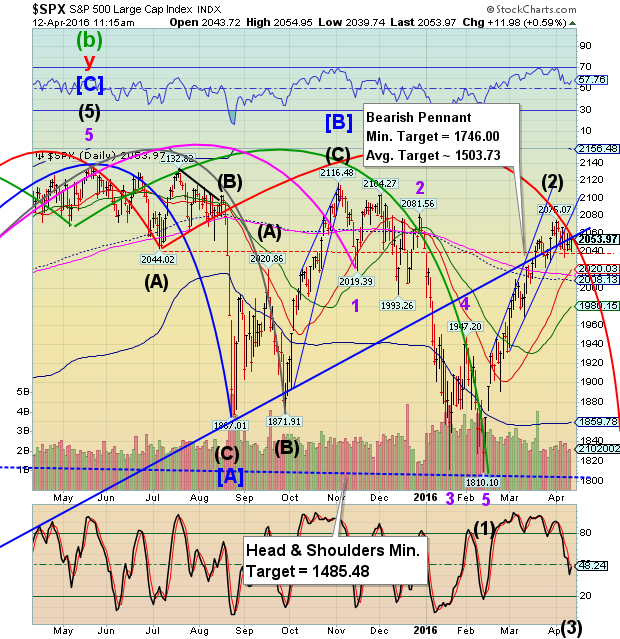

SPX using a long-time support to stay elevated...for now.

Stock-Markets / Stock Markets 2016 Apr 12, 2016 - 04:34 PM GMT In a nod to options expiration, it appears that Wave (ii) may extend another day or so. The Cycles Model was strong during the March options expiration. This month the Cycles Model shows weakness.

In a nod to options expiration, it appears that Wave (ii) may extend another day or so. The Cycles Model was strong during the March options expiration. This month the Cycles Model shows weakness.

ZeroHedge reports, “Last week when BofA reported that "everything is being sold" as its smart money clients (institutional, private and hedge funds) dumped stocks for a whopping 10th consecutive week, it said that "BofAML clients were net sellers of US stocks for the tenth consecutive week, in the amount of $3.98bn. Net sales last week were the largest since September, and the fifth-largest in our data history (since 2008). Since early March, all three client groups (institutional clients, private clients and hedge funds) have been sellers of US stocks."

While SPX is short-term positive, there appears to be a limit on the move in the form of narrowing trading bands. They also portend a potential change in trend.

You can see the thin support line across the daily chart, extending from July 7, 2015. SPX is in the Master Cycle originating at that date. The last pause above it was on December 31, 2015. For the time being, SPX refuses to go beneath it.

However, it may not last. John Hussman comments, “From an intermediate-term perspective, the U.S. equity market continues to trace out an arc that we view as the rounded top-formation of the third speculative bubble in 16 years. The S&P 500 is presently at the same level it set in November 2014, and the broad NYSE composite is at the same level it set in November 2013. I’ve frequently emphasized that, with a few exceptions such as 1987, most market peaks are a process, not an event. While we have to be alert for the potential for steep, vertical losses, a historically-informed understanding of this process demands that investors be patient, and refrain from placing too much faith in what I’ve often called the “fast, furious, prone-to-failure” advances that occasionally clear oversold conditions.”

As we watch the Italian Banks crashing and Deutsche Bank teetering, it is also a wonder that BKX is holding its own for the moment. The narrowing trading bands foretell a huge move is in the making.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.