Subprime Debt Makes a Comeback; Auto Loan Crisis is Here

Interest-Rates / Global Debt Crisis 2016 Apr 11, 2016 - 06:20 PM GMTBy: Sol_Palha

"A great calamity is as old as the trilobites an hour after it has happened." ~ Oliver Wendell Holmes

Greed and recklessness continue to govern the markets; nothing was learned from the 2008 financial crisis. Hence, history is destined to repeat itself, and this might occur a lot faster than most anticipate. Fitch states that Subprime Auto bond delinquencies are at a 20 year high.

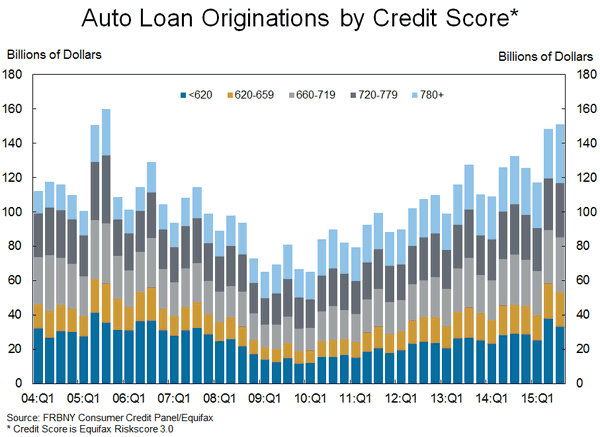

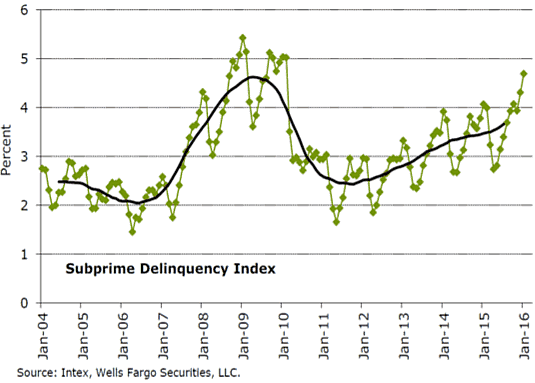

Take a look at this chart; it shows you great things are (us being sarcastic)

The number of individuals who are more than 60 days late on their auto payments surged 11.6% year over year; this brings the current delinquency rate to 5.16%. During the financial crisis of 2008, the delinquency rate peaked off at 5.04% according to Fitch. This fully validates the argument we have made over the years stating that this recovery is nothing but an illusion. This illusion is maintained by hot money, and this was done by keeping rates so low that it would force any sane person or business to speculate to earn a higher yield.

This chart further illustrates the deteriorating picture

This is why the Fed is hell bent on lowering rates; it has pushed central bankers Worldwide into a corner forcing them to embrace negative rates. Lower rates mean more hot money will flow into the markets as companies borrow even larger sums to buy back their shares, to further enhance the illusion that all is well. By buying back their shares, they can raise the EPS without actually improving efficiency or selling more products.

"Our concern isn't necessarily individual transaction performance, but how a group of mid-sized and smaller issuers could be exposed to funding risk at the same time, and which results in unanticipated consequences for investors," Duignan said. "You could see a vicious cycle" where investors stop buying from smaller companies, which would then be forced to cut back on their servicing costs, resulting in even more loan losses, he said.

In General, investors expect some sort of trouble, and they understand the risk is high, and that is why they gravitate towards these investments because of the higher yield. However, the outlook changes when you actually have to take a loss. It is one thing to anticipate one and quite a different issue to having to deal with one. If delinquencies start to surge, investors could suddenly head for the exits leaving this market with no buyers.As they say, it's always quiet before the storm. If you have invested in this sector, now might be time to hedge your positions by purchasing some puts; in other words, short the auto loan sector.

We live in an era where the illusion of an economic recovery is maintained via massive injections of hot money and in such an atmosphere, the end is clear. We will witness another financial crisis and as such it is always a good idea to have some Gold bullion. You should view this as a hedge against the next financial crisis.

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.