? No need to focus on that!

For this reason most people will be blindsided by the collapse just like they were in 2008.

Some people won’t be, however. Many of them are subscribers to The Dollar Vigilante newsletter. Not only will they be more prepared to survive the coming chaos but many have already enriched themselves by positioning in our recommended investments and trades in precious metals, gold stocks, bitcoin and more.

You might be thinking it is too late, like this new subscriber who posted in our subscriber’s only Facebook group:

As you can see, many subscriber’s responded that it is never too late… although I don’t know how much longer we’ll be able to say that.

That’s one of the great thing about being a TDV subscriber, though. You get access to thousands of others who have already begun to take action to protect their future. Many of them are very happy to help those new to the group who may need some hand-holding or specialized advice. Plus we offer plenty of resources to those who are new to investing in precious metals, cryptocurrencies and gold mining stocks like our well-received Beginner’s Guide to Investing, free to subscribers.

That’s one of the great thing about being a TDV subscriber, though. You get access to thousands of others who have already begun to take action to protect their future. Many of them are very happy to help those new to the group who may need some hand-holding or specialized advice. Plus we offer plenty of resources to those who are new to investing in precious metals, cryptocurrencies and gold mining stocks like our well-received Beginner’s Guide to Investing, free to subscribers.

We’ve built all those resources over the last six years because we knew this time was coming. And we knew people would desperately need these resources, as they simply won’t get them from the mainstream media nor from their Wall Street broker or government-registered financial advisor.

Every day, big name investors, economists and now even Prime Ministers are warning of a coming catastrophe that will wipe out the world-wide economy, most banks and even entire countries. And all the resources you need to not only survive it but prosper through it are right here.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.