SPX May Have Topped this Morning

Stock-Markets / Stock Markets 2016 Apr 11, 2016 - 04:57 PM GMT SPX topped out at 2062.93 and promptly turned back down. New short positions may be added here. Confirmation comes beneath Short-term support at 2051.37. Stops may be put in at 2065.00 to 2067.50.

SPX topped out at 2062.93 and promptly turned back down. New short positions may be added here. Confirmation comes beneath Short-term support at 2051.37. Stops may be put in at 2065.00 to 2067.50.

ZeroHedge comments, “This morning's 160 point spike in Dow Futures - out of nowhere - was predicated on hopes of an Italian bank bailout. While this may seem like an odd reason to "buy buy buy" US equities, in the new normal, it really is not.. and when put in context, the 'bounce' in EU banks should do more to scare than soften investors' concerns...”

VIX was temporarily under pressure, but was only lower than Friday’s low by a tick. Investors aren’t buying the bailout story.

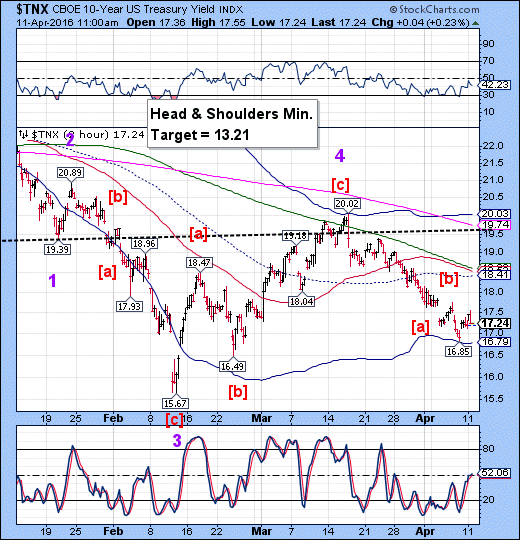

TNX eased back down without making a new high, as well. This supports the thesis of equities resuming their decline.

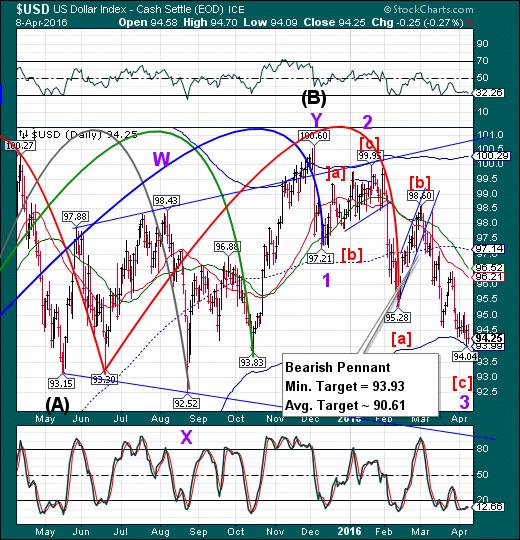

USD/DXY made a new low at 93.75 and appears to be going lower. The target again is between 93.65 and 93.40. Those who are short USD should be taking profits and stepping aside for a bounce at their discretion.

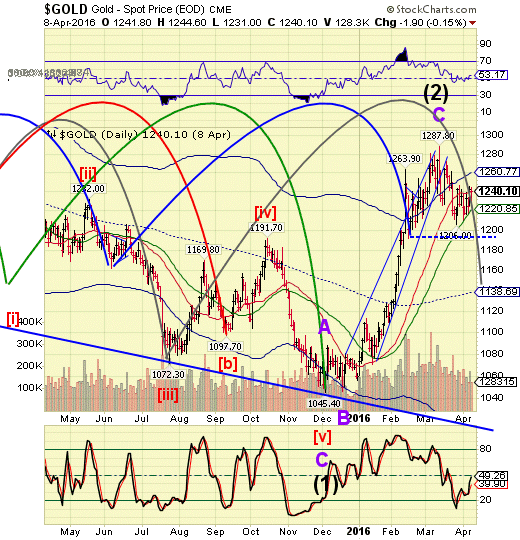

Gold futures challenged its Cycle Top by rallying to 1259.60 this morning. That appears to complete the retracement and may also be a good short entry with a stop at 1288.00.

Crude made a high this morning at 40.65, challenging the mid-Cycle resistance at 40.35. It has since declined below resistance.

This may also be a good short entry. The stop on this one would have to be 42.50. If my analysis is correct, this decline may be a barn burner.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.