The ‘Tide’ has turned… NEGATIVE For STOCKS!!!

Stock-Markets / Stock Markets 2016 May 18, 2016 - 10:27 AM GMTBy: Chris_Vermeulen

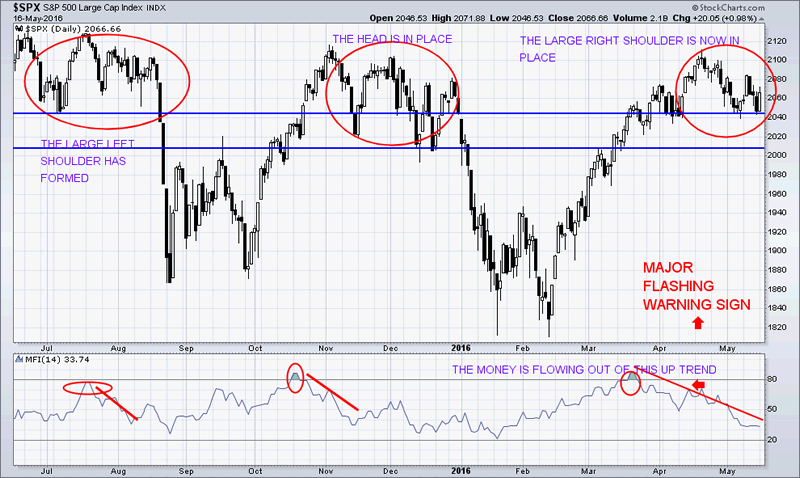

Currently, a ‘sharp fall’ is now anticipated within the equity markets! This decline will be accompanied with ‘new volatility’. There is a great deal of ‘uncertainty ‘within the U.S. markets. Currently, we are viewing a ‘textbook’ ‘head and shoulders pattern’ in the SPX and is going to be a big inflection point we look back on months from now.

Currently, a ‘sharp fall’ is now anticipated within the equity markets! This decline will be accompanied with ‘new volatility’. There is a great deal of ‘uncertainty ‘within the U.S. markets. Currently, we are viewing a ‘textbook’ ‘head and shoulders pattern’ in the SPX and is going to be a big inflection point we look back on months from now.

There are less and less stocks that are participating in the recent move upwards which suggest a technical breakdown is likely to happen.

The ‘cycles’ of the SPX have recently confirmed that we have now witnessed the ‘highs’. The ‘top’ is currently in place and I expect that the ‘negative trend’ will continue to persist.

See my live analysis charts and forecast click here

The ‘smart money’ has been exiting the equity markets during the last few weeks with strong waves of selling volume taking place on a consistent basis.

Yesterday morning, Monday, May 16th, 2016, I alerted my subscribers to two new positions to enter into so as to take advantage of during this next significant market move and change in volatility.

Consequently, consumers have already started to slow down in their spending. They will change their past behavior, and, as a result, will begin to save (whatever funds that they may still have) as stocks start to fall in value along with the average investors retirement accounts. The present day spending behavior will come to a grinding halt in due time!

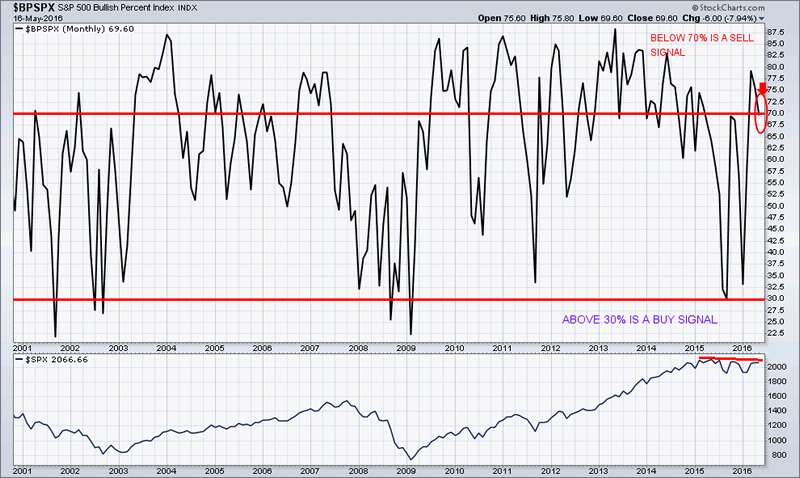

Before “The Great Credit Crisis of 2007 -2008”, the ‘smart money’ exited the equity markets in November of 2006. And it appears that the NDX-100 and the Russel 2000 are leading the ‘charge’ downward once again for the pending market correction.

We are, once again, repeating this same technical pattern, now!

Concluding Thoughts:

In short, the first chart I showed in this article paints a very clear picture of where stock prices are headed – Lower.

Large cap stocks over the past year have been making lower lows and lower highs. The most novice of traders knows what that means… It means, we are in a down trend.

There are many ways to take advantage of what is about to unfold next and subscribes and I are already in position for the first big and quick trade, but there are many more just around the corner!

I share a few ways I am taking advantage of this with followers of my newsletter at: www.TheGoldAndOilGuy.com

Chris VermeulenJoin my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.