What's Behind the Longest Stock Market Rally?

Stock-Markets / Stock Markets 2016 Apr 15, 2016 - 02:40 PM GMT Good Morning!

Good Morning!

SPX closed above its hourly Cycle Top at 2082.44 last night, but appears to have dropped beneath it in Premarket action.

ZeroHedge comments, “Good news is still bad news after all.

After last night's China 6.7% GDP print which while the lowest since Q1 2009, was in line with expectations, coupled with beats in IP, Fixed Asset Investment and Retail Sales (on the back of $1 trillion in total financing in Q1)...

... the sentiment this morning is that China has turned the corner (if only for the time being). And that's the problem, because while China was a good excuse for the Fed to interrupt its rate hike cycle as the biggest "global" threat, that is no longer the case if China has indeed resumed growing. As such Yellen no longer has a ready excuse to delay. This is precisely why futures are lower as of this moment, because suddenly the "scapegoat" narrative has evaporated.”

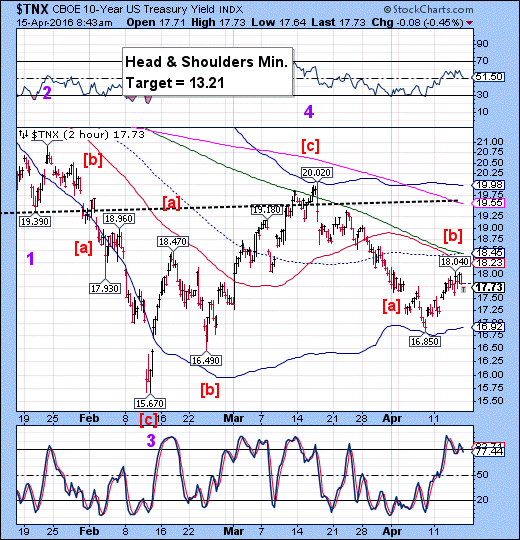

TNX has eased into negative territory, but has not violated its support at 17.57 as yet. The TNX sell signal may be triggered at that point.

The WSJ reports, “U.S. government bond prices retreated Thursday as the latest sign ofa robust labor market sapped demand for haven assets.

Selling pressure from government bonds in Germany and the U.K. had also rippled into the U.S. bond market.

The bond market recouped some losses in the afternoon session after a $12 billion sale of 30-year bonds drew strong demand.”

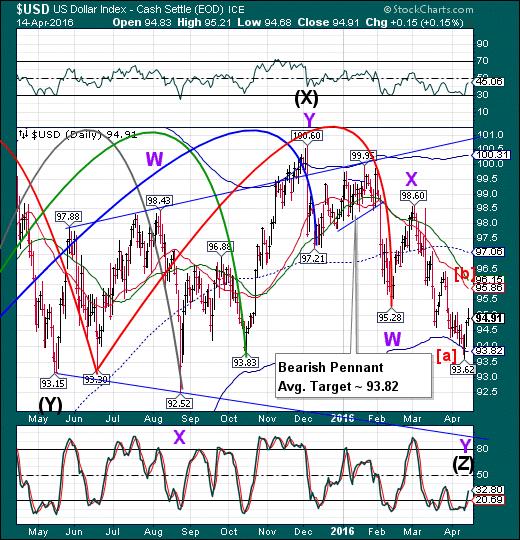

The bounce in USD may have already topped out at 95.20. The Cycles Model suggests that it may find a high today. Either way, we should see USD begin to decline in earnest by next week. We are looking for the next Master Cycle low in early May.

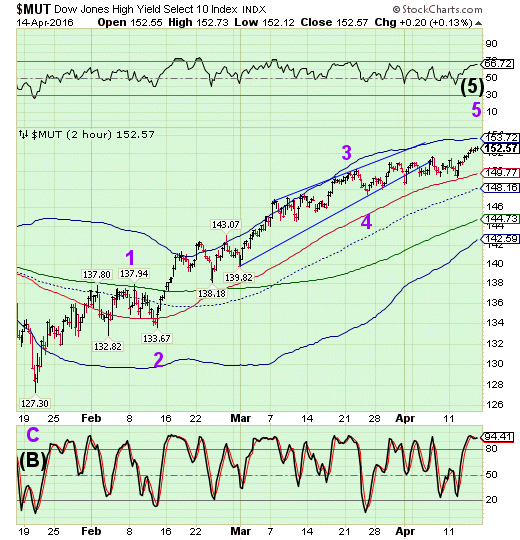

Today is day 86 in the Liquidity Cycle. The results of this Cycle are staggering. MUT rallied almost exactly 20% in the last 86 days. BKX rallied 21.1% in the same time frame. The Shanghai Index rose 17.75%. The DJIA rose 16.26%. While the other indices were influenced by this Cycle, they didn’t come close to these performances.

The index that “took the cake” was crude oil, of course. It rallied 67.7% in 62 days. We know why this may have happened. It was the banks that had gone over their head in oil loans and speculation. They needed a way out, so this is what has been engineered, IMO.

Now that it has gone its course, we may see a reversion or possibly a pendulum swing to the opposite side.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.