Is the Derivatives Markets About to Implode the System Again?

Stock-Markets / Financial Crisis 2016 May 25, 2016 - 04:04 PM GMTBy: Graham_Summers

The 2008 Crash was caused by the unregulated derivatives markets. And if you think that problem has been fixed, you’re mistaken.

Consider Deutsche Bank (DB).

DB sits atop the largest derivatives book in the world.

This one bank has over $75 trillion in derivatives on its balance sheet. This is over 20 times German GDP and roughly the same size as global GDP.

At this size, if even 0.01% of these derivatives are “at risk,” you’ve wiped ALL of the banks’ capital.

The bank’s CEO was “very disappointed” when Moody’s recently downgraded its credit rating.

Personally, we’d be a lot more disappointed by the share price.

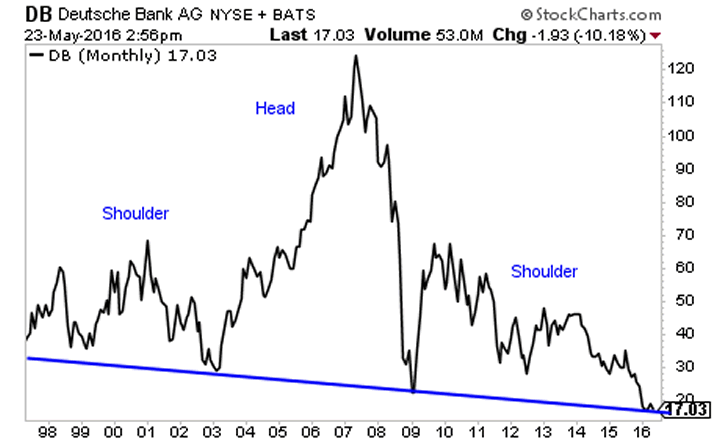

DB shares have gone effectively NOWHERE for nearly 20 years. Moreover, this might be the single largest Head and Shoulders topping pattern ever. As we write this, we’re right on the neckline.

DB is perhaps the best example of the derivatives problem, but it is by no means the only one. US banks alone have over $200 trillion in derivatives sitting on their balance sheets.

And over 77% of these derivatives are based on interest rates.

This comes to roughly $156 trillion in interest rate-based derivatives… sitting on the TBTF balance sheets.

If even 0.1% of this money is “at risk” it would wipe out 10% of the big banks equity. If 1% were “at risk” it would wipe out ALL of the big banks’ equity.

Suffice to say, the Fed cannot afford a spike in interest rates without imploding the big banks: the very banks it has funneled TRILLIONS of dollars to in an effort to prop up.

At some point this whole mess will come crashing down just as it did in 2008. The derivatives market remains a $600 TRILLION Ticking Time Bomb.

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 Crash back in late 2007? We did, and our clients made triple digit returns when the markets imploded.

We’re currently preparing for a similar situation today.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.