Bank Bail-Ins Pose Risks To Retail Depositors

Interest-Rates / Credit Crisis 2016 May 19, 2016 - 06:16 PM GMTBy: GoldCore

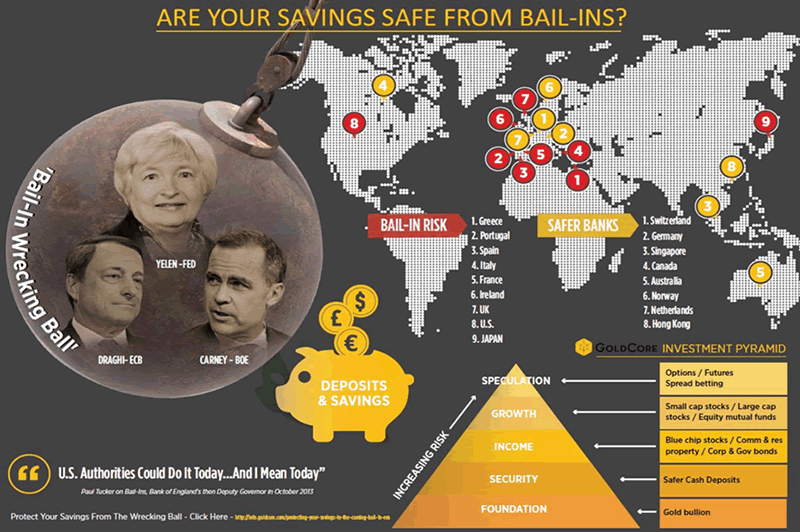

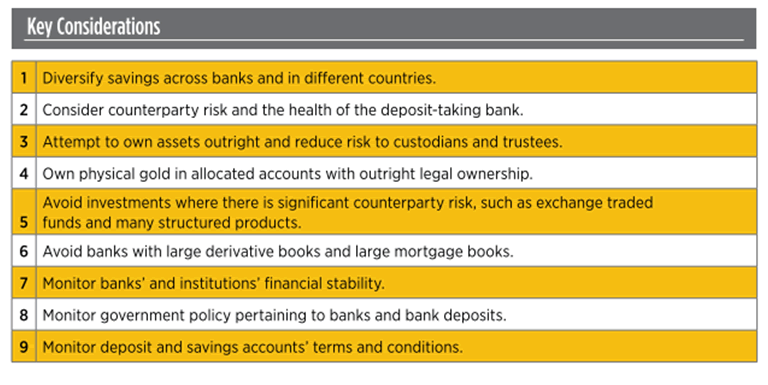

Bank bail-ins pose risks to retail investors and especially savers throughout the western world. The new bail-in rules have been made operational since the beginning of this year in the EU and in many other countries yet the risks and ramifications of bail ins have been largely ignored in most of the media.

Bank bail-ins pose risks to retail investors and especially savers throughout the western world. The new bail-in rules have been made operational since the beginning of this year in the EU and in many other countries yet the risks and ramifications of bail ins have been largely ignored in most of the media.

The Financial Times covers bail-ins today with a focus on the risk to investors while continuing to ignore that posed to savers and depositors including small and medium size enterprises.

A banking union in the EU is wonderful in concept but in practice is fraught with difficulties and risk. The use of bail-ins and the confiscation of deposits while protecting some tax payers in the short term, will likely destroy consumer and business confidence in the already fragile Eurozone economies and severely impact on the tax take in EU economies in the aftermath of the bail-ins and ensuing recessions or depressions.

Small and medium size businesses are the back bone of European and global economies. The confiscation of their corporate deposits, the very capital they use to fund growth – including servicing debt, paying rent and mortgages, employing staff and paying wages – would be highly deflationary and would push economies over the edge and into sharp recessions and lead to contagion in the Eurozone.

Bank bail-ins remain one of the greatest, but most poorly analysed and understood threats to depositors and savers today. The law of unintended consequences …

Read Protecting your Savings In The Coming Bail-In Era (11 pages)

Read From Bail-Outs to Bail-Ins: Risks and Ramifications (51 pages)

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.