SILVER: Prospects for the Birth of a New Bull Run

Commodities / Gold and Silver 2016 May 02, 2016 - 12:21 PM GMTBy: Joseph_Russo

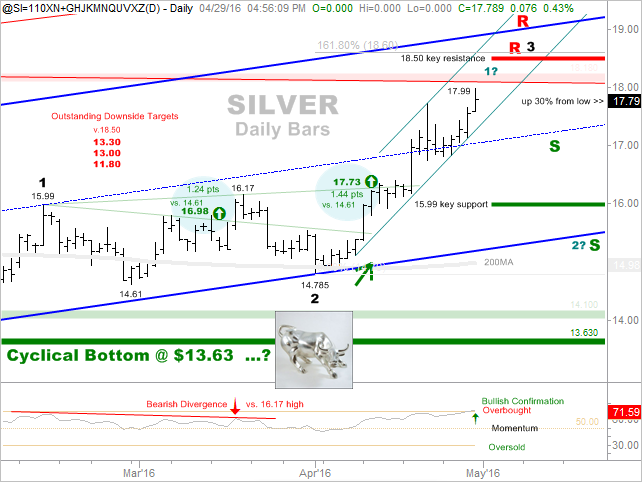

The prospect for the birth of a new Bull-Run in Silver speaks to a broader cyclical theme that relates to a dying dollar bull, and a corollary cyclical sentiment shift back toward a strong market preference for tangible vs. paper assets. From its current cyclical low in December of 2015, Silver Bullion has risen 30%.

In the broadest of terms, the above referenced theme would suggest the early adoption of a general pair's trade that was short the dollar and long commodities.

At present, from an Elliott Wave perspective, the 30% rally in Silver is somewhat tentative in terms of whether or not its wave structure is exhibiting impulsive (bullish) or corrective (bearish) patterns.

From its cyclical low at $13.63, the 1st wave move up to $15.99 appears impulsive. The sideways expanded flat/running correction to the noted wave-2 low at $14.78 was clearly corrective in nature, which led to a rather impressive run to the current print high just under $18.00.

The latest move up is clearly impulsive however; price needs to run higher in amplitude toward the $18.60 level or better yet, toward the rising blue upper trend channel boundary in order to satisfy the appearance of a sufficient 3rd wave advance.

Click here for additional observations relative to confirming the birth of a new bull market in Silver Bullion.

Until Next Time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2015 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.