American Billionaire Warns To Get Out of the Stock Markets and Run To Gold

Stock-Markets / Stock Markets 2016 May 08, 2016 - 09:00 PM GMTBy: Jeff_Berwick

Billionaire trader, Stanley Druckenmiller, recently stated that the current situation in the global economy is similar to the situation on the eve of the crisis of 2008.

Billionaire trader, Stanley Druckenmiller, recently stated that the current situation in the global economy is similar to the situation on the eve of the crisis of 2008.

At the Ira Sohn Investment Conference in New York, he said, “The bull market is exhausting itself… The Fed has borrowed from future consumption more than ever before. It is the least data dependent Fed in history. This is the longest deviation from historical norms in terms of Fed dovishness than I have ever seen in my career.”

And Druckenmiller was quoted by CNBC, saying, “This kind of myopia causes reckless behavior.”

He warned that people should get out of the stock market and buy gold.

We agree with him, of course. But, it got us to thinking about how many Americans, or other Westerners, own gold at this crucial time.

It’s impossible to know what your average Westerner personally owns in precious metals. Certainly, the amount of Americans that hold stocks, either directly or through pension and mutual funds, is much higher. Some estimates are that nearly half of Americans own stocks in one way or another. But, estimates of the amount of Americans who own precious metals seem to range between 1-9%… and from my estimation, the number is likely much closer to 1% than it is to 9%.

If you were to ask average Americans, coming from an NFL game, or on their way to work, whether they owned precious metals, I think it’d be a rare person who says yes.

Most don’t even seem to recognize things like silver as having any value… or at least, in this part of California where Mark Dice offered people a 10 ounce silver bar (current value over $150) or a chocolate bar ($1) and had no takers on the silver.

The Wall Street Journal asked a number of investment “experts” if they think people should own gold as an investment. Their responses included:

- “I hate gold as an investment. It just sits there and glitters.”

- “I personally have never held gold, nor advised any of my clients to hold it.”

- “No, gold doesn’t belong in the portfolio of the average U.S. investor. “

- “I recommend gold for wedding rings but not for investors’ portfolios.”

And I particularly liked this quote from one of the investment geniuses, meant as a reason not to own the yellow metal, “Gold is only worth what another party is willing to pay for it.” Ya, like EVERYTHING else in the world.

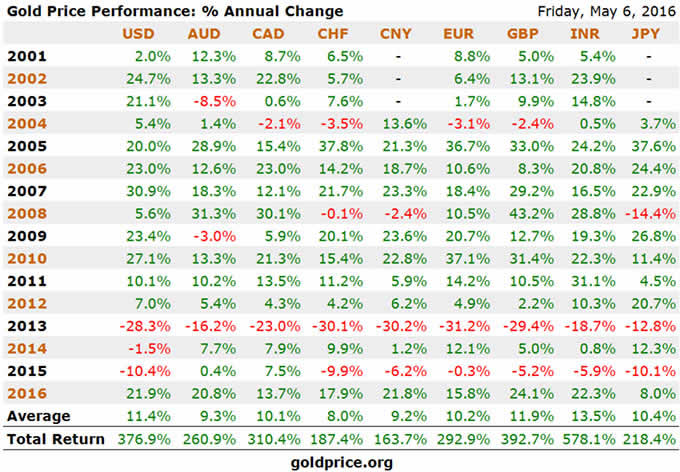

But, what is staggering about their views on gold is how they don’t see it as a good investment despite how gold has performed for the last 16 years:

In terms of every major fiat currency in the world, it has been stellar. If you could get those kind of returns in anything you should be knocking people out of your way to get to it!

Yet, your average American doesn’t seem to know much or care about it… and your average government-registered financial advisor talks about it like it is kryptonite. And this, at a time when people like Druckenmiller are saying we are on the verge of a 2008-like crisis event…

Note how gold fared in 2008/2009 during the last major crisis event that saw stock markets get cut in half in value.

Gold has just emerged from a 3 year pullback in its bull market (in terms of US dollars that is… it only had a 1 year pullback in other currencies – during 2013). And gold stocks have begun to fly. I haven’t looked at every sector in every market in the world, but if any other sector has risen more than 100% in the last 4 months, I haven’t heard about it.

And still, no one is talking about it.

This is fantastic news… because if an investment you own has skyrocketed and it is on the front page of every newspaper in the world and your taxi driver is buying it, then you know it is time to sell… but this is not the case for gold, silver and precious metals mining stocks.

It’s been a stealth boom. And one that we think is just beginning. A time will come when your taxi driver will be telling you about all the gold mining stocks he just bet his mortgaged house on… but that is still far off.

I even have a personal story that shows this exact situation.

In January I told my mom, who isn’t on the internet and doesn’t even know what I do, that she should buy gold and silver. She told me, “Oh, I don’t know, that sounds risky.”

I managed to convince her to just put 5-10% of her net worth into gold, silver and some precious metals shares. I would have preferred she put closer to 50%, but she saw it as being too risky.

Her stock portfolio is now up 100% since then and her overall net worth increased by more than 20%. Not bad! But it is pretty telling that it was such a hard sell to the mother of the Dollar Vigilante! You’d think my immediate family might listen to me… but then again, they thought I was crazy for quitting my job at a bank in 1994 to start an internet company… that went on to be worth $240 million.

Of course, we have thousands of other examples from our subscriber base of the same story of people who heeded our advice recently and have done spectacularly. Here is just one of many subscriber’s comments from yesterday in our private subscriber’s only Facebook Group thanking TDV’s Senior Analyst, Ed Bugos:

Just through subscribing to the TDV newsletter, she made more in six weeks than her government registered financial advisor did for her in eight years! It’s no surprise if her advisor was similar to the ones we listed above. They are mostly clueless.

Wily traders like Druckenmiller, on the other hand, have made billions knowing what is really going on. Meanwhile, your average financial advisor probably took some government courses “educating” him on Keynesian economics and then went to work for a big corporation, like Goldman Sachs. Such firms sell you stocks and bonds in the companies that pay them for financings and distributing their stocks and bonds to the sheeple. Undisclosed conflicts of interest are everywhere.

Take control of your own financial future and subscribe to TDV (click here for more) to make sure you get the best information and analysis from people who have no other interest except to make sure their subscribers profit. If our insights don’t work, we go out of business… unlike Wall Street, which can lose most of their client’s life-savings and then get a bail-out of trillions of dollars from their friends to do it all over again… and they are.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.