Did Shanghai Just Blow a Hole in the Old Gold Market?

Commodities / Gold and Silver 2016 Apr 29, 2016 - 09:25 PM GMT I did not want the day to pass without posting a few words on gold’s significant push to the upside, now trading just shy of the $1300 mark. To be sure, the dual positions with respect to rates on the part of the Bank of Japan (to stand pat) and the Federal Reserve (to remain ultra-dovish) played a role in the dollar’s recent weakness and gold’s strength. Those determinants though, in my view, are only part of the story, and the few percentage point drop in the dollar against the yen over the past week is really not enough to justify a nearly $60 rise in the price of gold over the past five trading sessions. The bigger determinant has been China’s underpinning of the gold price on two different occasions over the past week after it had taken a major turn to the downside in New York trading.

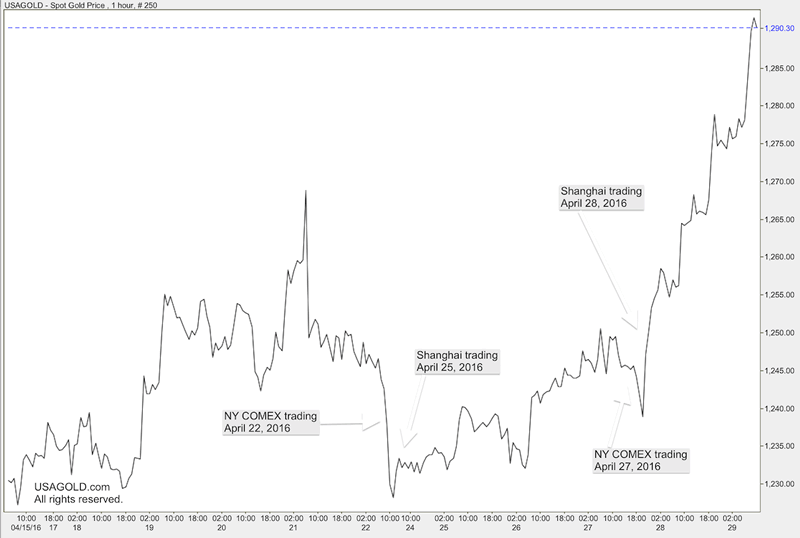

I did not want the day to pass without posting a few words on gold’s significant push to the upside, now trading just shy of the $1300 mark. To be sure, the dual positions with respect to rates on the part of the Bank of Japan (to stand pat) and the Federal Reserve (to remain ultra-dovish) played a role in the dollar’s recent weakness and gold’s strength. Those determinants though, in my view, are only part of the story, and the few percentage point drop in the dollar against the yen over the past week is really not enough to justify a nearly $60 rise in the price of gold over the past five trading sessions. The bigger determinant has been China’s underpinning of the gold price on two different occasions over the past week after it had taken a major turn to the downside in New York trading.

Taking place in benchmark sessions of the newly inaugurated Shanghai fix, the two reversals of New York pricing – occurring over the course of the past week – sent a message loud and clear to traders around the world: China was going to be a presence in the gold market and a formidable one. Its main mission remains the import of physical gold into China from whatever sources it can find. Most importantly, what it revealed by its activity on those two occasions, is that it is willing to bid up the price in order to secure physical metal. Up until those events, many analysts and traders believed China would be content to follow along with London and New York’s lead despite the introduction of its own yuan-based pricing mechanism, i.e. that it would continue on with the business of acquiring gold as it had in the past. That gold paradigm had a hole blown in it this past week. Welcome to the new gold paradigm.

I would be hard-pressed, at this juncture, to label China’s buying as an intervention, but in terms of how the market interpreted China’s price fixes on April 25 and April 27, it had the same impact as if it were, both psychologically and materially. The follow-on trading in London and New York yesterday and today had the look of short-covering – a direct reaction to a significant change in gold market sentiment. At the epicenter of that change sits the new Shanghai gold fix.

If China is going be an aggressive buyer of gold through its fix, paper traders will need to take notice or face the prospect of being called upon to make physical delivery at either the COMEX or the London benchmark sessions. Shanghai’s guardian at the gate posture might be enough to put a damper on players taking the short side of the market. Too, other market participants (hedge funds, investment funds, etc.) are likely to take a long look at the new architecture in the gold market, and when they do, they might decide to line-up on the side of China and the strategic instrumentality of its new benchmark.

To put a strong foundation under that line of thinking, reconsider this quote from Peoples Bank of China governor, Zhou Xiaochuan:

“At present, up to 12 trillion yuan stays in domestic residents’ saving accounts. The launch of individual gold investment, therefore, will allow residents to change currency assets into gold assets. At the macro level, it will expand channels for changing savings into investment, thus adjusting the money supply; in the micro aspect, allowing citizens to trade and keep gold can improve social welfare, benefiting both the country and the population. Moreover, with the dual attributes of common commodity and currency commodity, gold is a desirable instrument for hedging. Therefore, developing gold trade for individuals is practical.”

With those thoughts in mind, let’s go back for a minute to the notion of on-going dollar weakness and the decisions by Bank of Japan to stay pat on rates and the Federal Reserve to remain ultra-dovish. Do you remember reports a few weeks back, reported here, about a secret G20 accord to organize a de facto dollar devaluation? More and more, it is beginning to look like such an accord may have been agreed. If so, it would explain the Fed’s mysterious dovishness of the past several weeks. It also serves as an additional impetus to gold demand among investors of all descriptions – private, public and institutional. (Don’t forget the United States is the third largest buyer of gold after China and India.) Worth Wray, chief economist and global macro strategist at STA Management and an expert on emerging markets, says such an accord would be a “game changer.”

At the time the rumored accord was revealed, we suggested that “major international accords are rarely reversed in the short term given that they are usually inspired by deep-seated concerns among the members. Adding credence to the rumor, we should not overlook the fact that the Fed did feature concern about emerging markets in its public statement following last week’s meeting. It all comes together rather nicely. . . . . . .Too, since the rumors were first reported just this weekend, the market reaction is far from fully realized.”

Even now, we continue to believe that the full impact is yet to be realized. Coupled with Shanghai’s aggressive acquisition strategy, we do think that we may have entered a new era for the gold and silver markets. In the past, strong physical demand often failed to translate to prices. We may have come to a place where that gap between cause and effect may have been breached.

Final Note: Though it is too early to characterize the two instances of reversing the price trend in the New York market as systematic support for higher prices, both stand out as examples of how China can go about achieving its goal to become a major player in gold’s pricing dynamics. Too, there will likely be price levels along the way, where traders in both the East and West believe prices are too high and due for a correction. Asian physical buyers, under those circumstances, likely will go to the sidelines and Western traders might once again exploit the weaker demand. In short, the trading in Asia, like the trading in the West, is unlikely to become a one-way street.

____________________________

Reader note: This article and much more are featured in the upcoming edition of our monthly newsletter, News & Views – Forecasts, Commentary & Analysis on the Economy and Precious Metals. To receive the full edition free of charge by e-mail, we invite you register here.You will also receive immediate access to our April issue. For over 25 years, News & Views has offered in-depth, cutting-edge coverage of the gold and silver markets – guiding light not only for our clientele, but readers all over the world. Over 20,000 subscribers.

Reader note: This article and much more are featured in the upcoming edition of our monthly newsletter, News & Views – Forecasts, Commentary & Analysis on the Economy and Precious Metals. To receive the full edition free of charge by e-mail, we invite you register here.You will also receive immediate access to our April issue. For over 25 years, News & Views has offered in-depth, cutting-edge coverage of the gold and silver markets – guiding light not only for our clientele, but readers all over the world. Over 20,000 subscribers.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.