Market Bubbles, Bubbles, Toil and... Pop

Stock-Markets / Liquidity Bubble Apr 22, 2016 - 06:10 PM GMTBy: Doug_Wakefield

"Prosperity is like a Jenna tower. Take one piece out and the whole thing can fall." That's a direct quote from John Williams, the President of the San Francisco Federal Reserve Bank in a speech a few weeks ago. - US Recession Data Shows It's a Very Short Road to Capital Controls, Simon Black, March 15, 2016

"Prosperity is like a Jenna tower. Take one piece out and the whole thing can fall." That's a direct quote from John Williams, the President of the San Francisco Federal Reserve Bank in a speech a few weeks ago. - US Recession Data Shows It's a Very Short Road to Capital Controls, Simon Black, March 15, 2016

"On April 13, 2000, when the Chairman was in front of the Senate Banking Committee, he was asked if an interest rate hike would prick the stock market bubble. He responded: 'That presupposes I know that there is a bubble... I don't think we can know there's been a bubble until after the fact. To assume we know it currently presupposes that we have the capacity to forecast an imminent decline in prices.' " [Chairman of the Federal Reserve, Alan Greenspan - Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve (2008) William Fleckenstein w/Fred Sheehan, pg 99]

In 2009 the world embarked on the largest ever debt expansion by the state (privately own central banks) to "defeat deflation", "rescuing" us from the Great Recession.

In 2014, we learned from the highest authority in the global banking world, the Bank of International Settlements, that all of this cheap debt, had now brought us to another unsustainable juncture, when they stated in the New York Times' article, Central Banks, Worried About Bubbles, Rebuke Markets (June 29 '14), that "dangerous new asset bubbles were forming even before the global economy has finished recovering from the last round of financial excess", and that "a growth model that relies on too much debt, both private and public", "over time sows the seeds of its own demise."

So which is it? Did Greenspan not see a bubble in April 2000 yet was concerned about "irrational exuberance" in December 1996?

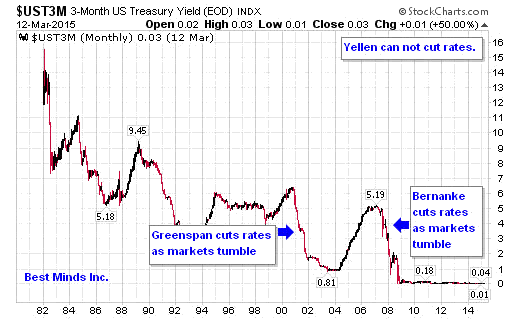

Did Greenspan and Bernanke not understand that cutting rates to the lowest in American history at the time would unleash a torrent of new debt that "over time sows the seeds of its own demise"?

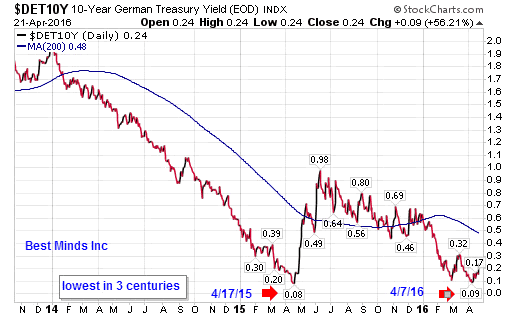

Chart from Free Money: What Could Go Wrong?, March 13, 2015

Does Yellen, Chairman of the Federal Reserve and holder of one of the most powerful offices in the financial world, not see the continuing debt bubble that she and her global cohorts fostered when she recently stated, "I certainly wouldn't describe this as a bubble economy"? What about an economy strapped by a debt bubble? What about "a growth model that relies on too much debt"?

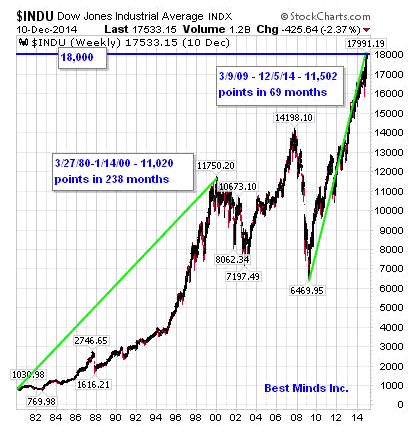

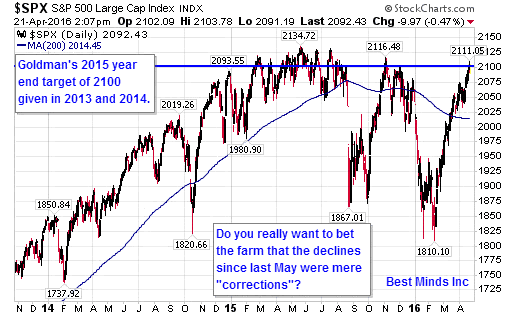

Chart from 10 Years of 'Why Sell Now?', Dec 11 '14

On March 9, 2015, Draghi's QE Europe got underway, and the ECB started buying up sovereign bonds in an attempt to lower the costs of borrowing. However, since central banking planners always hype their "unlimited powers" far in advance of an event, 6 weeks after the start of QE Europe the yields on 10 year German bunds reached their three CENTURY low. Five weeks after the start of QE Europe the DAX topped and rolled over from its highest level ever.

The launch of QE Europe "corporate bond" was announced on March 10, 2016. Once again, bund yields were dropping along with stocks worldwide in January and February before this announcement. The March announcement let everyone know that starting in April, the ECB would use part of its increase of $20 billion euros of new debt each month to purchase European corporate bonds in an attempt to once again move borrowing costs lower and stocks higher.

Well the ECB's release on April 21st comes 6 weeks after the March 10th release. Two weeks ago 10-year bund yields reached 0.089%, the second lowest reading in history. Today, bund yields did not support the "unlimited powers to suppress yields", and the 10-year shot up 56% to 0.24%.

Have Morgan and Goldman Already Warned Equity and Bond Investors?

While the financial industry still teaches the erroneous efficient market theory to advisors, anyone reading headline after headline about financial markets since 2008 understands that the public has been groomed to give up on what is left of free markets, and to place all their trust in the "central bankers have your back, and can always print more debt to rescue your investments" theory. Frankly, if this myth were true, no one, including the largest banks in the world, would be concerned about risk. The lessons of cheap money and unsustainable booms could be thrown in the bust bins of history as we sail into the future.

But common sense tells us that markets are not efficient when centrally planned and "assisted" constantly. The lessons from the history of merchant bankers make it clear that some players have always known a great deal more than Main Street.

In my March 2015 article, Investment Parachutes, Do You Have Yours? I presented a target in the S&P 500 given by David Kostin, Chief Equity Strategist at Goldman Sach in 2013 and 2014. Consider this level over the last 18 months.

S&P 500 May Reach 2,100, Goldman Sachs Says, Bloomberg, May 21, '13

"Goldman Sachs Group Inc. said the U.S. stock-market rally may last at least another 2 ½ years, sending the Standard & Poor's 500 Index (SPX) up 26 percent to 2,100.

David Kostin, the bank's New York-based chief U.S. equity strategist, raised forecasts for the U.S. equity benchmark, predicting it will finish 2013 at 1,750 and 2014 at 1,900 as stock valuations increase, according to a research report dated yesterday.

Goldman: The Stock Market in 2015 Will Be...Meh, Business Insider, Nov 20 '14

"Goldman Sachs equity strategist David Kostin is out with his 2015 outlook for the S&P 500. Kostin's price target: 2,100."

What about JP Morgan? Have they presented anything to the buy and never sell group of investors and advisors that might need to be considered with Dow 18,000 back in the headlines? Consider the following comments released by JP Morgan last spring:

"The market depth of 10-year Treasuries (defined as the average size of the best three bids and offers) today is $125 million, down from $500 million at its peak in 2007. The likely explanation for the lower depth in almost all bond markets is that inventories of market-makers' positions are dramatically lower than in the past. For instance, the total inventory of Treasuries readily available to market- markets today is $1.7 trillion, down from $2.7 trillion at its peak in 2007. Meanwhile, the Treasury market is $12.5 trillion; it was $4.4 trillion in 2007. The trend in dealer positions of corporate bonds is similar." - March 2015 Letter to JP Morgan Stockholders, page 31

So I ask you, if liquidity has been declining at the market maker level over the last several years as QE has been increasing debt levels worldwide and inflating asset prices, what will happen when the crowd hits the sell button and not only find buyers unwilling to pay "all time high" prices for stocks and bonds, but face a dearth of cash and liquidity too?

The New York Times informed readers last week in their article, Regulators Warn 5 Top Banks They Are Still Too Big Too Fail, that 5 of the 8 largest US banks were told by a join task force between the Federal Reserve and the FDIC that their plans for how to wind themselves down in a crisis did not pass. JP Morgan's letter states on page 11 that "Flexibility - or "optionality" - within the resolution strategy helps mitigate risks, that if not overcome, could otherwise undermine successful execution of the preferred strategy and, more broadly, pose serious adverse effects to the financial stability of the United States."

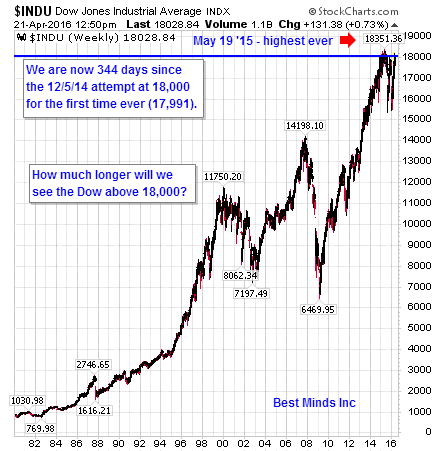

Does that sound like bull market rhetoric that would push the Dow easily over 18,000 again and keep climbing? Are most individuals even being presented with information of this gravity?

As prices once again begin to descend away from the S&P 2100 and Dow 18,000 levels, the illusion that centrally planned markets by Keynesian economists are the same as free markets argued by Austrian economists will start to unravel. Far more is going to change in the period ahead than merely watching inflated market prices leave their mountain top experiences.

Be a Contrarian, Remember Your History

If you are reading this article, you are already aware of the huge disconnect between the global slowdown, and stocks leaping skyward these last 2 months. It is very clear to anyone paying attention to "the game", that the number of critical pressure points is even higher now than they were last May.

Click here to start the next six months reading the paid research found in The Investor's Mind newsletters and ongoing brief market emails as we continue through this highly volatile year.

On a Personal Note

Check out the posts at my personal blog, Living2024 . The latest post is A Global Currency: Peace or Pain .

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.