Is Silver a better bet than Gold in the Near Future?

Commodities / Gold and Silver 2016 Apr 29, 2016 - 04:21 PM GMTBy: Chris_Vermeulen

Last week, the beginning of April 18th, 2016, silver was on fire, rising sharply and forcing ‘Wall Street’ to take note of its move, though, many investors believe that gold and silver are one and the same, one can hold either in your portfolio and earn the same returns? the truth is far from that!

Last week, the beginning of April 18th, 2016, silver was on fire, rising sharply and forcing ‘Wall Street’ to take note of its move, though, many investors believe that gold and silver are one and the same, one can hold either in your portfolio and earn the same returns? the truth is far from that!

In reality, though both silver and gold are considered precious metals and over the long-term, they have a high degree of ‘correlation’ in their movements, but in the short-term, for the active investor, both offer opportunities at different times.

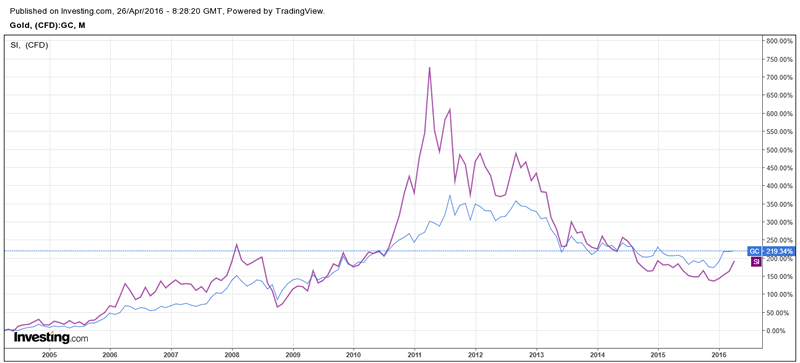

From the chart below, it is clear that once the bull market starts in precious metals, silver beats gold hands down. From 2005 to the highs in 2011, gold returned an impressive 350% returns, whereas, for the same period, silver recorded an astounding 700% return.

My subscribers are aware that we are extremely bullish on the precious metals over the next few years when the global economies enter ‘The Great Financial Reset’. Gold will be in a sustained bull market for years to come and will reach levels which now seem unbelievable.

History suggests that if gold witnesses a resounding bull market, silver will outperform it.

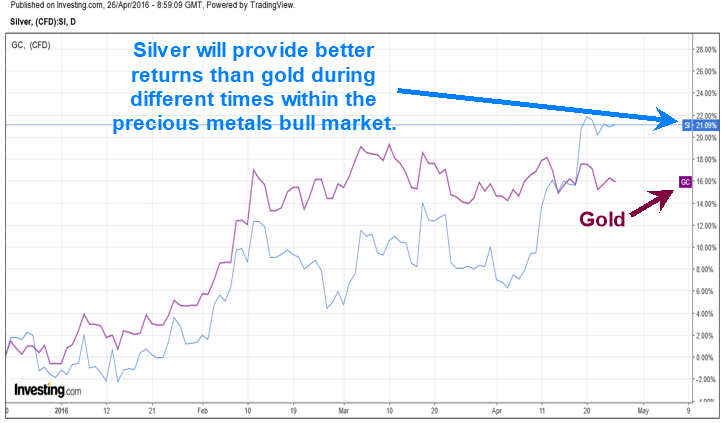

However, occasionally, investors will benefit if they trade in and out of both these markets. At times, holding silver is more profitable than gold and at other times, it is the other way around.

Consider this, if one would have bought gold, during the start of this year of 2016, one would have made an impressive 16% returns in the first two months’ as shown in the chart below. However, silver would have returned a 12% return for the same two-month period.

Since then, I raised a ‘red flag’ regarding a short-term top developing in gold and gold prices have been range-bound with a downward bias.

On the other hand, silver has taken off, on April 18th, 2016, netting an investor a 16% gain in this month, which beats most other asset classes, including gold. Today, ‘Commercial Traders’, as determined by their large position, which we have not been this bearish on silver since 2008. This is when silver traded from $21 per ounce all the way down to $8 just before silver had a multi-year rally topping in 2011. They set a new record short position last week!

Concluding Thoughts:

In a couple days, I will be posting the second half of this article here on this website to show you what exactly is likely to happen and when for both gold and silver. Trading and investing is not as simple a most think it is. Just because you or someone you follow is bullish on an investment does not mean it is a good buy or should be bought. Timing is everything in the markets and knowing when and where to buy and sell is the key to long-term success.

The big question you should be asking yourself is if precious metals are headed lower? This I will share with you in a couple days, stay tuned.

If you would like to know when to buy and sell as a short-term trader or long-term investor using ETF’s and join me at www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.