Silver Up 5.6%; Gold Down 1% as Deutsche Bank Settles Gold and Silver Manipulation Suits

Commodities / Gold and Silver 2016 Apr 15, 2016 - 02:01 PM GMTBy: GoldCore

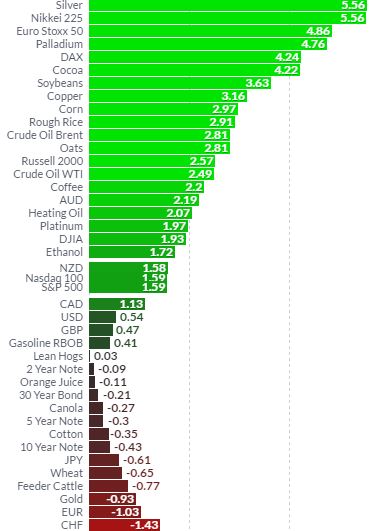

Silver prices have surged 5.6% this week, while gold is down 1% in dollar terms, 1.5% in sterling terms but flat in euro terms. Gold appears to be consolidating after the recent gains and the bounce in stocks this week is likely leading to traders taking profits.

Silver prices have surged 5.6% this week, while gold is down 1% in dollar terms, 1.5% in sterling terms but flat in euro terms. Gold appears to be consolidating after the recent gains and the bounce in stocks this week is likely leading to traders taking profits.

Market Performance – 1 Week (Finviz.com)

Silver remains strong despite gold’s weakness this week and continues to eke out gains. Since Monday April 4, silver has surged from $14.93 to $16.32 per ounce for an 9.3% gain.

The close above $16.00 per ounce was important and will embolden the technicians and momentum players who are likely positioning in expectations of silver testing resistance at higher levels. Silver is now testing technical resistance at $16.30/oz and a close above that level could see silver quickly move to test the next level of resistance at $18 per ounce seen in May 2015.

Ongoing robust physical demand finally seems to be impacting on prices which remain depressed. Investment demand is likely to remain robust and may even increase due to ineffectual QE policies, still ultra loose monetary policies, negative interest rates leading to increased allocations to non yielding, but non negative yielding silver.

Yet more evidence showing that the gold and silver markets – like all markets today – are manipulated came yesterday. Deutsche Bank agreed to settle U.S. lawsuits which said that it had conspired with other banks to manipulate gold and silver prices at investors’ expense. The settlements were disclosed in a Manhattan federal court by lawyers representing investors and traders who accused Deutsche Bank of violating U.S. antitrust law.

The gold settlement was disclosed on Thursday, and the silver settlement on Wednesday. Terms were not disclosed, but both settlements will include monetary payments by the German bank. Deutsche Bank also agreed to help the plaintiffs pursue claims against other defendants.

As defined by Wikipedia, “market manipulation is a deliberate attempt to interfere with the free and fair operation of the market and create artificial, false or misleading appearances with respect to the price of, or market for, a security, commodity or currency”.

Today, the majority of major markets are subject to manipulation which is creating artificial prices. Obviously, QE and artificially depressing bond yields is the most glaring example of this. These false price signals can lead to the misallocation of capital and to lulling investors into false senses of security regarding risk assets. This heightens the risk of market dislocations involving stock and bond market crashes and indeed currency devaluations.

By artificially suppressing the pricing mechanism, similar to forcing an inflated beach ball under the water, markets that have been manipulated may rapidly bounce higher and move in the opposite direction to what is initially intended.

Manipulation of the gold and silver markets is a serious issue and one we have long expressed concerns about. It seems increasingly likely that part of the reason for the weakness seen in the gold and silver price in recent years was due to banks manipulating prices as long alleged by veteran silver analyst Ted Butler and by the Gold Anti- Trust Action Committee (GATA).

This is not a victimless crime as it likely impacted the finances of thousands of companies in the precious metals sector internationally. The entire sector – from mining companies, to refineries to bullion dealers – has been badly hit by the weakness in precious metal prices. There is also the not small matter of the millions of investors internationally who have seen losses on their gold and silver investments – be they in mining shares, ETFs or indeed in bullion. We are examining the settlement carefully.

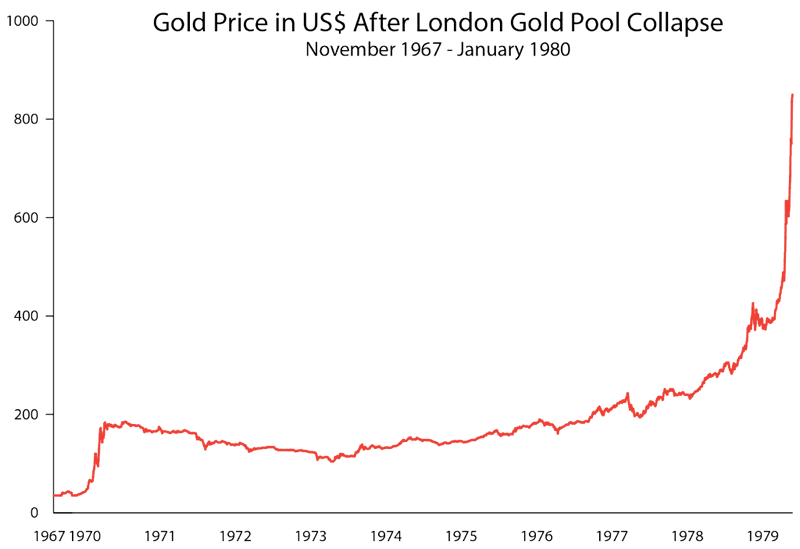

The history of manipulation of the gold market is of short term success followed by ultimate failure and then much higher prices as the fundamentals of supply and demand always assert themselves in the long term. This was clearly seen after the failure of the “London Gold Pool” in the late 1960s and gold’s massive bull market in the 1970s.

While gold and silver buyers have suffered in recent years, ironically such manipulation is an opportunity for investors today as it allows them to accumulate precious metals at artificially depressed prices. This is the unintended benefit of such manipulation – the silver lining if you will.

The golden beach ball was pushed near the bottom of the ‘gold pool’ in recent months. The further a beach ball is pushed under water in a pool – the higher it ultimately jumps out of the water. This creates a great opportunity for investors to accumulate precious metals at prices which will be viewed as very cheap indeed in the coming years.

Gold Prices (LBMA)

15 April: USD 1,229.75, EUR 1,092.16 and GBP 867.46 per ounce

14 April: USD 1,240.30, EUR 1,101.04 and GBP 874.96 per ounce

13 April: USD 1,245.75, EUR 1,100.37 and GBP 875.33 per ounce

12 April: USD 1,259.20, EUR 1,102.15 and GBP 880.18 per ounce

11 April: USD 1,247.25, EUR 1,095.84 and GBP 878.96 per ounce

Silver Prices (LBMA)

15 April: USD 16.17, EUR 14.33 and GBP 11.40 per ounce

14 April: USD 16.13, EUR 14.32 and GBP 11.39 per ounce

13 April: USD 15.98, EUR 14.14 and GBP 11.21 per ounce

12 April: USD 15.96, EUR 13.98 and GBP 11.15 per ounce

11 April: USD 15.56, EUR 13.66 and GBP 10.93 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.