US Jobs Report punches SPX beneath the 50-day Moving Average

Stock-Markets / Stock Markets 2016 May 06, 2016 - 03:20 PM GMT The SPX Premarket appears to have fallen beneath the 50-day Moving Average.

The SPX Premarket appears to have fallen beneath the 50-day Moving Average.

The mover is the huge monthly payrolls miss. ZeroHedge reports, “It appears that the Fed is now officially "one and done" because the only indicator that until recently "confirmed" a "strong recovery", non-farm payrolls, just had a major stumble.

In yet another Goldman jinx which just two days ago boosted its payrolls forecast from 225K to 240K, moments ago the BLS reported that ADP's ominous print was right when it said that April payrolls rose only 160K, far below the 200K expected, and higher than just 1 of 92 economist expectations. This was the lowest print since last September's 145K.”

Labor force Participation dropped again, explaining, in part, why the unemployment rate remains stuck at 5%.

The VIX correction needed one final pullback before going higher and it got it in conjunction with the payrolls report in the form of a stop hunt to clear out some timid longs.

ZeroHedge observes, “The machines went wild when the dismal jobs data struck. The instant reaction was a complete crush of VIX (despite stocks tumbling, Gold surging, and bond yields plunging), but that rapidly turned around and now VIX is heading higher again... Gold is now up 22% Year-to-date as S&P futures indicate cash will open in the red for 2016.”

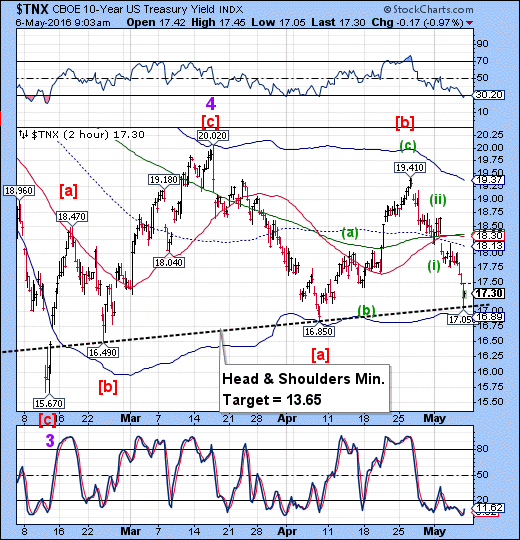

Of course, the “one and done” message from the Jobs Report opened the doors for a larger flow of money to bonds as a safe haven. The new Head & Shoulder neckline was challenged, but not pierced. However, the message is clear. Any further decline in yield may bring on a “measured move” to the H&S target.

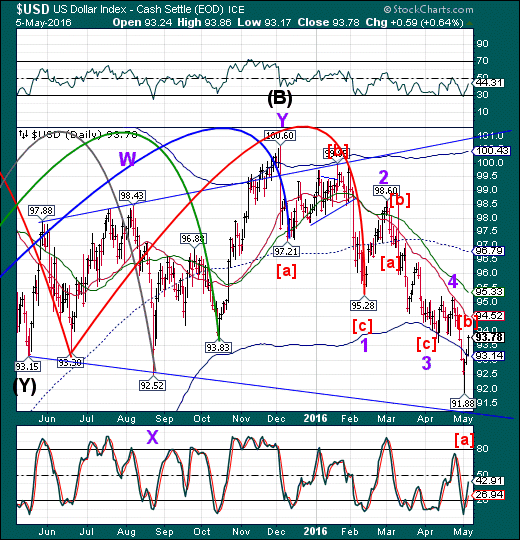

USD made a quick decline to the morning low of 93.28, bouncing back in a probable Wave c of a correction. This indicated a further decline.

The downside target has been revised, since the retracement went above the Cycle Bottom. The new target is now 90.66,, which is not far from the original target of 90.50.

We may see this target being hit in the next few days.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.