Long Awaited Gold Price Breakout

Commodities / Gold and Silver 2016 Apr 26, 2016 - 06:45 PM GMTBy: Jim_Willie_CB

For the last year or more, not an elephant, not a gorilla, but a dragon has been found at the dinner table. Its breath has just made everybody at the table totally bald with some scorched red faces. Now all are looking at each other, wondering who will first mention the bald guys at the table. The Shanghai levers are finally functioning, starting with the Gold Fix and continuing with the RMB-based gold futures contract (which delivers gold metal oddly). The game is finally on, as in the climax chapter to the End Game. Paper gold is totally disconnected from fundamentals. The paper charade is as impressive as it is corrupt. Its enemy is physical gold and related demand. Silk Road nations have strong gold demand, which will disrupt the entire geopolitical balance of power, extending from trade and non-USDollar platforms. The West has the corner on toilet paper used in the gold market. The United States has the corner on the USDollar, used in fraud and illicit tolls.

For the last year or more, not an elephant, not a gorilla, but a dragon has been found at the dinner table. Its breath has just made everybody at the table totally bald with some scorched red faces. Now all are looking at each other, wondering who will first mention the bald guys at the table. The Shanghai levers are finally functioning, starting with the Gold Fix and continuing with the RMB-based gold futures contract (which delivers gold metal oddly). The game is finally on, as in the climax chapter to the End Game. Paper gold is totally disconnected from fundamentals. The paper charade is as impressive as it is corrupt. Its enemy is physical gold and related demand. Silk Road nations have strong gold demand, which will disrupt the entire geopolitical balance of power, extending from trade and non-USDollar platforms. The West has the corner on toilet paper used in the gold market. The United States has the corner on the USDollar, used in fraud and illicit tolls.

PAPER GOLD FRAUD

Paper Gold is a term used to describe the actively traded futures contracts which determine the gold price. Owning such paper instruments is not the same as owning physical gold, since corruption defrauds the investor and interrupts the claim. Most investors remain largely unaware of how disconnected the paper markets (COMEX in United States & LBMA in England) are from reality. The entire concept of contractual (paper) price discovery has been corrupted beyond all recognition. The activity in the last couple years has raised great alarm due to the rapid pace of divergence between paper gold prices and the tangible world fundamentals within the gold arena.

The claims of paper contracts per ounce versus actual gold has run to almost 300-to-1 in recent months. It was considered outrageous two years ago when at only 25-to-1 or 40-to-1 in ratio. Imagine the lunacy of even five to six people claiming ownership to your car or house, or better yet your summer cottage by the lake. The dominance of paper gold pricing mechanisms has resulted in profound shortages in supply, as well as horrendous conditions for mining firms. They have been forced to shut down marginal mines, since not profitable. Only a rare few among mining firms like Majestic Silver has undertaken to deny supply to the COMEX, and to call a partial strike against the criminal COMEX organization. Absolutely no equilibrium exists in the gold market, as demand outstrips supply, which quickly vanishes. The shortages have made history in recent months and years.

Paper Gold on COMEX and LBMA is a crime scene. It is toilet paper with gilded surfaces, better described as elaborate corrupt contracts with a few gilded letters at the top. Trading gold futures, which are essentially delivery contracts, must entail some degree of abstract financialization. If someone is merely trading a gold contract in order to arbitrage, then it would be costly, time consuming, and ultimately pointless to shift physical gold around. It is only the paper gold contracts that trade hands, not the physical metal on ramps. The banker cartel relies upon this hardship of movement to create the corrupt scheme. People do not wish to carry 80 silver coins in their pockets or a kilogram of gold in a suitcase, so instead they use certificates which become instantly corrupted. The necessary evil has grown far beyond its intended proportions, a practice refined and led mainly by the big banks.

Currently, the number of contracts on the COMEX represents 300 times as much paper gold as there is physical metal in the COMEX vaults. Moreover, this number has ballooned at a faster pace over the past two years or so. The 300:1 ratio of contracts to physical ounces is propped by powerful restrictions. The COMEX forbids delivery of gold on the ramps to satisfy a gold contract, under threat of banning the party from participation and entry in the door. Almost nobody takes actual delivery of their metal, except for the big Wall Street banks which steal gold from other depositors. These banks also routinely rig the windows to enable removal of investor gold in the GLD Exchange Traded Fund, and silver from the similar SLV fund. Imagine a gold futures contract with no delivery possible. How absurd! But it has been the reality since June 2012.

The situation is perhaps even more frightening in the London Bullion Market Assn (LBMA). This market sees $trillions worth of gold trades every day. The activity is truly baffling. On individual trading days, more gold changes hands within contract trading (paper shuffling) across the London market than all the available gold in the world. Yet no metal moves anywhere, in a grand charade. These are merely paper transactions, with almost no actual metal ever in movement. The staggering leverage and dilution should not make any sense to the rational observer. However, in sharp contrast, the Eastern nations are accumulating gold in large volume.

GOLD & SILVER PRICE REVERSALS

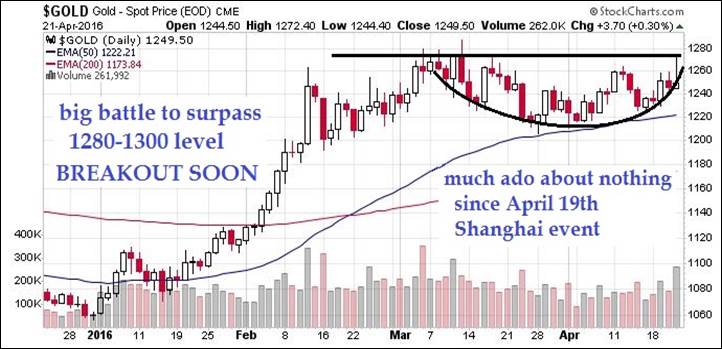

The gold reaction to the Shanghai market development has been muted. But a powerful reversal is in progress, which should be impossible to halt or to obstruct. An unsual pattern shows itself in an upward bias Cup & Handle toward a reversal, where the $1300 level is well defended.

The signals are many on the positive side. The reversal pattern is powerful and unmistakable. The upward tilt is unusual and potent, as a very bullish signal indeed. An explosive violent rise could occur soon. It might not be noticed well by some analysts. The moving average crossover for the 20-week MA above the 50-week MA is a very reliable signal, confirmed by the stochastics cyclical index. Gold is stodgy but it will prevail and complete the upside breakout. The banker cabal will throw a lot of paper at it, but the paper will be burned and converted to metal by force. These are exciting times. The world is on the verge of witnessing the fall of the banker cabal and the removal of the King Dollar as global reserve currency. The battle is as fierce as the dollar is toxic. See the gold weekly chart where the breakout seems imminent.

The daily gold chart shows a rather tepid response to the April 19th event, where Shanghai launched the Gold Fix and began the gold-delivered futures contract priced in RMB terms. The battle is on to defend the $1280-1300 level. Pressure builds to break out above that level. It will happen soon, but impossible to tell when. It depends on how much more worthless contract paper the banker cabal chooses to stuff in the COMEX toilets, how much more corruption they wish to be exposed for, how much more desperation they will display on a very well observed global stage. The Chinese to be sure are very angry at continued paper stuffing of the golden ballot boxes where votes are placed on the price discovery process! Notice the absent gold rally in the last several days of trading, with no breakout evident in the daily chart.

Silver leads the precious metals breakout in impressive fashion. The Cup & Handle pattern indicates an 18 target to be reached very quickly. Both following charts exhibit a constructed launching pad for an assault on the $20 level. Suspicion has arisen that China is acquiring silver in an industrial stockpile, possibly for monetary purposes also. A bigger controversy has emerged, whereby JPMorgan might be the hired agent by China to secure vast amounts of silver bullion. The USGovt appears to have reneged on yet another lease contract with the Middle Kingdom. The US has confirmed once more itself to be the exceptionally corrupt nation. See the weekly chart for silver, where the breakout is as clear as one's reflection off a shiny silver surface. It is consolidating at the $17 price level.

A different pattern is shown on the daily silver chart, one that rhymes with the breakout in the weekly silver chart. Notice the surge in volume to exit the range established since February. The target for the daily chart breakout is also indicated around the $18 level. This chart and the chart above resemble a launching pad of a different look where a tilted range no longer held the price movement.

SILVER SURFER

Beware the silver surge in impressive moves upward. The silver price has surged over 10% in the last two or three weeks to over $17 per ounce, where consolidation occurs. The Silver Surfer is on the move, making his presence known. The Sprott Silver fund will add $75 million to silver drainage. Gold fights the geopolitical banker battles, but silver rides through the gate on a swift white horse. Silver has surged in recent weeks. Its impressive move of nearly 80 cents on April 19th was duly noted, an echo from the Shanghai gongs. Silver easily surpassed technical resistance at $16.20/oz. The next big test is resistance at $18 per ounce. The brief peaks in early 2015 will not stop the Silver march upward. No significant activity was seen at either minor peak event, a requirement for resistance to be exerted. The Silver Surfer is ready to capture the earth's attention again.

The Supply & Demand dynamics in the silver market remain conducive to higher prices in the coming months. Industrial and investment demand for silver is strong. Industrial demand for silver is expected to rise 3% in 2016, according to Capital Economics. Silver investment demand has risen by 400% from under 50 million ounces in 2006 to 200 million ounces in 2015. Investment demand remains robust with monetary role becoming clear. The stockpile function adds to supply pressures.

An interesting event recently occurred. The Sprott Physical Silver Trust (PSLV) is an honest strong player in the precious metals arena. Eric Sprott and John Embry are as honest and full of integrity as Wall Street executives are corrupt and lacking scruples. The Sprott fund is a trust created to invest and hold nearly all of its assets in physical silver bullion, managed by Sprott Asset Mgmt. They announced in the first week of April that it has priced a follow-on offering of 12.3 million transferable, redeemable units of the Trust (called shares). The price is set but most important is the volume. The gross proceeds from the Offering will be US$74.91 million. The demand will come quickly, a substantial amount of silver to come out of an already very tight market.

Investment demand is will surely remain robust and probably increase due to ineffective QE policies, still ultra-loose monetary policies, negative interest rates, and ongoing federal deficits among most sovereign nations. The ruin of money is complete, and entering the climax phase for demise of the USDollar and its removal as global currency reserve. African style monetary policy at the US Federal Reserve since 2012 has rendered the USDollar toxic, and undermined the global reserves held by nations. Hyper monetary inflation has severe consequences. The community of nations has reacted in a global revolt. Most people among the common masses cannot imagine a world without the USDollar. They assume it as a constant. It is not. Only a small minority among the common masses have observed the broad-based movement in the East to construct non-USD platforms like the BRICS Development Fund and the Asian Infra-structure Investment Bank (competitors to the Intl Monetary Fund and World Bank), the Chinese Interbank Payment System (alternative to SWIFT), and even the Eurasian Economic Union (seeking to join with the European Union itself). Thus the upcoming shock, when the USDollar is gone and shortages arise, then later the price inflation from the currency crisis. It is especially difficult to convince the common masses of paradigm shift and great change when they do not know what the term global currency reserve means, and do not know what the SWIFT bank transactions are. The former is usage of USTreasury Bonds in core reserves within foreign banking systems. The latter is a method of transfer from bank to bank across the world.

If truth be told, the official monetary policy is wrecking the global economy. QE with ZIRP serve as a death warrant to the USDollar, etched in monetary policy. Assured mutual destrution is clear. The Gold Standard is visible, a solution avoided since 2008 but urgently called for now. Bear in mind the honest inflation adjustment, which calls for the 1980 high to occur at $150/oz for silver. It remains realistic, especially given the increasing usage of silver in various industrial application. Silver will be part of the new asset backed global currency system. NEXT COMES A GLOBAL LEHMAN MOMENT WITH BANK FAILURES AND A THREAT TO THE ENTIRE WESTERN BANKING SYSTEM. Nothing has been fixed since 2008. No big bank liquidations have occurred. No currency reform has occurred. The banking reform has been a sham, run by the big banks themselves. Banker power has been preserved. Next the Western bank power will be lost.

Behold an obscure but shocking statistic, not easily observed since the crude oil price decline has dominated many headlines. The bank losses are next, unavoidable over time. The queues of loaded crude oil vessels grab headlines. A favorite bizarre broken data point is that in the full year 2015, over half a million containers were exported from US shores like Los Angeles, San Francisco, New York, and New Jersey that were empty. A new major US export is stale air locked in containers, loaded from US ports and destined for Asia and Emerging Markets. US export of fraudulent bonds, military weaponry, diabetes, and laced vaccines now has another item on the sickening list. The system is truly broken.

CLIMAX OF DUMPED PAPER IN GOLD MARKET

The Wall Street and London Centre banker criminals dumped $2 billion of paper gold into futures markets on April 21st. They dumped $1.5 billion of paper silver into futures markets. They only buy a little time, while losing more face. The entire world observes the corruption in real time. A powerful Chinese response to final days suppression is coming, as Shanghai will deliver a message soon. It will be given in their time frame, not ours.

The desperation is obvious, palpable, incredible, fascinating, and unmistakable. History is being made, as the last ditch is overrun. The banker cabal wishes to defend an indefensible $1300 gold price and to defend an indefensible $18 silver price. They will fail, but not before throwing $billions of unbacked unsupported counterfeit contract paper at the market. The Chinese will flush the paper like so much toilet paper in sudden thrusts of the lever, down the COMEX toilet, using their gilded Shanghai lever. The publicity grows on their corruption, like with admissions by Deutsche Bank. The lawsuits are piling up.

The Wall Street and London Centre hives risk a powerful response by China at their newly fortified Shanghai helm. Expect very soon a strong message given to the West. The Chinese will not tolerate further corruption in the gold price mechanisms. They hold too much gold and they want it priced properly for global usage, even a banking role, a currency role as well. The Chinese are the leading producer and consumer of gold. They demand proper pricing for an important asset soon to become a widely used banking reserve asset. Expect very soon for China to test the mettle of the corrupt Western stewards of paper gold & paper silver by lifting the Gold Price by something like $100 and lifting the Silver Price by something like $2.00 in a single overnight alarm gong. The Chinese are motivated to deliver a message of wrested control, to slam the table, marking new management for the precious metals market. It is coming! It will happen soon! The Chinese are patient, but their patience has almost run out.

NEW SCHEISS DOLLAR & GOLD TRADE STANDARD

In time, expect an eventual refusal by Eastern producing nations to accept USTreasury Bills in payment for trade. The IMF reversal decision assures this USTBill blockade in time, and might accelerate the timetable. The United States Govt cannot continue on five glaring fronts of gross negligence and major violations. These violations have prompted the BRICS & Alliance nations to hasten their development of diverse non-USD platforms toward the goal of displacing the USDollar while at the same time take steps toward the return of the Gold Standard. The violations are:

1) to import finished goods and crude commodities, paying with IOU coupons

2) to commit multi-$trillion bond fraud in its big banks, done without legal prosecution

3) to do QE bond purchases in applied hyper monetary inflation, monetizing debt

4) to rig all major financial markets in favor of the primal USDollar

5) to engage in numerous regional wars to support the USDollar.

The New Scheiss Dollar will arrive in order to assure continued import supply to the USEconomy. It will be given a 30% devaluation out of the gate, then many more devaluations of similar variety. The New Dollar will fail all foreign and Eastern scrutiny. The USGovt will be forced to react to USTBill rejection at the ports. The US must accommodate with the New Scheiss Dollar in order to assure import supply, and to alleviate the many stalemates to come. The United States finds itself on the slippery slope that leads to the Third World, a Jackass forecast that has been presented since Lehman fell (better described as killed by JPM and GSax). The only apparent alternative is for the United States Govt to lease a large amount of gold bullion (like 10,000 tons) from China in order to properly launch a gold-backed currency. Doing so would open the gates for a generation of commercial colonization, but actual progress in returning capitalism to the United States. The cost would be supply shortages to the USEconomy, a result of enormous export increases to China. The colonization has already begun, with secret deals galore. As Ron Paul has stated, one cannot blame capitalism for the current failure, since we have had almost none!

The Gold price will find its true value and price over $10,000 per ounce. The Silver price will find its true value and price over $300 per ounce. In reaching these levels, the ratio will return to the 30-1 range. Several steps have been laid out by the Hat Trick Letter toward the return of proper price to precious metals. The major upcoming events will be exciting to watch unfold, one after the other, in an inevitable sequence away from fascism and concentrated uni-polar power, with a strong movement toward freedom and equitable systems with distributed power. The steps will each involve a quantum jump in the Gold & Silver prices. The process will take a few years, but might be breath-taking in speed once the process is begun. The steps involve:

- the critical mass of rejected USTBills in trade settlement, citing its corrupt roots and illicit monetary policy as foundation

- the return to the Gold Trade Standard and introduction of Gold Trade Notes as letters of credit, in replacement for a fair tangible payment system (no more IOU coupons)

- the recapitalization of the global banking system with Gold as primary reserve asset, so as to relieve the grotesque stagnation, insolvency, and dysfunction

- the seeking of equilibrium in Supply vs Demand in the new fair uninhibited market, with exclusive control removed from London and New York, and placed elsewhere like in Shanghai, Hong Kong, Dubai, and Singapore.

- the seeding of BRICS gold & silver backed currencies from participating nations within the Alliance (likely several with slight variation in features)

- the re-opening of the gold mine industry with some blue sky, and relief from the Evergreen element at Barrick

- the remedy toward owners of over 40,000 tons of rehypothecated and stolen gold in bullion banks across the world (primarily in Switzerland.

"As a Golden Jackass subscriber, I greatly enjoy listening to your interviews because it really lends a sense of passion that lies behind the tremendous body of information and formulation that goes into your monthly research. Though I must admit, it scares the hell out of me most of the time. Still, I will not miss it for the world. I feel that having a truly objective insight from your research, in depth analysis, and accurate forecasts gives me and my family an important life saving advantage. And I mean that sincerely."

(MichaelS in Ontario)

"I have continued my loyal patronage of your excellent commentaries not so much because of my total agreement with your viewpoints, but because you have proven yourself to be correct so often over the years. When you are wrong, you have publicly admitted it. You are, I suppose by nature, an outspoken and irreverent spokesman for TRUTH against power, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerly assimilating any and all free information (articles, interviews, etc) that Jim Willie puts out there. Just recently I finally took the plunge and became a paid subscriber. I regret not doing this much sooner, as my expectations were blown away with the vast amount of sourced information, analysis tied together, and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com, which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.