A Perspective on the Markets

Stock-Markets / Financial Markets 2016 May 11, 2016 - 03:51 PM GMT Good Morning!

Good Morning!

I wanted to do a survey of the major domestic stock indices to get a “feel” for where we may be.

The first is the NDX, which has the cleanest pattern. Note the clear (no overlap) pattern in the decline. This decline begs to be extended in a series of impulsive declines. In a measured decline, the NDX may drop to 3724.00, below both the February and the August lows.

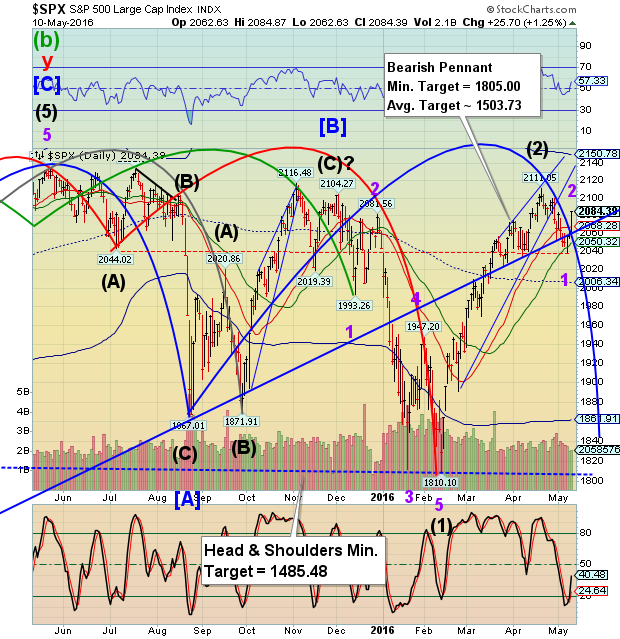

The final wave up to the 2104.27 high on December 2 is five waves and appears truncated. This would make sense, as it appears to be a hybrid of the NDX and the DJIA which we will view next. Based on that view, the pattern finally comes into focus. A measured decline may go to 1805.00, which is all it needs technically to usher in a Wave 3 of (3).

This has been a difficult pattern to follow. Without the NDX as a guideline, the pattern may be even more difficult.

INDU is another pattern altogether. It had more strength in the latest rally, but would be expected for a Wave (C). Now its must decline beneath 17450.00 to re-establish the downtrend. You can see where some technicians are viewing this as a Triangle pattern. However, 5-wave patterns do not appear in a Triangle pattern and the Triangle appears to be broken prematurely.

This decline would be expected to go beneath the lower trendline, even in a Triangle.

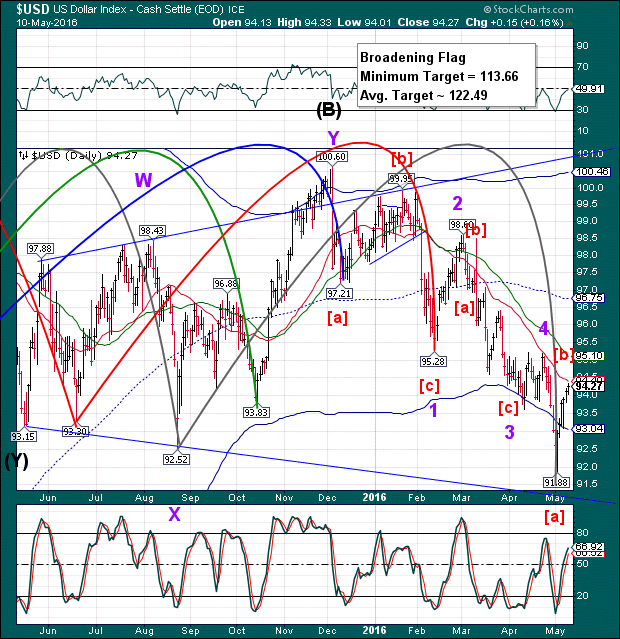

The rally from the USD low does not appear to be impulsive. That implies one more probe lower to the 90.50 low we have been discussing. Wave [c] equals wave [a] at 91.03. A caution…should the decline reverse at the Cycle Bottom support at 93.04, the decline may be complete.

This may catch traders wrong-footed. CNBC reports, “Following disappointing jobs data last week and the ensuing uptick for the greenback, Goldman Sachs has said the dollar has reached a bottom from the perspective of the U.S. Federal Reserve.

In a note late Tuesday on the performance of the greenback, Goldman Sachs said last week's disappointment on payrolls offers an important insight on positioning.

Even though the data was weaker-than-expected, the dollar rose marginally in the minutes after the release. A surprise move considering that disappointing data usually increases the chances of a central bank being more dovish.”

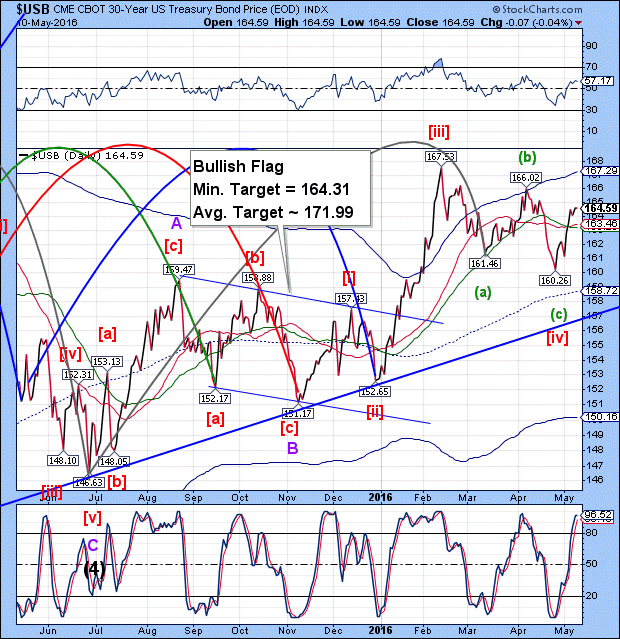

USB appears to be in need of a final probe higher to complete the Wave structure. It must at least exceed the Feb 11 high at 167.53. Note that there is more of an (inverse) correlation between USB and equities than the USD. That may change as USB reaches its peak.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.