How Do the Gold ETFs Really Work?

Commodities / Gold and Silver 2016 Apr 15, 2016 - 11:51 AM GMTBy: Arkadiusz_Sieron

To understand the relationship between the gold ETFs’ inventories and the price of gold it is necessary to grasp how the ETFs work. As we already know, the aim of gold ETFs is to replicate the performance of gold. How do they achieve that? Surely, they purchase and hold the gold bullion (at least SDPR Gold Trust claims to do it, since many other gold ETFs hold gold futures contracts rather than bullion, but it does change the underlying mechanism at work). This is basically why the ETFs net assets value (NAV) tracks the price of gold so well. What is NAV? It is the sum of funds’ assets less any liabilities, divided by the number of outstanding shares. Assume that there are 1000 shares of an ETF, which holds 100 ounces of gold. If the price of gold is $1200 per ounce, the NAV amounts to $120. Since SPDR Gold Trust holds only gold bullion, the net assets value of a GLD share will naturally move by the same percentage as the gold prices (regardless of the absolute level of gold inventories).

However, there is one small problem. The ETF shares are traded like stocks, therefore their prices fluctuate in a trading day due to supply and demand. Thus, if many investors want to buy an ETF, its share price might rise above its NAV. And when many investors want to sell an ETF, the ETF’s share price might fall below the value of its underlying bullion. Indeed, usually this is the case: higher gold prices trigger unfounded optimism among ETF traders who rush to buy shares, which drives up their prices. Conversely, lower prices drive investors into excessive pessimism. Consequently, they rush in panic mode to sell ETF shares, which lower their prices. Investors should remember that the gold trade is driven (to a large extent) by investors’ sentiment. In the short-term, gold traders are increasingly bullish to higher prices and increasingly bearish to lower prices.

Fortunately, such divergences between NAV and share prices are only temporary – thanks to the creation/redemption mechanism. When this happens, an authorized participant (AP) can jump in to intervene. Who is the AP? The AP is usually large financial institution, like market maker, which is responsible for obtaining the underlying assets necessary to create and run the ETF. In short, it buys gold and delivers it to the ETF provider. In turn, it gets a block of equally valued (based on NAV) ETF shares, called a creation unit. The AP may resell these shares for profits. It may also redeem creation units to get the bullion back (only APs can redeem ETF’ shares, retail investors can only resell them on the open market).

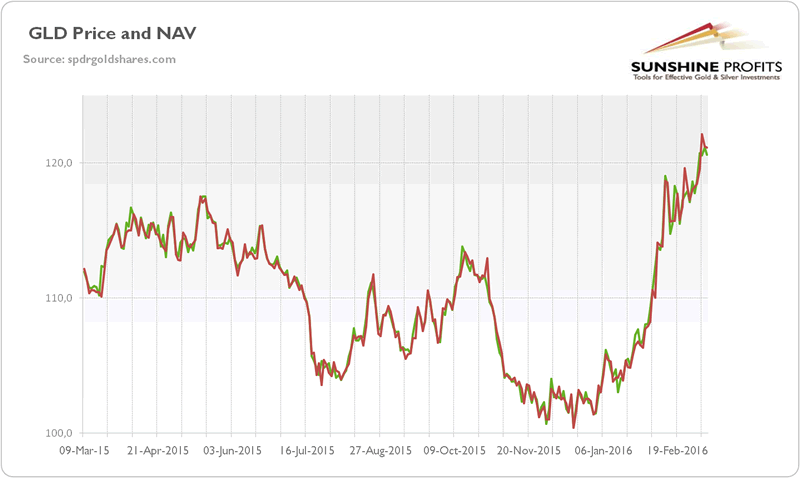

The role of APs in keeping ETF shares in line with the fund’s NAV should be clear now. When the AP notices the overpriced ETF shares (above the fund’s NAV), it purchases the gold bullion and sell ETF shares on the open market. Conversely, if the ETF shares are undervalued (below the fund’s NAV), the AP buys the ETF shares, redeems them for gold bullion which can be resold. In both scenarios, the AP’s actions drive the ETF’s share price toward fair value (fund’s NAV). The arbitrage process is not perfect; however, it works very well. As the chart below shows, the GLD share prices are trading most of the time at fair value.

Figure 1: The price of GLD (green line) and the SPDR Gold Trust’ Net Asset Value (red line) for the last twelve months.

Summing up, the changes in the ETF’s holdings of gold bullion result only from the arbitrage. Normally, changes in gold prices do not require any change in ETF’s inventory. Only when the ETF’s share prices deviate from the NAV – which usually occurs only as consequence of aggressive buying (selling) of shares triggered by price rallies (declines) lasting for a while – the gold bullion flows into or out the ETFs. Hence, the correlation between the ETF flows and the price of gold results from the normal arbitrage which underlies working of all ETFs. Those who claim that gold outflows from the ETFs prove some sort of manipulation may not understand how the ETFs work. Those who argue that selling or buying gold to the ETFs’ inventories drives the price of gold likely confuse effects with cause. In fact, the flows of bullion into (out) the ETFs’ holdings are caused by changes in sentiment among ETF traders happening after changes in gold prices.

If you enjoyed the above analysis and would you like to know more about the structure of the gold market, we invite you to read the March Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.