Why We’re About to See the Largest Wealth Drought in Modern History

Stock-Markets / Credit Crisis 2016 Apr 14, 2016 - 04:38 PM GMTBy: Harry_Dent

If there’s anything the Chinese have going for them, it’s savings. Only a handful of countries have a higher savings rate than they do. For a still relatively poor emerging country with GDP per capita about a fifth of that in the U.S., the Chinese get an A+ in this area.

If there’s anything the Chinese have going for them, it’s savings. Only a handful of countries have a higher savings rate than they do. For a still relatively poor emerging country with GDP per capita about a fifth of that in the U.S., the Chinese get an A+ in this area.

But if diversification and asset allocation are the key to preserving wealth, then the Chinese get an F!

The reason: 75% of their wealth is in real estate, with the rest largely in cash. They’ve overinvested in one illiquid and bubbly asset that they wrongly believe can only go higher.

Relative to income, China has seven of the 10 most expensive cities in the world.

In other words, it has the greatest real estate bubble in modern history!

Price to income ratios in the top cities are off the charts. Beijing is 33.5 times income, Shanghai is 30.2 and Shenzen is 30.0. The average condo in such tier I cities is only 650 square feet and would go for $460 per square foot, or $300,000. In a tier II city, we’re talking $100,000.

That may not sound like a lot, but if tiny condos are selling for $300,000 in the biggest cities at 30 times income, that would suggest the Chinese are only making about $10,000 per year, which squares with the actual statistics!

That begs the question: how do they even do it!?

Wade Shepard put this question forward in a recent Forbes article called “How People in China Afford Their Outrageously Expensive Homes.”

In China, owning your home is paramount. If you’re a man, you have zero chance of getting a date if you don’t. But with home prices running at exorbitant rates, what’re their chances?

It all comes back to China’s phenomenally high savings rate.

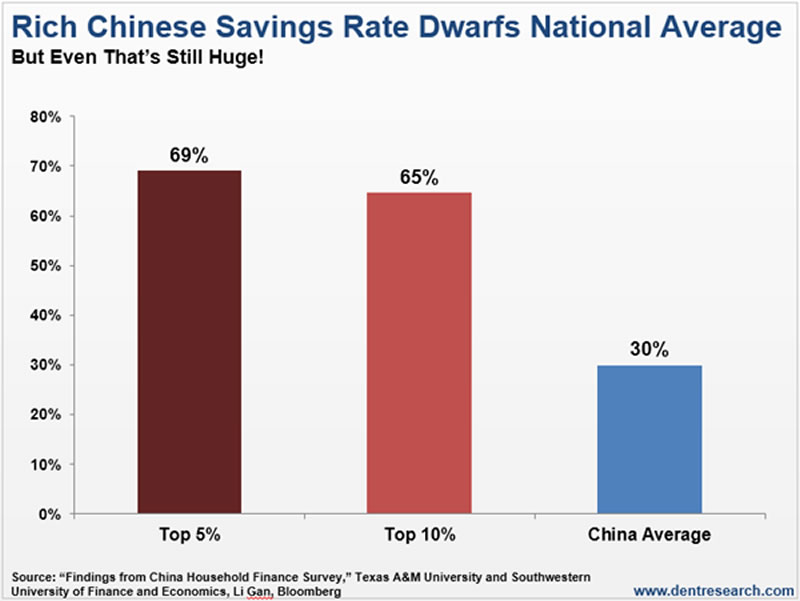

Compared with about 2% in the U.S., the Chinese on average save about 30% of their income. And for the most affluent, it’s more than double that!

But it’s not just the super-high savings rates.

It’s the family and friends network that helps younger people buy such massively expensive homes –typically without a mortgage. Only 18% of homes have a mortgage, compared to half of all homes in the U.S., and minimum down payments on first homes is 30%. For second homes, it’s 60%.

So the last thing China has to worry about is a foreclosure crisis like the U.S. saw with high percentages of homes in negative equity.

China’s problem… is that they’ve invested their high savings in a massive real estate bubble and don’t realize the risks to their wealth!

In urban areas, real estate has bubbled up between five and seven times just since 2000. It’s even greater than the unprecedented housing bubble in Japan in the 1980s, which suffered a 60% collapse that it’s never recovered from – even 25 years later.

A 60% collapse is the minimum the Chinese should expect. But it would actually take 80% to get back to the pre-bubble values of early 2000.

This would be devastating to the Chinese. It is estimated that household wealth in China is $27.2 trillion, or about three times GDP. With 75% of that in real estate, that comes out to $20.4 trillion.

If real estate falls 60% as it did in Japan, that would mean $12.2 trillion in wealth would just disappear.

And if it falls 80%-plus due to the larger size of China’s bubble like I expect, we’re talking $16 trillion or more evaporating!

How would the already insecure Chinese consumers feel (after past poverty and weak social safety nets) if their rapidly built wealth suddenly disappears?

I say: it means they’re going to spend less money! That will halt China’s efforts at expanding into a consumer-driven economy.

What I predict… is that this crisis in China will be the largest relative evaporation of household wealth in modern history. And it’s all from their overinvestment in one illiquid and bubbly asset: housing. Among urban households, 20% own two or more homes, near twice the rate in the U.S.

But the Chinese not only overinvest in real estate – they often buy empty properties for the future, or even for pure investment. They don’t actually use these properties. An independent firm monitored homes that were using no electricity and found a 27% vacancy rate.

Who would speculate in real estate with 27% of condos empty!?

In what country would real estate continue to soar with such vacancy rates!?

So, yes, the Chinese get an A for high savings, but their Achilles heel is an irrational belief that real estate will only go up, up, up! That is the worst assumption you could possibly make in the very country that has the greatest overbuilding bubble and the most overvalued real estate in the world.

What I see ahead: the sucking sound of shrinking savings!

China’s unprecedented real estate wealth implosion will make Japan’s in the 1990s look like nothing. And if you are in cities like Vancouver, Sydney, Melbourne, Brisbane, Singapore, San Francisco, L.A., New York and London – anywhere that thrives on affluent Chinese laundering their money out of their corrupt country, and into your real estate – you will hear that sucking sound as well!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.