Stock Market ‘Counter Trend Rally’ is Now Completing!

Stock-Markets / Stock Markets 2016 May 07, 2016 - 03:16 PM GMTBy: Chris_Vermeulen

Last Friday, April 29th, 2016, the U.S. Indexes were very bearish as price clearly broke below the 20 day moving average then rebounded back up to test that level and was rejected and sold into.

Last Friday, April 29th, 2016, the U.S. Indexes were very bearish as price clearly broke below the 20 day moving average then rebounded back up to test that level and was rejected and sold into.

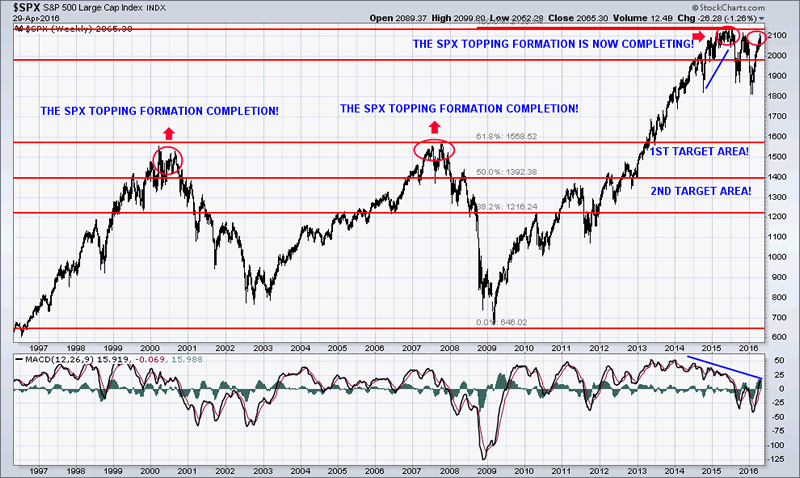

The chart below shows the market bullish and bearish momentum and price action. The momentum of these markets has now shifted away from being ‘bullish’. It is currently struggling to find support and hold up. Do not expect new highs on the SPX and I feel its beginning its ‘bearish reversal’ (topping phase) before making a new leg down.

This ‘counter trend rally’ is now completing!

It is important to realize that all bear markets have strong rallies within them. In fact, some of the more powerful market rallies happen during bear markets, so what we have experienced this year is very normal.

With being that said, this bear market counter trend rally is running out of steam and is on the verge of a very strong wave of selling which will catch the majority of market participants off guard. Why? Because these super strong counter trend rallies actually convince the average investor that stocks are the place to be and will continue higher. These counter trend rallied get investors to buy up stocks at the ultimate worst possible time, just before prices collapse. We have seen this happen time and time again and this time is no different.

Where Do We Put Our Money Then?

Gold prices have surged this year. Silver has lagged far behind but has recently rallied to make up for its underperformance this year. Silver, known as ‘poor man’s gold” and I feel will do exceptionally well in the coming year as it enters a new bull market.

I would expect sideways consolidation at this point for gold and silver before they continue up again, but they are definitely moving much higher the rest of this year. Subscribers and I are long gold through an ETF and if this trade pans out in the coming weeks it could end up being a multi-year investment.

These ‘monetary metals’ are now ‘confirmed’ to keep rising as a safe haven and currency play by both investors and countries in my opinion.

The U.S. dollar has broken support in the last few days. This is a primary driver causing gold and silver to begin these big moves up in the past week.

US Dollar Index Weekly Chart Below:

As you can see below, the dollar broke support early in the week, but has recovered nicely to get back above support for the time being. I feel it’s just a matter of time before the dollar breaks down and collapses 10 – 15 cents. If this/when this happens precious metals should sky rocket!

Market Trading Conclusion:

In short, the US large cap stock are in the very final stage of topping before share prices collapse and start a 8-16 month bear market. There will likely be some big event that triggers the selloff, the question is what and when?

There are going to be some great short term trades that could generate 50%, 100% or more within the next month which I have been following closely with subscribers of my ETF trading newsletter which you can be a part of. Join at: http://www.thegoldandoilguy.com/etf-trading-newsletter/

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.