Gold Price Not Ready for a Final Intermediate Cycle Low

Commodities / Gold and Silver 2016 May 31, 2016 - 12:26 PM GMTBy: Gary_Savage

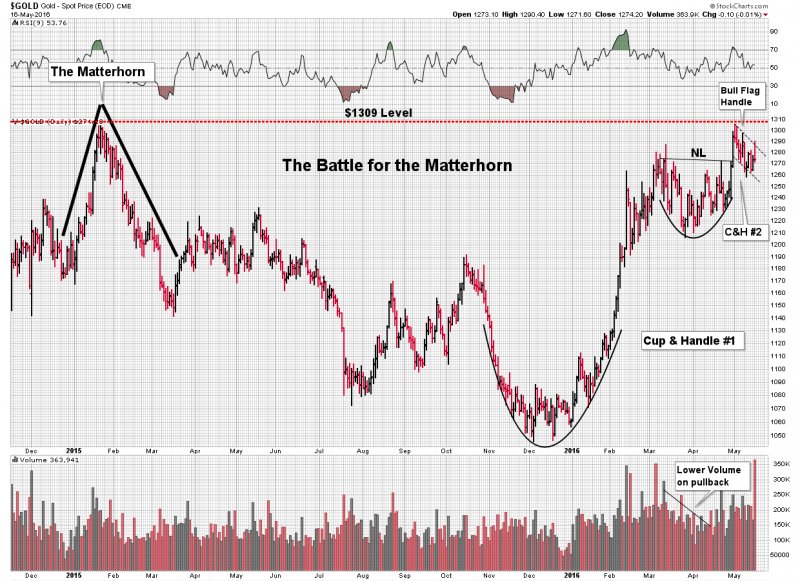

The voice of complacency says no pullback in gold. Anyone who took profits will not get a chance to reenter. Here is the chart. Clearly this analyst was expecting gold to soon take out the 2014 high. It’s forming a bull flag and cup and handle patterns in preparation for the rocket launch right?

The voice of complacency says no pullback in gold. Anyone who took profits will not get a chance to reenter. Here is the chart. Clearly this analyst was expecting gold to soon take out the 2014 high. It’s forming a bull flag and cup and handle patterns in preparation for the rocket launch right?

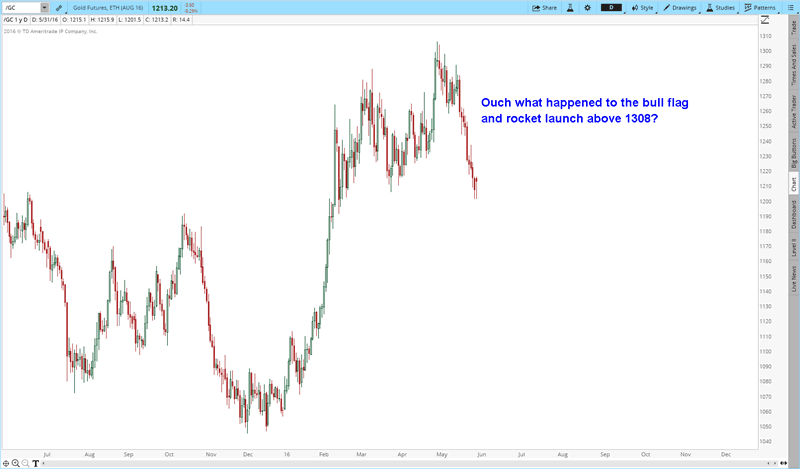

Well this is why I don’t put a lot of faith in chart patterns. They often morph into something else. Doesn’t look much like a bull flag, or a cup and handle anymore does it?

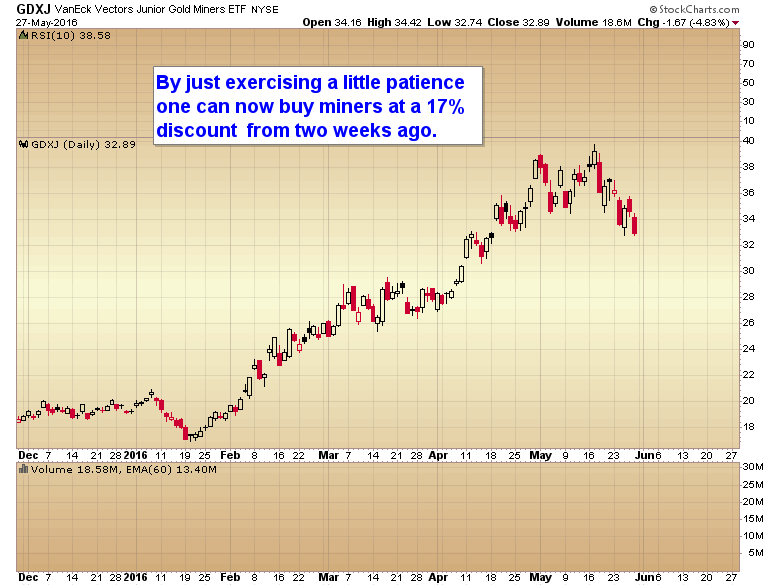

“Bulls won’t get a reentry into the metals sector”

I’ve got news for you, We already have a 17% better entry.

I’ll say it again. At intermediate turning points, either tops or bottoms, you need different tools to anticipate the turns. If you strictly follow chart patterns, and technicals like most amateur analysts, more often than not you are going to get caught on the wrong side of the market.

And anyone who tries to convince you that the volatile metals market won’t have an intermediate degree correction, or that it will be mild just hasn’t been paying attention. Gold is a very emotional asset for most traders. That means it tends to have big swings in both directions.

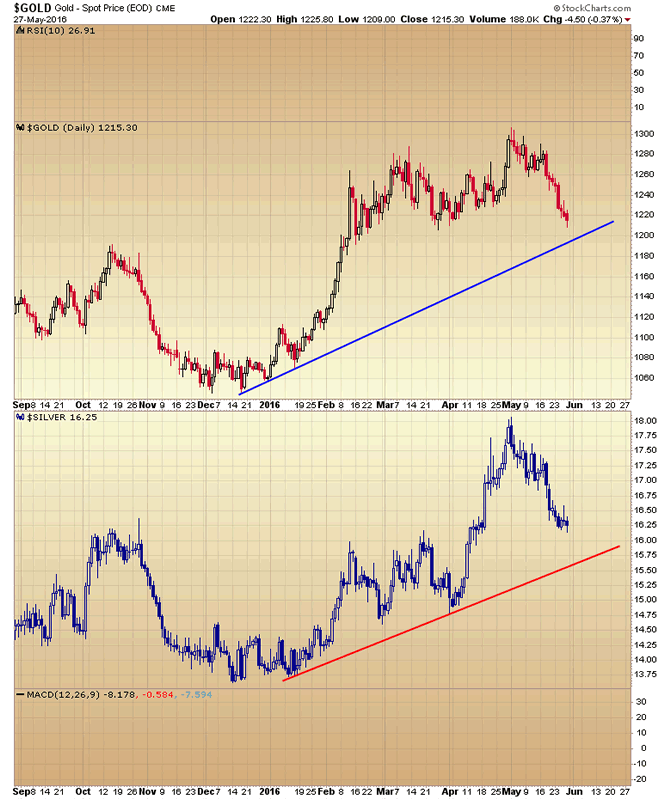

Let me stress again to have some patience. Both gold and silver will need to break their intermediate trend lines before the intermediate cycle low can be complete.

I’d also like to see the commercials reduce their large short position considerably more, and I would like to see sentiment move a lot further in the bearish direction before I try to call an intermediate cycle low.

Like our new Facebook page to stay current on all things Smart Money Tracker

Gary Savage

The Smart Money Tracker

Gary Savage authors the Smart Money Tracker and daily financial newsletter tracking the stock & commodity markets with special emphasis on the precious metals market.

© 2016 Copyright Gary Savage - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.