USD may attempt a new Low, SPX probing the Trendline

Stock-Markets / Financial Markets 2016 May 10, 2016 - 02:24 PM GMT Traders are beginning to ask the question, “Is the Dollar oversold enough for a trend change?”

Traders are beginning to ask the question, “Is the Dollar oversold enough for a trend change?”

YahooFinance Has an article explaining the technical analysis for a reversal.

Allow me to weigh in. April 27 was a Pi date, warning that a bottom may come soon. The chart low occurred on May 3, six calendar days later.

I have put the Cycle bottom at 91.88 on a preliminary basis. This morning USD rallied to a high of 94.36, just beneath Intermediate-term resistance at 94.44. It is likely to decline from here There may be one more probe of the low, which may tell us whether the dollar has already put in its bottom or will do so in the next week. If the decline is unfinished, Wave [c] equals Wave [a] at 91.06. The USD may not make the original target of 90.50 by this analysis.

SPX has challenged the trendline again in the Premarket. At one point SPX futures appear to have probed as high as the Short-term resistance at 2073.15, but gapped down to the trendline at 0700 hours. It is bouncing again, but has not filled the gap, so we may assume that SPX is attempting to complete a Wave [c] of 2 this morning, at least in the futures. Today is a Pivot day, so it appears that this probing above the trendline may not last.

ZeroHedge reports, “In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward $44 a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50 consecutive months however showed a modest rebound from the prior month on the back of China's recent, and now burst, speculative commodity bubble.”

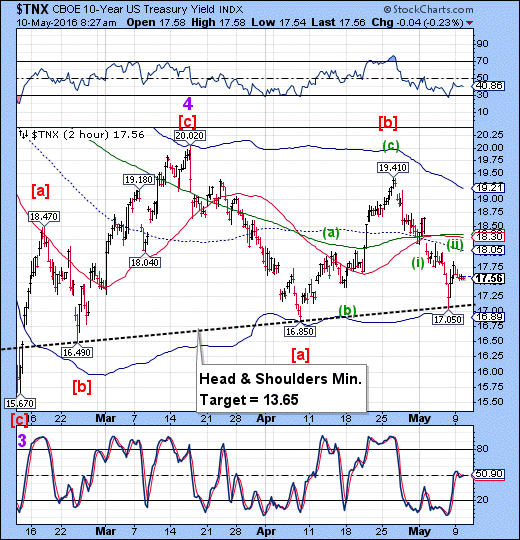

TNX is stuck in neutral. A rally in stocks is likely to push TNX higher. If so, that would also make Wave (c) of [ii] more proportional. A further probe to mid-Cycle resistance at 18.05 is likely, in that event.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.