Woe-Mart: The Retail Giant Walmart Has Faltered

Companies / Retail Sector Apr 19, 2016 - 03:48 PM GMTBy: EWI

The era of "always low prices" no longer translates into always high profits. Learn what we think is behind the shift

The era of "always low prices" no longer translates into always high profits. Learn what we think is behind the shift

Walmart founder Sam Walton said:

"There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else."

Never were those words felt more acutely for those on the Walmart payroll than right now. Reason being: Over the last year, the eponymous Walmart "customer" has, indeed, taken his business elsewhere, fueling a series of epic setbacks for the retail giant:

- Store closures, layoffs, and the shuttering of its entire fleet of smaller "Express" locations across the U.S.

- A near 40% decline in its stock (WMT) before hitting bottom in November 2015

- Losing its status as the world's #1 retailer to Amazon

- And -- the sour cherry on top: The first decline in annual revenue since Walmart went public 45 years ago

In the words of a March 31 Bloomberg: It's "the end of an era for Walmart."

Which leaves one question: How the heck does a big-box behemoth go from retail victor to re-fail victim?

Well, according to the mainstream experts, the main cause of Walmart's woes are many-fold, from falling oil prices - to - China's flailing economy - to - the extinction of the brick-and-mortar store - to - the biggest baddest culprit of all, the brawny greenback:

"Walmart profits hit by strong dollar" (CNN Money)

Economists can always be counted on for providing endless explanations as to why a corporate king gets dethroned -- after the fact.

But in our opinion, one's time and energy is better served anticipating those turns. Which is exactly what our analysts did in regard to Walmart's reversal of fortune -- starting with our September 2013 Elliott Wave Financial Forecast's bearish call for Walmart stock:

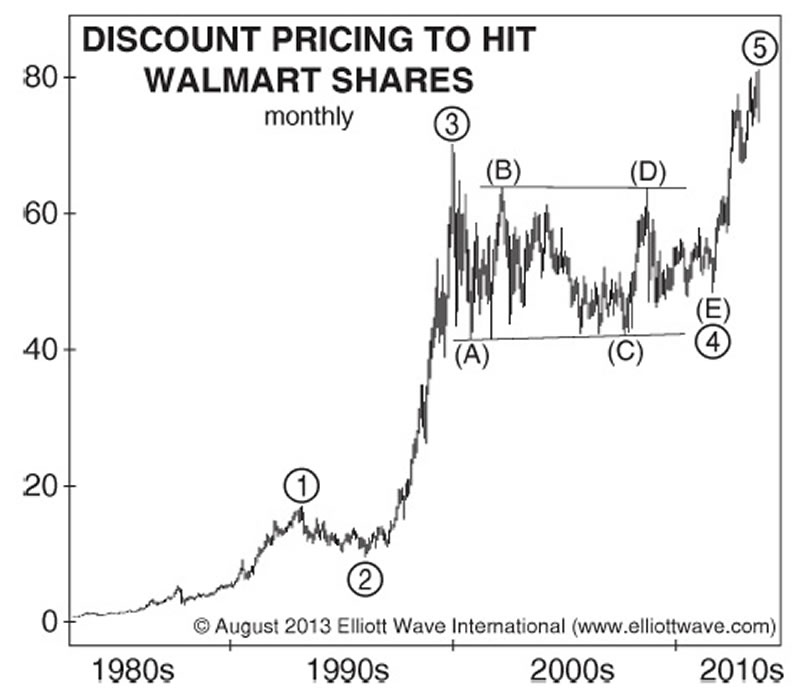

"We'll stick with our contention that the economy is turning toward a deflationary depression. This long-term chart of Walmart is another under-the-radar clue to the unfolding debacle.

"It shows the world's largest retailer completing a five-wave rally that dates back to the early 1980s. As consumers go on a buying strike over the next few years, Walmart's stock should fall by at least 50%."

From there, Walmart made one more new high at $90.97, after which the anticipated downside drama arrived in full force, with shares plunging 37% to end at a four-year low in November 2015.

Which brings us to the larger issue at hand: Walmart's struggle to convert "always low prices" into always higher profits goes hand in hand with the underlying trend in the U.S. economy: that of deflation.

What You Need to Know NOW About Protecting Yourself from DeflationIn this free Special Report, you will learn about this unexpected but imminent risk to your portfolio AND you'll get 29 specific forecasts for stocks, real estate, gold, cultural trends -- and more (excerpted from Prechter's New York Times bestseller Conquer the Crash -- You Can Survive and Prosper in a Deflationary Depression). |

This article was syndicated by Elliott Wave International and was originally published under the headline Woe-Mart: The Retail Giant Walmart Has Faltered. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.