Silver Price "Damp Squib" Rally of 2016

Commodities / Gold and Silver 2016 Apr 16, 2016 - 10:48 PM GMTBy: Clive_Maund

The combination of silver having arrived at a short-term target, with bearish looking candlesticks appearing, gold completing a Head-and-Shoulders top and latest COTs for both gold and silver being at the sort of extreme readings characteristic of a top, all point to silver reversing to the downside here.

The combination of silver having arrived at a short-term target, with bearish looking candlesticks appearing, gold completing a Head-and-Shoulders top and latest COTs for both gold and silver being at the sort of extreme readings characteristic of a top, all point to silver reversing to the downside here.

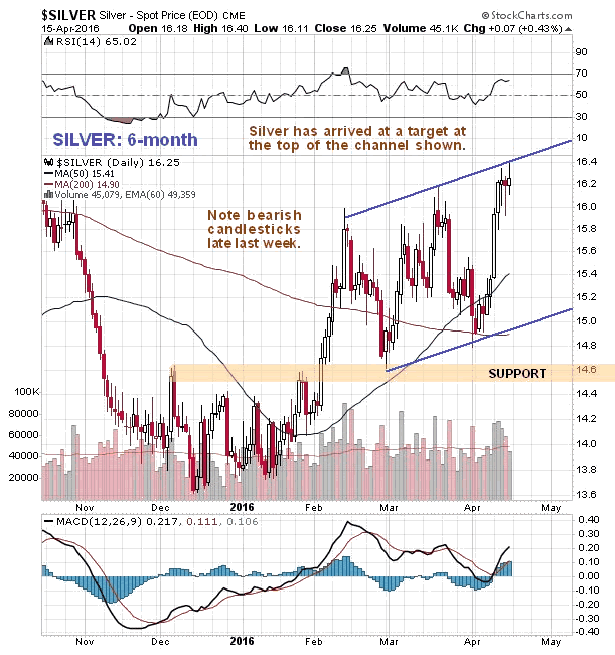

On its 6-month chart we can see how silver's sharp advance over the past week or so has brought it up to a trend channel target, where the advance has run into trouble, with bearish looking candlesticks in recent days suggesting that it will soon drop away again.

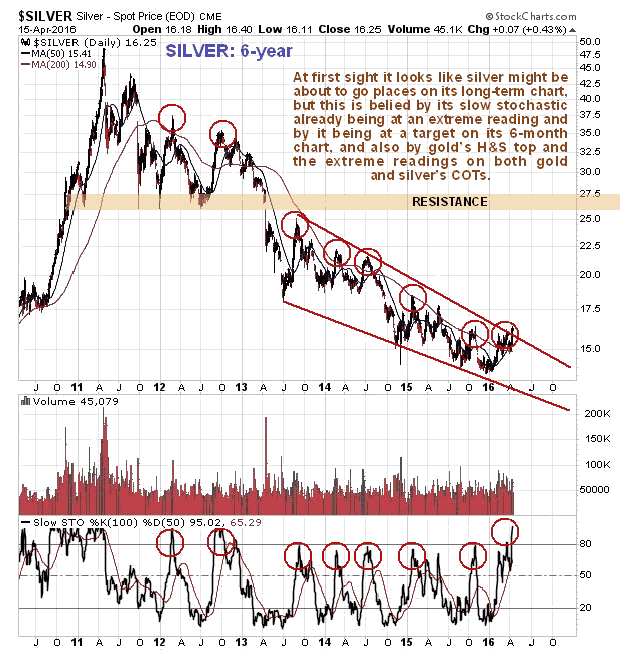

Silver actually looks quite promising on its 6-year chart, as it appears to be on the point of breaking out of its long-term downtrend. However, this is belied by the various factors mentioned above and by the slow stochastic shown on this chart, which is at an extreme reading only attained twice in the past 4 years, and both those occasions were tops. So it looks set to slump back into its downtrend.

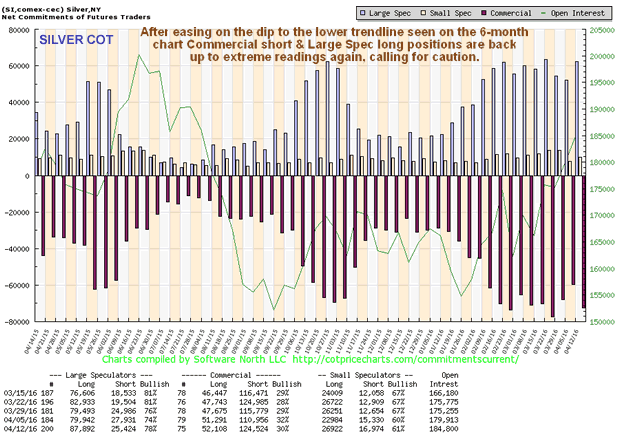

After easing last week, related to silver dropping back to the lower boundary of its channel shown on its 6-month chart, Commercial short and Large Spec long positions ramped up again this week close to recent very high readings due to silver advancing sharply back to the top of its channel. Like gold, these readings are construed as meaning that silver is probably at a top here.

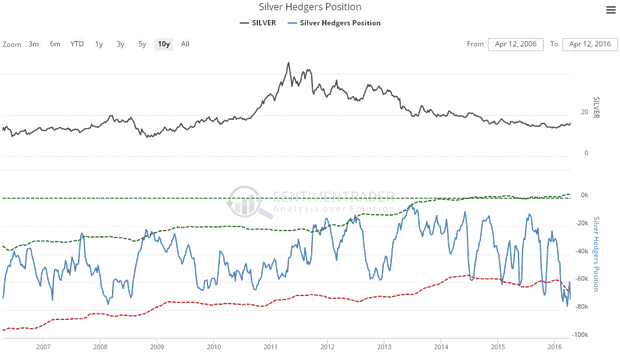

The silver Hedger's chart, which is a form of COT chart, goes back much further, and reveals that readings are at their most extreme since 2008, after which silver plunged in tandem with the broad market crash - and there are signs that the broad stockmarket may be on the verge of another severe decline, which is something we will look at in detail in a separate report. This chart is viewed as providing a serious warning, which the majority will ignore, of course.

Chart courtesy of www.sentimentrader.com

Conclusion: despite PM stocks enjoying a mean reversion rally on the back of recent dollar weakness, silver has been a "damp squib" so far this year, hardly rallying at all, and instead of playing catchup as many are anticipating, it looks set to slump back into its downtrend as gold and the stockmarket fall, and the dollar rallies.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2016 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.