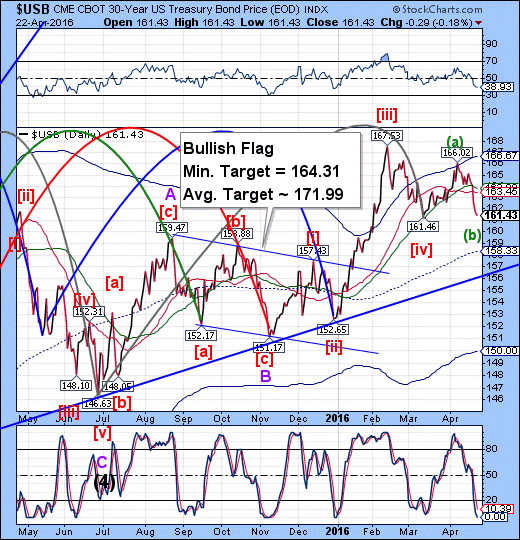

US Bonds Nearing Their All-time High

Interest-Rates / US Bonds Apr 25, 2016 - 06:23 PM GMTUSB futures are lingering at their lows from Friday. The Cycles Model suggests a Trading cycle low may be made at any time in the next 72 hours. What may follow is a ramp to the average target of the Bullish Flag formation.

Bloomberg writes, “Bond investors are taking bigger risks than ever before.

Yields on $7.8 trillion of government bonds have been driven below zero by worries over global growth, meaning money managers looking for income are pouring into debt with maturities of as long as 100 years. Central banks’ policy is exacerbating matters, as the unprecedented debt purchases to spur their economies have soaked up supply and left would-be buyers with few options.”

A case in point is Unilever’s 0% Coupon bond issue. ZeroHedge writes, “On Friday we wrote our latest take on how the ECB's CSPP, or corporate bond buying program, in which we explained how this ECB's latest market manipulating adventure is about to crush the fundamentals of the European (and soon, courtesy of the ECB's "SPV" loophole, global) bond market. We showed how the ECB, in its latest attempt to become an even more market-moving hedge fund, is set to buy billions in corporate bonds and not just European but also international, as long as they have a European-domiciled (read Ireland or Netherland) SPV holdco.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.