USD is a Puzzle. I may have a Solution

Currencies / US Dollar Apr 13, 2016 - 10:25 AM GMTThere is a lot not to like about this Wave structure, but it may be that the decline is finished. The decision to take this opinion is based on several factors. But the main one was the following Bloomberg article that caught my eye: “Hedge funds are close to calling it quits on the dollar’s best run in a generation.

Large speculators cut net bullish positions on the greenback to the lowest in almost two years last week. If they keep trimming at the current pace, those bets will be wiped out entirely by the end of the month. Currency options are signaling a less than one-in-four chance the greenback will extend its two-year, 25 percent surge against the euro in 2016, while against the yen the likelihood is less than one in 10.”

The sentiment being reported here begs for a reversal. In addition, a reversal at the Cycle Bottom is also an excellent indicator of a trend change. However, the Cycles Model doesn’t call for a Master Cycle low until early May. That is my quandary.

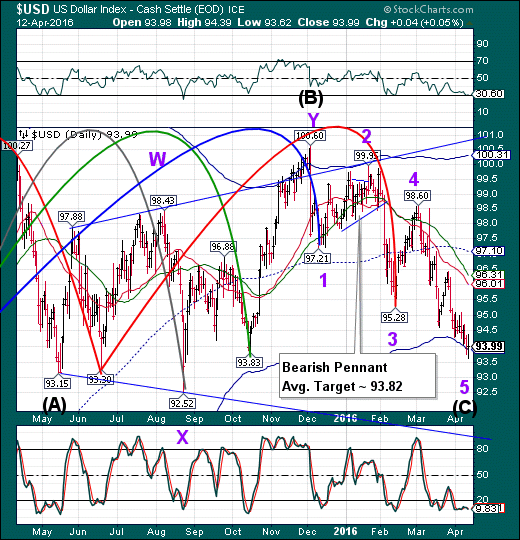

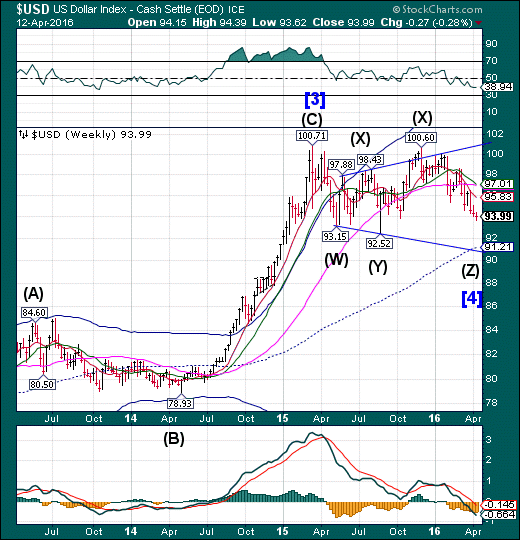

What we may be looking at is a giant Triple Zigzag Wave [4], as seen in the weekly chart. This would answer the riddle of all the overlap in the declining last wave. It would also call for a brief rally, possibly to weekly Short-term resistance at 95.83, followed by yet another decline to weekly mid-cycle support at 91.21. The additional reason I say that is due to the fact that DXY is has rallied to 94.40 correctively (possibly Wave [a] of an [a]-[b]-[c] correction). I may revise the daily chart to reflect that outlook before the mid-Week Report.

This also fits better with a severe decline in SPX through mid-May.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.