Stock Market Weekly Charts Showing Some Hesitation At Trend Line Resistance...

Stock-Markets / Stock Markets 2016 Apr 09, 2016 - 12:50 PM GMTBy: Jack_Steiman

So the market gapped up again as usual this morning due to the fed speak from last night. Any time the fed opens her mouth the market can't wait to rise. Flat futures became rocking futures even though the action from yesterday was quite bearish in nature for the very short term. Follow through for the bears? Are you becoming a comedian? No chance. Even before the fed spoke the futures were only flat. No follow through even in the futures to a bearish candle stick day. So the market blasted up today and went higher after that as usual but finally those very elevated Macd and other oscillators kicked in a bit and allowed the market to print more short term bearish candles. Will it matter? Probably not but a short term warning sign nonetheless even though you can not count on any normal technical analysis to work these days. We trade on the fed, not technical's.

So the market gapped up again as usual this morning due to the fed speak from last night. Any time the fed opens her mouth the market can't wait to rise. Flat futures became rocking futures even though the action from yesterday was quite bearish in nature for the very short term. Follow through for the bears? Are you becoming a comedian? No chance. Even before the fed spoke the futures were only flat. No follow through even in the futures to a bearish candle stick day. So the market blasted up today and went higher after that as usual but finally those very elevated Macd and other oscillators kicked in a bit and allowed the market to print more short term bearish candles. Will it matter? Probably not but a short term warning sign nonetheless even though you can not count on any normal technical analysis to work these days. We trade on the fed, not technical's.

The market keeps making a move towards that trend line resistance level at 2075 but those daily index Macd's are making the journey through very difficult. Maybe Yellen can come out over the weekend once again and talk the market up. If not then maybe the market can actually try to test a bit lower towards those fifty day exponential moving averages. The Sp at 2003. Hard to imagine the market approaching 2000 again but those Macd's say it is quite possible. Under normal circumstances I would say quite likely. Things aren't normal. So we saw a reversal off the top today but absolutely nothing bearish whatsoever. Maybe the Macd's will finally offer up the bears a day or two of hope only to be taken away of course in time but we should sell a bit further early next week before once again trying for that trend line zone.

The thing that makes all of this a joke in a very big way is how the market continues to act to worsening news on our own economy, let alone the economies around the world. Earlier this week the fed and some of her friends were saying that q1 gdp should come in at 1.4%. Later this week it was lowered amazingly to 0.7%. What happened? But wait, today lowered again to just a hair over 0%. The markets reaction? Who cares! I mean really. This market should be in absolute free fall. It really should folks but not an ounce of selling of any real kind to be found. It is astonishing and has to be driving the bears crazy.

They get what they want and then some and the market just doesn't care. I've never seen this type of behavior in to such bad news on our own economic situation. The power of the fed is amazing and especially so since what she's doing ISN'T WORKING!!! IT DOESN'T WORK AND STILL WE TREND HIGHER. What???? That's the game so how do you play it? I don't have a clue. The risk is so high it's insane. Do you play in to that type of risk? Do you just throw caution to the wind? Scares me to say yes. Maybe some of you have the guts to do that but I just don't think it's smart. Maybe the truth is the game has passed me by. Something for me to ponder. That said, I still have to stick with my thinking. The environment sucks for stocks even though it doesn't.

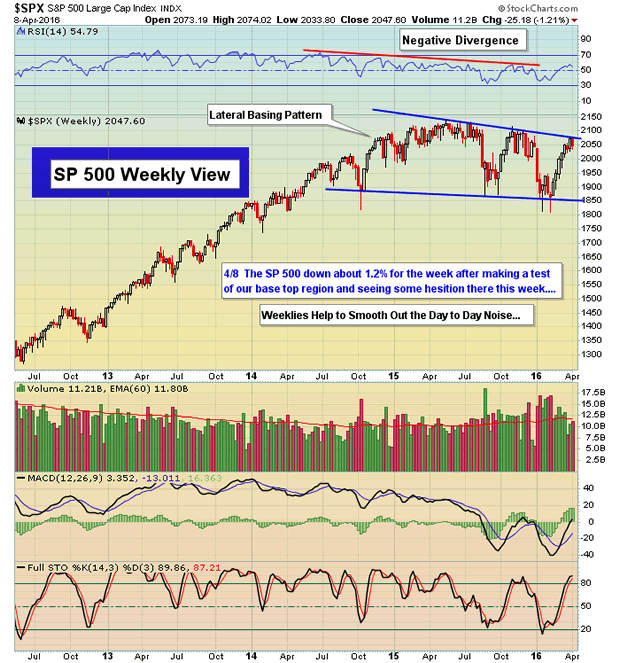

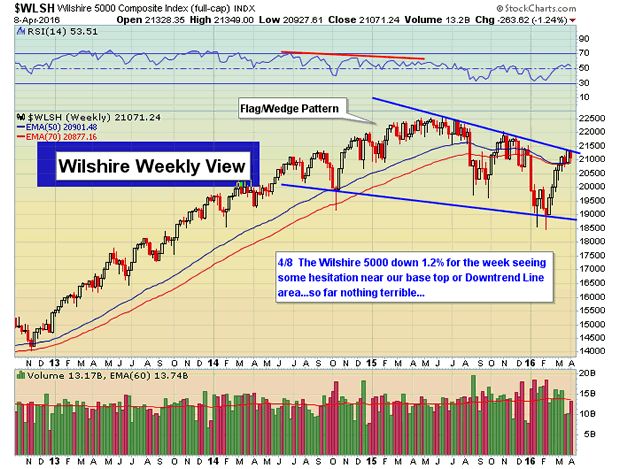

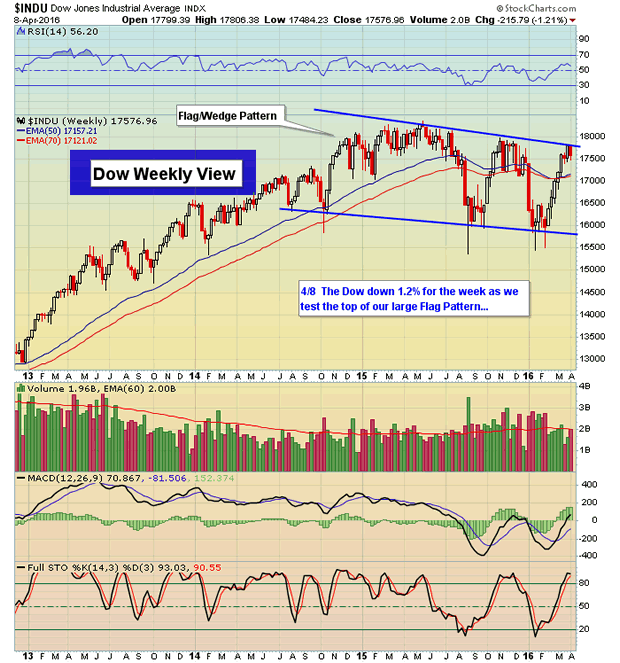

So for fun, even though it doesn't matter, let's discuss the look of those daily charts. Macd's are at very elevated levels and have made bearish crosses. Sounds nasty. It is. Makes buying very short term difficult to be sure. Factor in the Weekly charts which we've featured in this report that are showing hesitation at trendline resistance areas as well. In normal times I would never buy long once the crosses down occur. It's just too risky. You can even make a strong case for shorting but there's no chance I'll be doing that for some time to come but you get the idea. You could normally short and not even think twice about it.

A slam dunk trade for some selling short term at least. If we unwind those Macd's down without price erosion in the coming days get ready for lift off even though it shouldn't happen. We'll load up on longs if that occurs. Need to see these Macd's unwind though for safety's sake. Sp 2075 weekly trend line the level to focus on bigger picture for the bulls. 2003 the level to focus on bigger picture if you're a bear. My guess is we break up and out but a near term test down is very possible. If it breaks well below 2003 we have to think things over. Best to be heavy cash until we can get those Macd's to fall and reset.

Please join us for a free 3 week trial at www.TheInformedTrader.com

Jack

Jack Steiman is author of SwingTradeOnline.com ( www.swingtradeonline.com ). Former columnist for TheStreet.com, Jack is renowned for calling major shifts in the market, including the market bottom in mid-2002 and the market top in October 2007.

Sign up for a Free 15-Day Trial to SwingTradeOnline.com!

© 2016 SwingTradeOnline.com

Mr. Steiman's commentaries and index analysis represent his own opinions and should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret Mr. Steiman's opinions as constituting investment advice. Trades mentioned on the site are hypothetical, not actual, positions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.