Why Stock Market Price Spikes Are Actually Your Friend

Stock-Markets / Stock Index Trading May 19, 2016 - 03:38 PM GMTBy: Chris_Vermeulen

I could go on in detail about why and what price spikes provide us short term trades with, and I will in a future article and video. Keeping things short and simple we will let the charts to the speaking for now because they paint a very clear picture of what they do and how quickly we should expect our profit targets to be reached.

I could go on in detail about why and what price spikes provide us short term trades with, and I will in a future article and video. Keeping things short and simple we will let the charts to the speaking for now because they paint a very clear picture of what they do and how quickly we should expect our profit targets to be reached.

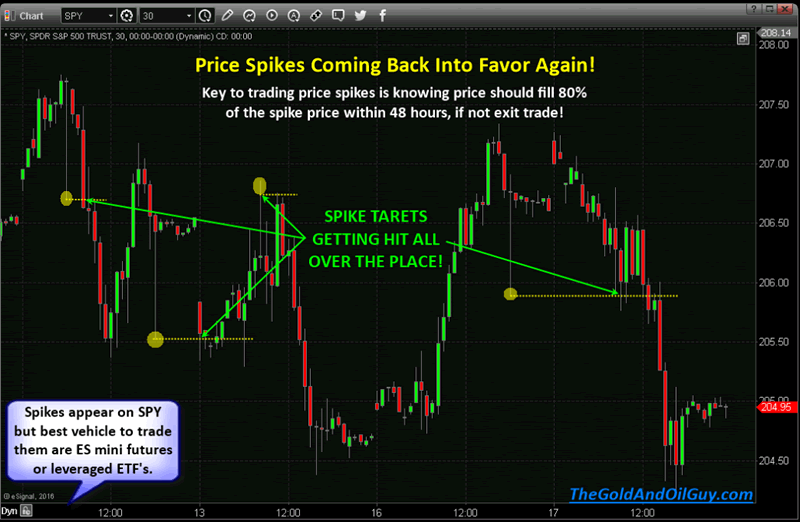

The chart below shows the recent price spikes in the SPY. These spikes come and go, meaning some months we may only see a couple, and other months we see 10-20 of these incredible momentum trading opportunities.

As you can see below this is a 30 minute chart going back 4 trading sessions and we saw 4 price spikes with each reaching their price targets within 24 hours of the spike alert.

Types of Price Spikes I Focus On

I only focus on price spikes that take place outside of regular trading hours, so before 9:30am ET, and spike after 4:00pm ET.

And, the spike must be a minimum of 0.23% away from the current market price. Why 0.23%? Simple really. We need enough of a move to make the trade and risk worth our while to trade.

You may be saying to yourself that 0.23% is not much of a move… well you are correct, but that is why I focus on trading these moves with a high degree lf leverage. I use the ES mini futures contract.

Recent Sample Spike Alert Trade Setup

See the sample Spike Alert that took place a couple days ago. It was small only 0.43%, but amplifying the leverage can turn a small move into big profits. In this case, the spike alert generated a quick $425.50 profit within 24 hours, which is a 7.5% ROI base on one ES mini futures contract. Here is another live example with my broker statement.

CONCLUDING THOUGHTS:

In short, spike alerts not only provide a steady stream of quick winning trades each month, but they also tell what the market bias/trend will likely be for that trading session.

If you day trade, then spike alerts are the ultimate tool for knowing which direction you should focus on trading that day, or at least until that price spike level has been reached.

Learn More At: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.