Consensus Forming: China Heading Back Into Financial Crisis

Stock-Markets / Financial Crisis 2016 Apr 30, 2016 - 06:27 PM GMTBy: John_Rubino

China’s historic post-2009 debt binge flew largely under the radar — fooling most observers into thinking the global economy was recovering rather than just re-leveraging.

China’s historic post-2009 debt binge flew largely under the radar — fooling most observers into thinking the global economy was recovering rather than just re-leveraging.

Now Beijing is back at it, borrowing over $1 trillion in this year’s first quarter, buying up commodities and creating the illusion of global growth. But this time the scam hasn’t gone unnoticed. Reporters, editors and money managers seem, at last, to be catching on. Some representative headlines:

George Soros warns of credit crisis in China

Chinese cities dive back into debt to fuel growth even as defaults rise

China debt climbs to US$25 trillion

China’s banks cut bad debt buffer as profits flatline

Doug Noland, meanwhile, goes to the heart of the problem in last night’s Credit Bubble Bulletin:

I recall an early-1998 Financial Times article highlighting the explosive growth in Russian ruble and bond derivatives. Not only had the “insurance” market for risk protection grown phenomenally, Russian banks had become major operators in what had evolved into a huge speculative Bubble in Russian debt exposures. That was never going to end well.

There was ample evidence suggesting Russia was a house of cards. Yet underpinning this Bubble was the market perception that the West would not allow a Russian collapse. With such faith and the accompanying explosion in speculative trading, leverage and a resulting massive derivatives overhang, any break in confidence would lead to illiquidity, panic and a devastating bust. Just such an outcome unfolded in August/September 1998.

From a recent Financial Times article: “The [Chinese] market for pledge-style repos — short-term, bond-backed loans — is currently bigger than the stock of outstanding debt”. Within this undramatic sentence exists the potential for a rather dramatic global financial crisis. And, to be sure, seemingly the entire world has operated under the assumption that Chinese officials (and global policymakers in general) have zero tolerance for crisis – let alone a collapse. So Credit, speculation and leverage have been accommodated – and they combined to run absolute roughshod.

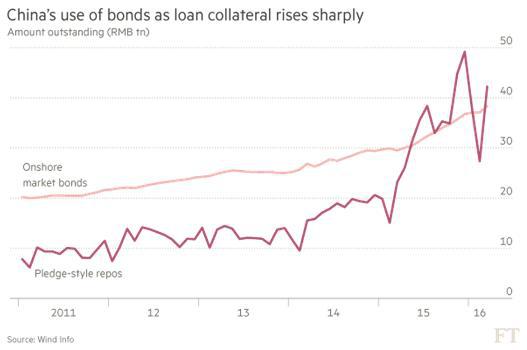

The Financial Times article includes a chart worthy of color printing and thumbtacking to the wall: “China’s Use of Bonds as Loan Collateral Rises Sharply”. The pink line shows “Onshore Market Bonds” having almost doubled since mid-2011 to about 40 TN rmb ($6.17 TN). The Red Line – “Pledge-Style Repos” – has ballooned four-fold since just early 2014 to surpass 40 TN rmb. So basically, in this popular market for inter-bank borrowings, borrowing banks have pledged bond positions larger than the entire market as collateral for their (perceived safe) short-term borrowing needs.

China has an historic Credit problem. It as well suffers from an unfolding “money” fiasco of epic proportions. My analytical framework attempts to differentiate the two, as each comes with its own set of (related) issues. A Credit Bubble is a self-reinforcing but inevitably unsustainable expansion of debt. Money (the contemporary variety) is a financial claim perceived as a safe and liquid “store of nominal value.” Importantly, systemic risk expands exponentially when risky borrowings are financed by an expansion of “money-like” instruments/financial claims. This typically occurs late (“terminal phase”) in the Credit Bubble Cycle.

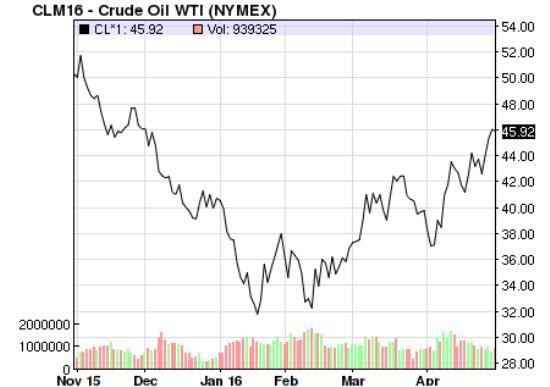

If the critics of China’s recent let-it-all-hang-out financial excess are right, a crisis of some sort is coming to a market near you. For instance, a fair bit of that Q1 $1 trillion went to boosting Chinese stockpiles — and therefore the price of — oil…

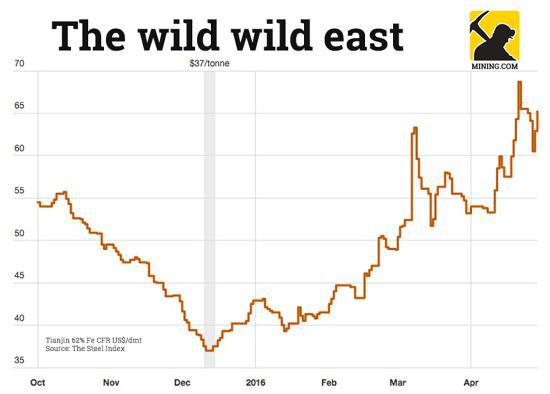

…and other commodities like iron ore. From More iron ore price madness as China’s mom-and-pops pile in:

On Friday the Northern China benchmark iron ore price jumped to $65.20 per dry metric tonne (62% Fe CFR Tianjin port) bringing gains since Wednesday to 7.8% as commodity investment fever grips Chinese investors. Last week iron ore hit a 16-month high following an 11% jump over just two trading days according to data supplied by The Steel Index.

The steelmaking raw material has enjoyed a 52% rise in 2016 and a 76%-plus recovery from nine-year lows reached mid-December. On the Dalian Commodities Exchange the price swings are much wilder.

Despite a clampdown on rogue traders, higher margin requirements and trading fees, circuit breakers on Dalian iron ore futures to curb excessive price movement were triggered for the umpteenth time on Friday. That’s despite the exchange in northeast China “temporarily” upping the daily price change limit to 6%. The most traded contract ended Friday at its highs, exchanging hands for 462 yuan or $71.40 a tonne, duly up 5.97% on the day.

Based on supply/demand fundamentals, oil and iron ore remain in massive gluts. So when China’s stockpiling ends — as it mathematically must — these markets will lose a lot of their exuberance. The question then becomes, how many speculators will default on their loans, and what kind of banking trouble will ensue? That’s unknowable, but it’s safe to assume, given the numbers involved, that the rest of the world will find it distressing.

So think of today’s relative calm as the eye of yet another storm, and what’s coming as a return to the hyper-leveraged new normal.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.