Fannie and Freddie Rescue Could Result in a Run on the US Dollar

Stock-Markets / Credit Crisis 2008 Jul 20, 2008 - 03:12 PM GMT “The end is neigh” was what many despondent investors were starting to believe as the past week kicked off with volatile trading amid concerns that US regional bank IndyMac's demise was a harbinger of many more bank failures.

“The end is neigh” was what many despondent investors were starting to believe as the past week kicked off with volatile trading amid concerns that US regional bank IndyMac's demise was a harbinger of many more bank failures.

Furthermore, Treasury Secretary Henry Paulson's plan to rescue the Government Sponsored Enterprises (GSEs), Fannie Mae (FNM) and Freddie Mac (FRE), left investors unconvinced.

The US government plan caused some agitation since Paulson was essentially asking for a blank check to ensure the funding backstop would be successful in helping the GSEs fulfill their role of providing financing for the US mortgage market. Debt holders were happy with the implications of the plan, but equity holders faced the possible dilution from a government purchase of the equity and/or the possibility of the equity becoming worthless.

As the credit crisis approached its first anniversary – literally a “year of living dangerously” – SEC Chairman Christopher Cox's announcement that naked short selling of 19 financial companies, including the GSEs, would no longer be allowed, set the stage for a reversal of fortune.

The SEC's announcement, together with a sharp drop in oil prices and a series of better-than-feared earnings announcements from US banks – including JPMorgan (JPM), Citigroup (C) and Wells Fargo (WFC) – triggered a recovery in investors' risk appetite, resulting in a strong stock market rebound.

The SEC's announcement, together with a sharp drop in oil prices and a series of better-than-feared earnings announcements from US banks – including JPMorgan (JPM), Citigroup (C) and Wells Fargo (WFC) – triggered a recovery in investors' risk appetite, resulting in a strong stock market rebound.

This type of event was precisely what Charles Kirk ( The Kirk Report ) was referring to when he said: “Technically, we are scraping against the bottom of the long-term trend channel in the S&P 500 but we need something to go right for a change for this constant selling pressure to end.”

Fed Chairman Ben Bernanke was in the hot seat on Tuesday, delivering his semi-annual monetary policy testimony before the Senate Banking Committee in Washington. In short, he abandoned his June assessment that the threat of an economic downturn had diminished, telling lawmakers that growth and inflation risks were increasing. There were “significant downside risks to the outlook for growth”, and “upside risks to the inflation outlook had intensified,” said Bernanke. His testimony had little impact on financial markets.

“So is the decline over?,” asked Richard Russell ( Dow Theory Letters ). “I've said that I can't see the market hitting bottom until at least the financials stop declining. Did the financials make the crucial turn to the upside yesterday? We should know shortly.”

David Fuller ( Fullermoney ) adds: “There is still plenty of fear and uncertainty out there. However, I think most stock markets have reached medium-term lows and should range higher in tradable rallies over at least the next month or two.”

On the other hand, Bill King ( The King Report ) sees more pain: “For about one year we tried to make two points: 1) If you're not scared, you're not doing your work; and 2) If you aren't negative, there is no fathomable non-violent environment that would make you negative.”

In my opinion, it's too soon to call a major market bottom, but the short-term picture has certainly improved for the better. Technical rallies aside, I still believe that the convalescence period will not be an overnight affair. Why is it that the Cat Stevens lyrics “… oh baby baby it's a wild world …” keep mulling through my head!

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

“Global business confidence has remained in a tight range since late May consistent with a global economy that is barely growing. Developed economies including the US, Europe and Japan are contracting moderately, while most developing economies are expanding moderately,” reported the Survey of Business Confidence of the World conducted by Moody's Economy.com .

A barrage of economic reports were released in the US over the past week (as summarized in the table below), none of which changed the outlook for economic growth, housing and inflation in any meaningful way.

Regarding the outlook for interest rates, Asha Bangalore ( Northern Trust ) said: “Chairman Bernanke's testimony suggested that the Fed is on hold, for now. The Fed is a tight spot and the best it can do in the months ahead is to help stabilize financial market conditions, with one of the prerequisites for this being an accommodative stance … given the backdrop of a housing market recession, a credit crunch, and weak real consumer spending.”

No short-term remedy for the economic woes exists, as John Mauldin ( Thoughts from the Frontline ) stated: “… we are in for a period of very tepid growth that will last through at least 2009. We have to work our way through the after effects of the twin bubbles of housing and the credit crisis bursting. There is no magic Fed wand. That simply takes time. No (rational) government or Fed policy is going to change the facts on the ground (although they can make things worse). But, in the fullness of time, we will in fact get through this.”

It was not only in the US that surging inflation was on centre stage, but elsewhere in the world Thailand, Mexico, the Philippines and Turkey increased interest rates in reaction to mounting inflationary pressures.

Mildly good news, however, was that Chinese consumer price inflation declined from 7.7% in May to 7.1% last month, whereas the economy grew 10.1% in the second quarter, down from 10.6% in the first – the fourth successive quarter in which growth slowed and the lowest rate since the last quarter of 2005.

The annual rate of Eurozone consumer price inflation in June was 4% while prices in the UK last month rose by 3.8% in year-ago terms. Both figures were significantly higher than the European Central Bank's and Bank of England's inflation targets.

As widely anticipated, the Bank of Japan left the overnight call rate target at 0.5% following last week's two-day monetary policy meeting.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Jul 15 | 8:30 AM | Core PPI | Jun | - | 0.3% | 0.3% | 0.2% |

| Jul 15 | 8:30 AM | NY Empire State Index | Jul | -4.9 | -5.0 | -8.0 | -8.7 |

| Jul 15 | 8:30 AM | PPI | Jun | - | 1.3% | 1.3% | 1.4% |

| Jul 15 | 8:30 AM | Retail Sales | Jun | 0.1% | 0.5% | 0.4% | 0.8% |

| Jul 15 | 8:30 AM | Retail Sales ex-auto | Jun | 0.8% | 1.0% | 0.9% | 1.2% |

| Jul 15 | 8:30 AM | PPI | Jun | 1.8% | 1.3% | 1.3% | 1.4% |

| Jul 15 | 8:30 AM | Core PPI | Jun | 0.2% | 0.3% | 0.3% | 0.2% |

| Jul 15 | 10:00 AM | Business Inventories | May | 0.3% | 0.5% | 0.5% | 0.5% |

| Jul 16 | 8:30 AM | Core CPI | Jun | - | 0.2% | 0.2% | 0.2% |

| Jul 16 | 8:30 AM | CPI | Jun | 1.1% | 0.7% | 0.7% | 0.6% |

| Jul 16 | 8:30 AM | Core CPI | Jun | 0.3% | 0.2% | 0.2% | 0.2% |

| Jul 16 | 9:00 AM | Net Foreign Purchases | May | $67.0B | NA | $65.0B | $111.9B |

| Jul 16 | 9:15 AM | Capacity Utilization | Jun | 79.9% | 79.4% | 79.4% | 79.6% |

| Jul 16 | 9:15 AM | Industrial Production | Jun | 0.5% | 0.2% | 0.0% | -0.2% |

| Jul 16 | 10:30 AM | Crude Inventories | 07/12 | - | NA | NA | -5840K |

| Jul 16 | 10:35 AM | Crude Inventories | 07/12 | - | NA | NA | -5840K |

| Jul 16 | 2:00 PM | FOMC Minutes | Jun 25 | - | - | - | - |

| Jul 17 | 8:30 AM | Building Permits | Jun | 1091K | 980K | 965K | 978K |

| Jul 17 | 8:30 AM | Housing Starts | Jun | 1066K | 985K | 960K | 977K |

| Jul 17 | 8:30 AM | Initial Claims | 07/12 | 366K | 376K | 380K | 348K |

| Jul 17 | 10:00 AM | Philadelphia Fed | Jul | -16.3 | -15 | -15.0 | -17.1 |

Source: Yahoo Finance , July 18, 2008.

Next week's economic highlights, courtesy of Northern Trust , include the following:

1. Leading Indicators (July 21): Interest rate spread and supplier deliveries are the only two components likely to make a positive contribution in June. Stock prices, initial jobless claims, manufacturing workweek, consumer expectations, real money supply and building permits are expected to make negative contributions. Forecasts of money supply and orders of consumer durables and non-defense capital goods are used in the initial estimate of the leading index. Consensus : -0.1%

2. Existing Sales (July 24): The market consensus is a decline in sales of existing homes during June to an annual rate of 4.94 million from 4.99 million in May. Existing home sales have dropped 15.9% from a year ago. The largest year-to-year decline in the current business cycle is a 23.8% drop in February 2008. Consensus : 4.94 million versus 4.99 million in May.

3. New Home Sales (July 25): Sales of new homes are expected to post a drop in June to an annual rate of 505,000 from 512,000 in May.

4. Other reports : Consumer Sentiment Index (July 25).

Markets

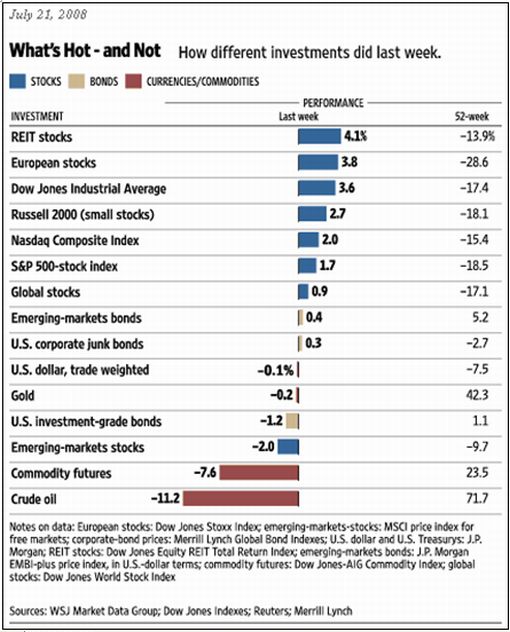

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , July 21, 2008.

Equities

Global stock markets staged a strong recovery last week after having declined for six consecutive weeks. The Dow Jones World Index registered an increase of 0.9% for the week, after a positive about-turn on Wednesday as a result of a dramatic slide in oil prices, better-than-feared earnings numbers for a number of US banks, and the SEC's moves to curb short selling of certain financial firms.

The Japanese Nikkei 225 Average (-1.8%) was the only developed market not participating in the rally and shared this dubious honor with emerging markets in general (-2.0%). Pakistan (-12.5%), Thailand (-9.0%), Indonesia (-7.2%), Taiwan (-5.9) and South Korea (-3.7%) all experienced a torrid time, with Turkey (+8.4%) being one of the few emerging markets gaining ground.

The US stock markets all improved, as shown by the major index movements: Dow Jones Industrial Index +3.6% (YTD -13.3%), S&P 500 Index +1.7% (YTD -14.1%), Nasdaq Composite Index +2.0% (YTD 13.9%) and Russell 2000 Index +2.7% (YTD -9.5%).

Four financial industry groups were among the top ten performers in the US this week: other diversified financial services (large banks), thrifts and mortgage finance, diversified banks, and investment banks and brokers were up 22%, 18%, 16% and 15% respectively. The homebuilding group (+19%) was also among the outperformers.

On the red side of the scale, the coal and consumable fuel group (-18%) was the worst performer, selling off in sympathy with declining prices of crude oil and natural gas. Similarly, other oil- and gas-related groups (integrated oil and gas, oil and gas exploration and production, and gas utilities) underperformed.

Click the thumbnail below for a market map, courtesy of Finviz.com , providing a quick overview of the performance of the various segments of the S&P 500 Index over the week.

As far as specific companies were concerned, Wells Fargo (WFC) added to the spark that fueled the rally in financials. The company delivered better-than-expected earnings, accompanied by an announcement of a 10% increase in the annual dividend.

The coming week will be another busy week of earnings reporting and should provide some clarity on whether last week's good numbers were an aberration or perhaps the start of a new trend.

Fixed-interest instruments

Government bonds experienced a volatile week, with yields benefitting from safe-haven buying early in the week, but then rising as investors switched from bonds to equities.

Yields kicked up as investors agonized about accelerating inflation throughout the world. The ten-year US Treasury Note increased by 13 basis points during the week to close at 4.09. Similarly, the UK ten-year Gilt yield rose by 14 basis points to 5.04% and the German ten-year Bund yield by 12 basis points to 4.58%.

Yields kicked up as investors agonized about accelerating inflation throughout the world. The ten-year US Treasury Note increased by 13 basis points during the week to close at 4.09. Similarly, the UK ten-year Gilt yield rose by 14 basis points to 5.04% and the German ten-year Bund yield by 12 basis points to 4.58%.

US mortgage rates also increased sharply, with the 15-year fixed rate rising by 22 basis points to 5.98% and the 5-year ARM 20 basis points higher at 5.88%.

Credit markets eased somewhat as shown by the slightly narrower spreads of both the CDX (North American, investment grade) Index and the Markit iTraxx Europe crossover Index.

Currencies

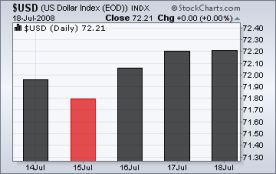

The US dollar fell to a record low of $1.6038 against the euro, before reversing course and improving in line with US stock markets. Expressed against a basket of currencies, the greenback ended the week 0.4% higher.

Individually, the dollar gained against the euro (-0.6%), the Swiss franc (-0.7%) and the Japanese yen (-0.7%). The latter two currencies were negatively affected by less risk averse investors seeking higher yields elsewhere. The British pound (+0.4%) confounded pundits and was the only major currency making headway against the dollar.

Thailand and the Philippines raised interest rates in an attempt to combat inflation, resulting in the baht (+0.9%) and the peso (+2.9%) gaining against the dollar.

Commodities

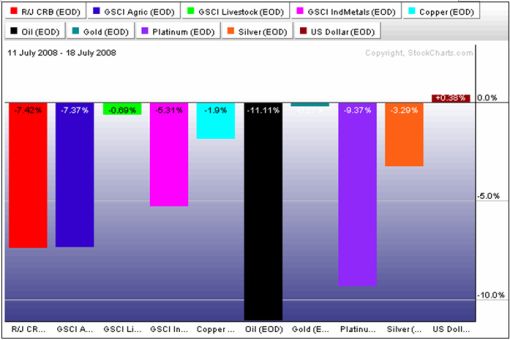

In the midst of all of the action last week, oil prices corrected sharply. After touching $146.37 at its high on Monday, West Texas Intermediate ended Tuesday's session at $138.74. The selling persisted for the remainder of the week, with prices settling at $134.60 on Wednesday, $129.29 on Thursday and $128.96 on Friday. The latter price marked an 11.2% decline from the prior week's close.

Worries about demand destruction, an easing of geopolitical tensions and bearish oil and natural gas inventory reports all played a role in driving prices lower.

The sharp pull-back in oil prices weighed on the entire commodities complex, with the chart below showing the past week's negative performance of the various commodities.

In summary, although the near-term outlook has improved and the long-awaited technical stock market rally has probably commenced, it is premature to cast caution to the wind. Now for a few news items and some words and charts from the investment wise that will hopefully assist in navigating the topsy-turvy markets.

Source: Gary Varvel, Slate , July 16, 2008.

Goldman Sachs: Macro-economic themes for 2nd half of 2008

“We have left a volatile first half of the year behind us and now need to determine what we think will happen in the 2nd half of 2008. It is clear that a number of themes that we saw in the first half of this year did not end on the 30th June but continue to dominate the economic environment:

“We have left a volatile first half of the year behind us and now need to determine what we think will happen in the 2nd half of 2008. It is clear that a number of themes that we saw in the first half of this year did not end on the 30th June but continue to dominate the economic environment:

“Renewed pressure on the US consumer – The ongoing deterioration in the housing, labour, equity and consumer financing markets will force US consumers to tighten their purse, which they, surprisingly, have kept open over the last six months. We believe that this was because they spent their tax rebate in the past months.

“Continuing losses and capital raises by the global financial sector – Our equity analysts believe that the peak of credit losses globally will be in the first quarter of 2009. In the meantime, we will continue to see write-offs and requirements for new capital by financial institutions in Europe and the US.

“Slower growth in Europe – The high euro and higher interest rates are starting to have a negative impact of the data that is coming out of the Eurozone. The UK is showing mounting signs that a recession may hit the economy.

“Inflation pressures to recede but risks to renewed pressure – Slower global growth will in our opinion lead to lower global inflation (from 5.6% to 4.2% in 2009) with inflation in the advanced economies falling below 3% and emerging markets from ~9% to ~6%. The risks to this view are commodity prices and inflation expectations which make this forecast one which we are monitoring very closely.

“Softer growth and lower inflation in China – Inflation data from China has shown a moderation (from 9% to 7% now) and we believe it will be about 5% by year end. This will help global inflation. We forecast Chinese growth to moderate from around 12% in the last two years to 10% in 2008 and 2009.

“Central banks balancing policy between inflation and growth – Central banks are having to chose between stimulating growth or tightening monetary policy to prevent inflation from running away. We believe the ECB and Fed will keep rates on hold for the rest of the year (based on our moderating inflation view). A number of emerging market policy makers appear to be behind the curve and this could create more broad-based problems if no action is taken.”

Click here for the full report.

Source: Goldman Sachs , July 16, 2008.

MarketWatch: Text of Paulson statement on Fannie, Freddie

“Fannie Mae and Freddie Mac play a central role in our housing finance system and must continue to do so in their current form as shareholder-owned companies. Their support for the housing market is particularly important as we work through the current housing correction.

“GSE debt is held by financial institutions around the world. Its continued strength is important to maintaining confidence and stability in our financial system and our financial markets. Therefore we must take steps to address the current situation as we move to a stronger regulatory structure.

“In recent days, I have consulted with the Federal Reserve, OFHEO, the SEC, Congressional leaders of both parties and with the two companies to develop a three-part plan for immediate action. The President has asked me to work with Congress to act on this plan immediately.

“First, as a liquidity backstop, the plan includes a temporary increase in the line of credit the GSEs have with Treasury. Treasury would determine the terms and conditions for accessing the line of credit and the amount to be drawn.

“Second, to ensure the GSEs have access to sufficient capital to continue to serve their mission, the plan includes temporary authority for Treasury to purchase equity in either of the two GSEs if needed.

“Use of either the line of credit or the equity investment would carry terms and conditions necessary to protect the taxpayer.

“Third, to protect the financial system from systemic risk going forward, the plan strengthens the GSE regulatory reform legislation currently moving through Congress by giving the Federal Reserve a consultative role in the new GSE regulator's process for setting capital requirements and other prudential standards.

“I look forward to working closely with the Congressional leaders to enact this legislation as soon as possible, as one complete package.”

Source: MarketWatch , July 13, 2008.

Bloomberg: Rogers calls Fannie, Freddie rescue plan a “disaster”

“Jim Rogers talks with Bloomberg from Singapore about the US government's efforts to bolster Fannie Mae and Freddie Mae, the outlook for financial stocks, the dollar and commodities, and his investment strategy.”

Click here for the full article.

Source: Bloomberg , July 14, 2008.

BCA Research: US policymakers restore confidence in Fannie and Freddie

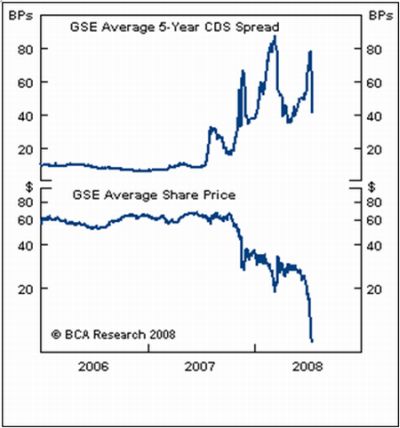

“The Treasury and Fed have announced their intention to support the equity and debt of Fannie Mae and Freddie Mac.

“Following a horrific week for equity investors, the Treasury department over the weekend decided that it needed to act to restore confidence in the two private mortgage agencies. The Treasury has requested authority not only to increase Fannie's and Freddie's lines of credit, but also to purchase equity in the two firms as needed, albeit on a temporary basis. While this does not amount to nationalization, there is often nothing more permanent than a temporary arrangement. The Federal Reserve has also opened the discount window to the agencies.

“The combined announcements by the Treasury and Fed will restore confidence in the equity and debt capital of Fannie and Freddie and give them the support they need to withstand the losses that we expect will accrue over the next 6 to 8 quarters. Stay overweight agency bonds versus Treasurys.”

Source: BCA Research , July 15, 2008.

Ambrose Evans-Pritchard (Telegraph): US faces global funding crisis, warns Merrill Lynch

“Merrill Lynch has warned that the United States could face a foreign ‘financing crisis' within months as the full consequences of the Fannie Mae and Freddie Mac mortgage debacle spread through the world.

“The country depends on Asian, Russian and Middle Eastern investors to fund much of its $700 billion current account deficit, leaving it far more vulnerable to a collapse of confidence than Japan in the early 1990s after the Nikkei bubble burst. Britain and other Anglo-Saxon deficit states could face a similar retreat by foreign investors.

“‘Japan was able to cut its interest rates to zero,” said Alex Patelis, Merrill's head of international economics. ‘It would be very difficult for the US to do this. Foreigners will not be willing to supply the capital. Nobody knows where the limit lies.'

“‘This is not the time for policy-makers to underestimate, once again, the systemic risks to the financial system and the huge damage this would impose on the economy. Bold, aggressive action is needed, and needed now,' said Brian Bethune, chief financial economist at Global Insight.”

John Authers (Financial Times): No easy fix for credit problems

“For the market, the Sunday announcement of government aid for the mortgage agencies Fannie Mae and Freddie Mac was nothing more than the confirmation of the obvious. Everyone knew they were too big to fail, and that their debt carried an implicit guarantee from the government.

“Hence shares in both agencies fell further. The debt was never in question; as far as shareholders are concerned, explicit intervention merely raises the chances of regulation to squeeze profits.

“Meanwhile, less predictably, attention turned to banks who are ‘small enough to fail'. It is on them, and not the mortgage agencies, that the current phase of the credit crisis now depends.

“This was the unforeseen consequence of the move to bolster Fannie and Freddie. The government's newly tangible support for the agencies aroused the fear that such action could only be needed if the situation were truly dire. That only intensified fears for institutions that are not so crucial, and would be behind the agencies in the queue for funds.

“This may be the precursor for a bear market rally, like the one that followed March's fire sale of Bear Stearns. But traders' response to what should have been good news suggests they are coming to realise that there is no quick or easy fix for the US credit problems.”

Source: John Authers, Financial Times , July 14, 2008.

Reuters: Many more bank failures likely after IndyMac

“US banks may fail in far greater numbers following the collapse of the big mortgage lender IndyMac Bancorp, straining a financial system seeking stability after years of lending excesses.

“More than 300 banks could fail in the next three years, said RBC Capital Markets analyst Gerard Cassidy, who had in February estimated no more than 150.

“Banks face pressure as credit losses once concentrated in subprime mortgages spread to other home loans and debt once-thought safe.

“While analysts declined to say which banks will fail next, several smaller lenders and one large one, Washington Mutual, appear already to have elevated levels of soured loans, relative to their sizes.

“‘You have to look at companies with the greatest exposure to the highest-risk assets, which include construction loans and exotic mortgages,' Cassidy said. ‘The final nail in the coffin for any depository institution would be a funding crisis where it is unable to gather deposits at reasonable cost, or wholesale funding markets are cut off.'

“The Federal Deposit Insurance Corp seized IndyMac on Friday after a bank run in which panicked customers withdrew more than $1.3 billion of deposits in 11 business days.

“As of March 31, the FDIC had put 90 banking institutions with $26.3 billion of assets on its ‘problem list'. This excluded IndyMac, which alone had about $32 billion of assets, and close to $19 billion of deposits.”

Source: Johathan Stempel, Reuters , July 13, 2008.

CNBC: SEC's Cox on naked shorts

“SEC Chairman Christopher Cox yesterday rocked the financial community with an emergency ruling regarding how stocks are sold short. He discusses this ruling with CNBC's Erin Burnett.”

Source: CNBC , July 16, 2008.

Financial Times: Short-selling – handy to have someone to blame

“When things go wrong, it is handy to have someone to blame. During financial crises, that person is usually the short-seller.

“That happened in the 1929 stock market crash, when Herbert Hoover, the US president, railed against those selling company shares they did not own. It has happened since around the world, including in the Asian financial crisis of the late 1990s. It is happening once again amid the current financial turmoil.”

Source: John Gapper, Financial Times , July 18, 2008.

BCA Research: The Fed – between a rock and a hard place

“As Fed Chairman Bernanke noted in his testimony, Fed policymakers face a challenging environment. Policy rates are already very low, yet economic and financial problems are getting worse, not better. The pace of US growth is set to slow markedly as the impact of tax rebates fades, and the latest problems with the GSEs warn that the financial shock-waves from the burst housing bubble will reverberate for a long time.

“Meanwhile, inflation is far above the Fed's comfort level, and it is getting harder to argue that inflation expectations are contained. Against this background, the Fed will take the easy course of keeping interest rates unchanged. It will keep using targeted liquidity measures to deal with financial strains as it does not believe that further rate cuts would solve the problems faced by GSEs and the banks. Nonetheless, additional rate cuts later this year or early in 2009 cannot be ruled out if the economic outlook deteriorates significantly.”

Source: BCA Research , July 17, 2008.

Asha Bangalore (Northern Trust): Chairman Bernanke's testimony – expected important shift in emphasis

“The June 25 monetary policy and recent rhetoric of Fed officials left a sense that inflation had taken precedence over growth in the inflation-growth debate. Chairman Bernanke's remarks today have moved the focus back to economic growth in the inflation-growth debate. That said, inflation is still a serious concern.

“In particular, he noted that ‘the possibility of higher energy prices, tighter credit conditions, and a still-deeper contraction in housing markets all represent significant downside risks to the outlook for growth'. He also added that FOMC participants indicated that ‘considerable uncertainty surrounded their outlook for economic growth and viewed the risks to their forecasts as skewed to the downside'. These remarks about growth and financial market conditions highlight that growth is the predominant concern, for now.

“With regard to inflation, Bernanke noted that the Fed is focused on preventing higher inflation expectations from being embedded in the ‘wage-price setting process', which would then translate in to a rise in actual inflation over the longer term. He also mentioned that ‘a critical responsibility of monetary policy makers is to prevent the process from taking hold'.

“Bernanke's comments on inflation also included these observations: ‘Although the inflationary effect of rising oil and agricultural commodity prices is evident in the retail prices of energy and food, the extent to which the high prices of oil and other raw materials have been passed through to the prices of non-energy, non-food finished goods and services seems thus far to have been limited. But with businesses facing persistently higher input prices, they may attempt to pass through such costs into prices of final goods and services more aggressively than they have so far.'

“The above comments imply that the Fed officials remain concerned about inflation but by a measure that is less severe than what their rhetoric suggested in the past month. In sum, the tone of the testimony leans more toward growth as the primary concern, while inflation is important but marginally lower in rank compared with growth.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 15, 2008.

Asha Bangalore (Northern Trust): FOMC forecasts

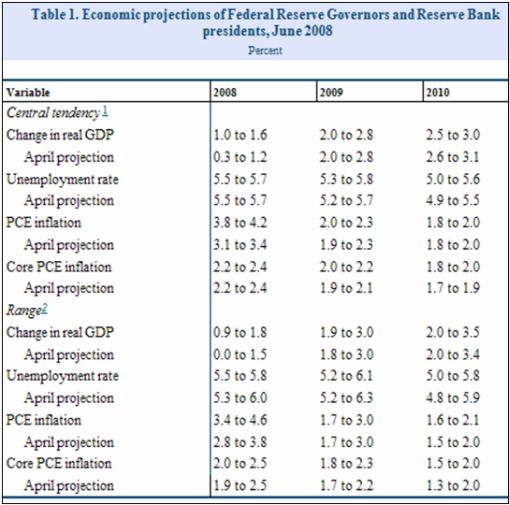

“The forecasts of the FOMC show slightly stronger growth in 2008, with predictions for 2009 and 2010 unchanged from the April 2008 forecast.

“The unemployment rate for 2008 was unchanged but it is estimated to be higher in 2009 and 2010 compared with the forecasts published in April.

“Overall inflation for 2008 was raised higher, while predictions for 2009 and 2010 were virtually unchanged. Core inflation estimates for 2008 was left unchanged, with forecasts for 2009 and 2010 raised by one-tenth.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 15, 2008.

Asha Bangalore (Northern Trust): Housing market doldrums – end is not here yet

“The National Association of Home Builders survey for July 2008 shows a grim picture of the housing market. The Housing Market Index fell to 16 from 18 in June. The July index is the lowest on record. The sub-indexes tracking current sales, sales in the next six months, and traffic of prospective buyers hit new lows. The message is that housing market conditions are yet to improve.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 16, 2008.

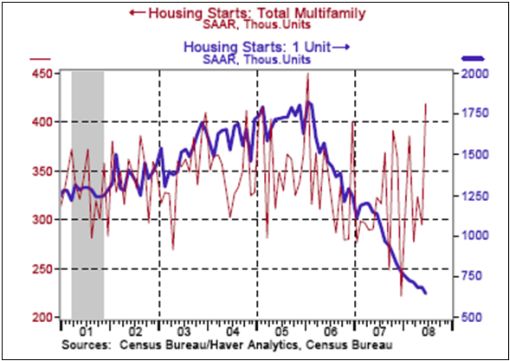

Asha Bangalore (Northern Trust): Housing starts – headline is misleading

“Housing starts rose 9.1% in June to an annual rate of 1.066 million units, following a 2.7% drop in the prior month. At first blush this reading suggests a turnaround in construction of new homes. Unfortunately, a change in construction codes in New York City accounted for the increase in housing starts and permits in the Northeast. If it were not for the change, total housing starts would have fallen 4.0% according to the Census Bureau.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 17, 2008.

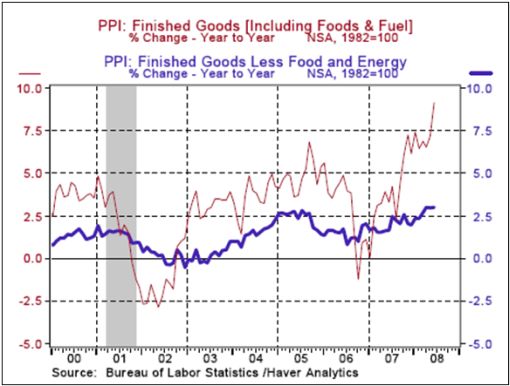

Asha Bangalore (Northern Trust): PPI – food and energy remain culprits

“The Producer Price Index (PPI) for Finished Goods increased 1.8% in June, reflecting higher food and energy prices. The energy price index moved up 6.0% and the food price index rose 1.5%. The core PPI increased 0.2%, putting the year-to-year gain at 3.0%, compared with a 2.0% gain in 2007. The upward trend of wholesale prices is troubling.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 15, 2008.

John Williams (Shadow Government Statistics): Annual 9.2% PPI still understated

“On a monthly basis, seasonally-adjusted June intermediate goods rose by 2.1% (2.9% May), crude goods gained 3.7% (6.7% May). Year-to-year inflation, remained hairy, but still shy of a real world that has seen a doubling in oil prices year-to-year, with June intermediate goods up by 14.5% (12.6% May) and with crude goods up by 45.5% (41.5% May). Crude energy materials rose by a modest 72.1%.”

Source: John Williams, Shadow Government Statistics , July 16, 2008.

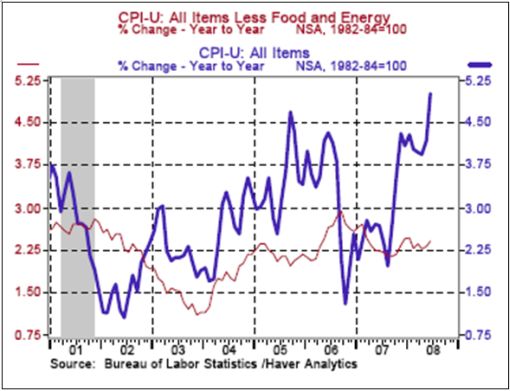

Asha Bangalore (Northern Trust): Surging inflation is a problem

“That inflation is a problem is an old story now. The Consumer Price Index (CPI) shot up 1.1% in June, putting the year-to-year increase as a hefty 5.0%, the largest since March 1990. The energy price index moved up 6.6% and food prices advanced 0.8% in June. The core CPI, which excludes food and energy, was up 0.3% in June, the largest monthly increase since January.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 16, 2008.

Bill King (The King Report): Inflation is sky-rocketing

“John Williams notes that though CPI-U (urban) is 5% y/y, pre-Reagan BLS methodology would put CPI at 12.6%. So when someone says this is not the ‘70s, it is only so because BLS has repeatedly changed its methodology in tabulating CPI. … CPI-W [CPI of workers] is 5.6% y/y. So if you work, CPI is worse.

“Several pundits and analysts are expressing the view that inflation is not ‘the problem'; the horrible and deteriorating fundamentals are ‘the problem'. What these advocates are missing is inflation is almost always a policy response to bad fundamentals – paper over the problems. And that's true now.”

Source: Bill King, The King Report , June 17, 2008.

Bloomberg: US Misery Index climbs to 15-year high

“The jump in consumer prices reported today by the Labor Department means the so-called Misery Index, the sum of the unemployment and inflation rates, is the highest since President Bill Clinton took office in January 1993. The measure, created by Arthur Okun, an economics adviser to President Lyndon Johnson, rose to 10.5 in June from 9.7 in the prior month.

“Surging costs and falling payrolls will cause consumers to slow spending growth to the weakest pace since 1991 by the fourth quarter, according to a monthly survey of economists by Bloomberg News. The figures underscore Federal Reserve Chairman Ben Bernanke's comment to lawmakers yesterday that US households are under ‘tremendous pressure'.

“‘You add that to what's going on with home prices and that's just a huge stress on consumers,' said Robert Dye, senior economist at PNC Financial Services Group in Pittsburgh.

“The Misery Index peaked in June 1980, when the jobless rate reached 7.6% and consumer prices rose 14.4%.”

Source: Timothy R. Homan, Bloomberg , July 16, 2008.

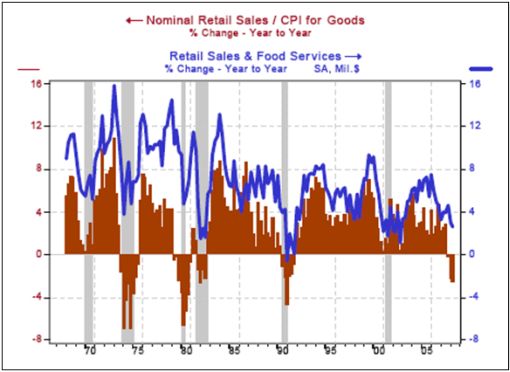

Paul Kasriel (Northern Trust): Retail Sales – what a difference a deflator makes

“Don't write off the U.S. consumer, right? Wrong. On a year-over-year basis there has been a sharp deceleration in nominal retail sales growth. On a year-over-year basis, there has been a sharp contraction in price-adjusted retail sales.

“The chart below using quarterly average data illustrates this. Growth in nominal retail sales peaked back in the first quarter of 2006 at 7.6% in this cycle. In the second quarter of this year, nominal retail sales growth had slowed to just 2.6%. Adjusted by the goods or commodities component of the CPI, retail sales on a year-over-year basis have been declining for three quarters running, contracting by 2.6% in the second quarter of this year.

“Notice that in the recession of 2001, although price-adjusted retail sales experienced slower year-over-year growth, they never outright contracted. In this recession – yes, despite all the happy talk, we are in a recession – real retail sales are contracting.”

Source: Paul Kasriel, Northern Trust – Daily Global Commentary , July 17, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.