FOMC statement and the Stock Market

Stock-Markets / Stock Markets 2016 Apr 27, 2016 - 05:33 PM GMT The algos have taken over after the FOMC release. ZeroHedge reports, “ The kneejerk - USD up, stocks down, bonds down - reaction has faded and with The Fed statement pitching its dovish tent back in domestic concerns while keeping a hawkish eye on global developments. The Long bond is back in the green but it appears machines are busier running oil stops higher and dumping gold.”

The algos have taken over after the FOMC release. ZeroHedge reports, “ The kneejerk - USD up, stocks down, bonds down - reaction has faded and with The Fed statement pitching its dovish tent back in domestic concerns while keeping a hawkish eye on global developments. The Long bond is back in the green but it appears machines are busier running oil stops higher and dumping gold.”

We want to be cautious with SPX until it crosses Short-term support at 2085.09. A move higher may change the Wave structure and delay the sell signal.

FOMC Statement Key Takeaways are: The best, and so far most concise assessment of the FOMC statement comes from Stone McCarthy which points out the following:

Key Take-Aways:

The April 27 statement downgraded economic activity, said it "slowed", but labor market conditions "improved further" and inflation still expected to rise toward 2% over the medium term.

Removed language that "global economic and financial developments continue to pose risks".

Kansas City Fed's Esther George dissented in favor of a rate hike.

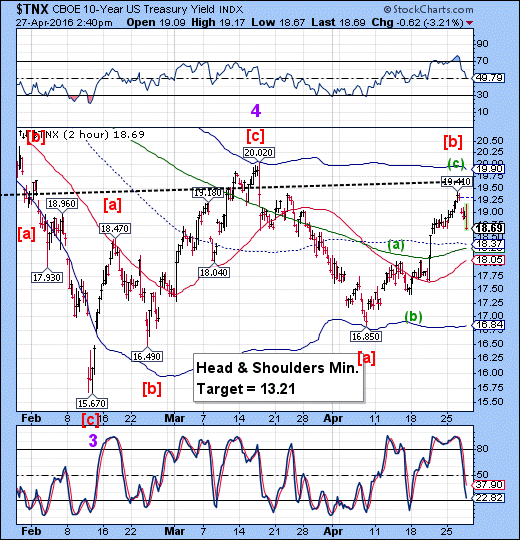

TNX also wobbled this afternoon, but it appears that it has resolved to the downside.

Crude oil spiked higher. I will cover it in the mid-Week report.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.