Wall Street Is Falling Off A Cliff, And The Bottom Is A Long Way Down

Stock-Markets / Financial Crisis 2016 May 07, 2016 - 03:22 PM GMTBy: Jeff_Berwick

For the past 50 or so years, the quickest way for a sharp young sociopath to get rich has been to join an investment bank or hedge fund. The former were riding a “regulatory capture” gravy train that became ever-more-lucrative as new government agencies morphed into subsidiaries of Wall Street. Hedge funds, meanwhile, were surfing the wave of easy money that inevitably results from putting banks in charge of interest rates and government spending.

For the past 50 or so years, the quickest way for a sharp young sociopath to get rich has been to join an investment bank or hedge fund. The former were riding a “regulatory capture” gravy train that became ever-more-lucrative as new government agencies morphed into subsidiaries of Wall Street. Hedge funds, meanwhile, were surfing the wave of easy money that inevitably results from putting banks in charge of interest rates and government spending.

Said another way, when financial assets are being artificially inflated by excessive liquidity, it’s easy to make money by shuffling this ever-appreciating inventory back and forth, and to look very smart while doing so.

But those days are ending with a bang. Consider:

Mega-bank profits are collapsing

Virtually every major bank in every major country reported Q1 earnings ranging from disappointing to catastrophic. To take just one representative example, Deutsche Bank’s profit fell by 58%, and it is now shedding 35,000 workers in 10 countries while eliminating half its investment banking customers.

It’s like that everywhere. Even Goldman Sachs, whose former (and future) execs hold decision-making roles in virtually every Treasury and central bank, is hurting:

Goldman Said to Extend Fixed-Income Job Cuts to 10% of Staff

(Bloomberg) – Goldman Sachs Group Inc. is cutting more jobs in its securities units, extending reductions in fixed-income operations this year to roughly 10 percent of workers there, according to people with knowledge of the situation.The dismissals in New York and London this week build on cuts that already had targeted about 8 percent of fixed-income personnel through last month, people with knowledge of the matter said, asking not to be identified because the plans aren’t public. The push also affects the equities division, one person said.

Goldman Sachs Chief Executive Officer Lloyd Blankfein is undertaking the firm’s biggest cost-cutting push in years as the investment bank tries to weather a slump in trading and dealmaking, people familiar with the plan said last month.

The Hedge Fund Model Turned Out To Be Pointless

Hedge funds were the rock stars of the investment world, raking in fees that dwarfed what traditional mutual funds charge, while turning high profile managers like Bill Ackman and David Einhorn into household names. But that too has passed. Far from being iconoclastic geniuses, hedge fund managers in the aggregate turned out to be a typical dumb-money herd, piling into stocks like Apple (down 30% from its recent high), Allergan (down 41%) and Valeant (down 87%), for (apparently) no other reason than that their prices were rising. Here’s how the huge and much-revered Sequoia Fund did with and without its Valeant position.

Einhorn’s Greenlight fund lost 20% in 2015, dramatically underperforming plain vanilla index funds which charge a fraction of hedge fund management fees. Ackman’s Pershing Square has lost $5.5 billion in just 15 months, primarily because of a huge bet on Valeant. And this, remember, is while stocks and bonds were generally rising.

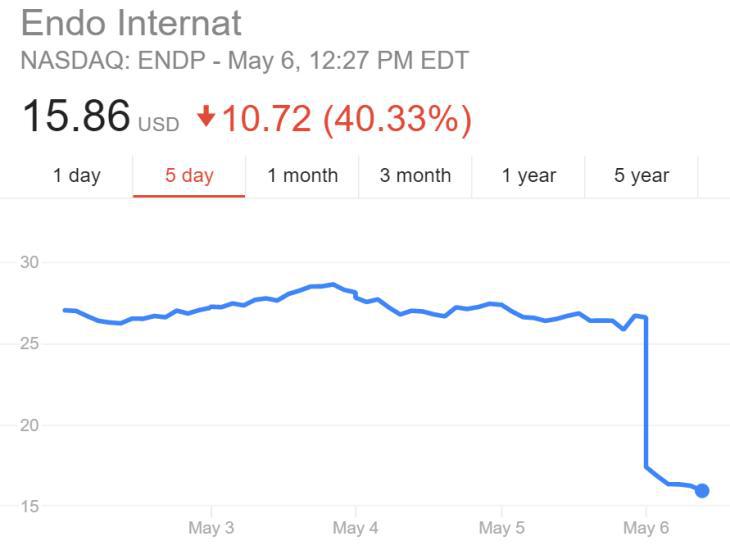

But wait, there’s more. Irish specialty pharmaceutical firm and hedge fund favorite Endo just announced disappointing earnings and weak guidance, causing its stock to gap down by 40% in a matter of minutes and virtually guaranteeing huge Q2 disappointments for thousands of hedge fund investors.

Clients, not surprisingly, are bolting en masse. Most recently, insurance giants MetLife and AIG announced plans to redeem big parts of their hedge fund positions. And hedge fund obituaries are now a financial media staple:

Hedge Fund Managers Lose Their Swagger

(Bloomberg) – Doug Dillard followed the path that once almost guaranteed entrance into the 1 Percent: Good college (Georgetown), investment bank (Morgan Stanley), MBA (Harvard). Then a hedge fund. A decade out of business school, he was heading Standard Pacific Capital, a multibillion-dollar San Francisco firm that traded global stocks. It did well by its clients, making money in 2008 as markets plummeted.

But Dillard’s returns—like most other hedge fund managers’—failed to keep pace in the post-Great Recession bull market. Investors exited. In February, when assets slid below $500 million, Dillard pulled the plug. “It has recently become clear to both of us that sometimes there is a logical conclusion to even a good thing,” he and his partner, Raj Venkatesan, wrote to clients.

They aren’t the only ones thinking their good thing might be gone. On April 26, Third Point manager Dan Loeb, one of the hedge fund elite, wrote to investors that the industry is “in the first innings of a washout.” At the annual Berkshire Hathaway shareholder meeting at the end of April, Warren Buffett told investors to keep money away from hedge funds because of their high fees and lousy returns.

Why is this happening?

First, QE and negative interest rates turned out to have unintended consequences, one of which is a drying up of bond trading. If governments buy up all the high-grade bonds then obviously there aren’t many left to trade. And if the yield on new bonds is negative, holders of existing positive-coupon bonds have no incentive to sell them. Hence, eerily silent trading desks around the world.

Second, the financialization of the global economy has created a vast sea of hot money that flows mindlessly from one location and asset class to another on a scale that exceeds traders’ ability to predict and/or manipulate. Put another way, in a world where it’s impossible to know what’s going to boom or crash next, it’s irrationally dangerous to place big bets on anything. See Bloomberg’s ‘Paralyzing Volatility’ Means Trouble for Wall Street Giants:

From stocks to currencies and bonds, the upswing in turbulence to start the year is chasing all but the bravest traders from financial markets. Despite the recent rebound in U.S. equities, volume in the S&P 500 Index is down 23 percent. Speculative bets on the direction of currencies have also dropped to the lowest in two years, while average daily trading among dealers in U.S. Treasuries is close to a seven-year low.

Worries about the outlook for the U.S., Europe and China, as well as mixed policy signals from central bankers around the world, have all contributed to what UBS Group AG Chief Executive Officer Sergio Ermotti called a “paralyzing volatility” that’s scaring away clients and caused industry-wide trading revenue to tumble to the lowest since 2009.

Investor concern over the state of the global economy is adding to “the structural pressure that’s been hurting banks for the last few years,” said Paul Gulberg, a banking analyst at Portales Partners LLC.

Whipsawed Traders

Where do we go from here? Probably into a crisis in which the world stops trusting markets, and financial assets are devalued accordingly.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.