Stock Market Bounce Day

Stock-Markets / Stock Markets 2016 May 02, 2016 - 02:06 PM GMT SPX appears to be completing its bounce today. Today is a Pi date, so the bounce may be over by the end of the day. Once through the 4.5 year trendline, there may be a panic event in stocks. A panic event may take place in as little as 4.3 days (30.1 hours) That may target May 9 as the next Master Cycle low. This is our preliminary target until we see how the decline develops.

SPX appears to be completing its bounce today. Today is a Pi date, so the bounce may be over by the end of the day. Once through the 4.5 year trendline, there may be a panic event in stocks. A panic event may take place in as little as 4.3 days (30.1 hours) That may target May 9 as the next Master Cycle low. This is our preliminary target until we see how the decline develops.

This decline has all the earmarks of a potential measured move. That is, this decline may be very close in length to the Nov. 3 to Feb. 12 decline at 306.38 points. That puts the potential low ever-so-slightly beneath the February low. This may incite a firestorm of arguments whether that support was broken or not, leaving the bulls with enough reason to stay bullish into the next decline.

Big mistake. ZeroHedge reports, “It has been a busy weekend for mostly negative newsflow.

It all started with China which on Saturday reported yet another disappointing PMIprint of 50.1, which both missed expectations and declined from the previous month; then we got the latest Iraq oil output and exports number which rose yet again, pushing it further into near record territory despite a weekend of political chaos in Baghdad which saw protesters loyal to al Sadr penetrate the fortified Green Zone; at the same time Russian total output dipped just 0.5% from its post-USSR record, suggesting the global oil glut is only set to deteriorate.”

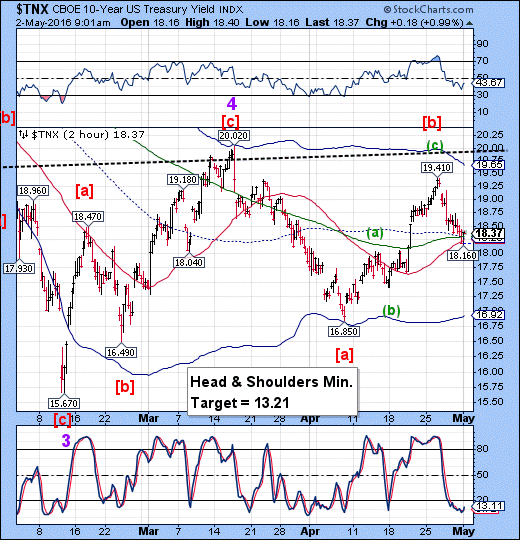

TNX has completed its first 5-wave impulse down and appears to be retracing today. Its target may be 18.75, its Wave (iv) high.

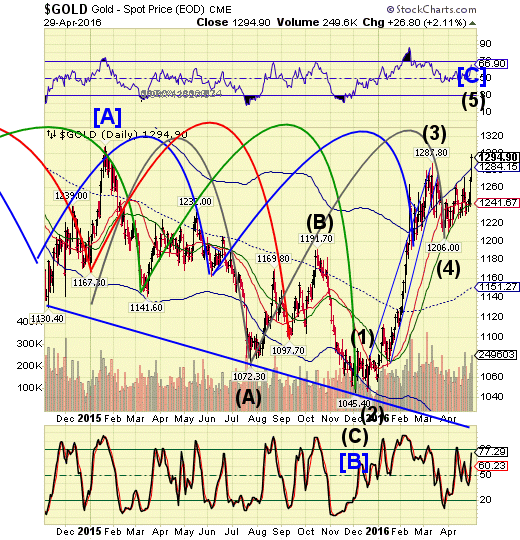

Gold futures hit 1305.94 while some public charts show gold peaking under 1305.00. Gold now appears to be rising above its January 2015 high at 1307.00. That has caused me to re-arrange the Elliott Wave structure to accommodate and clarify this move. Currently, gold may rally to the 1340.00-1350.00 range. I will hone in on a target as it becomes clearer.

This appears to be the final week of strength for gold. Statistically, Wednesday may be the peak, but we will wait for the peak to reveal itself.

Crude appears to have peaked on Friday morning. If so, we may see a precipitous drop in the price of oil starting as early as today.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.