Gold Stocks Breakout, Gold to Follow

Commodities / Gold and Silver 2016 Apr 08, 2016 - 10:14 PM GMTBy: Jordan_Roy_Byrne

Last week we concluded:

Last week we concluded:

As long as the gold stocks continue to hold support for another week or two then the near term outlook is bullish. A bull flag is a consolidation pattern that separates two strong moves. It could be developing in the miners. There is logical reason to be cautious if not bearish at this point. The metals look okay at best while the miners remain somewhat overbought. However, the action in the miners, if it continues for another few weeks is telling us what could be ahead.

The strength in the miners continues to surprise as the majority of pundits look for any reason for a pullback in the face of very bullish price action. The gold miners are now breaking out and Gold is likely to follow.

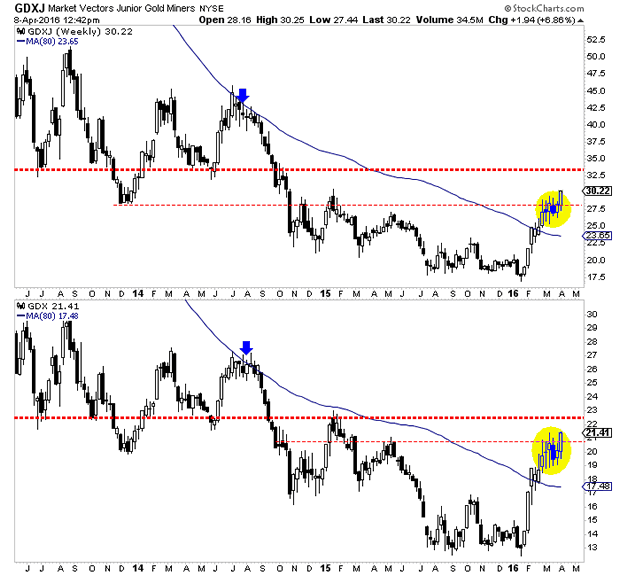

The weekly candle charts of GDXJ and GDX are shown below along with their 80-week moving averages. Note that the miners advanced for six weeks and their bullish consolidation began during that sixth week in late February. This week marks the fifth week since the previous advance. The miners are a little overbought here but not as much as they were five weeks ago. Moreover, we should note that overbought can become very overbought and extremely overbought. The immediate upside targets are GDXJ $33 and GDX $22.50 and it is possible this move has even greater upside.

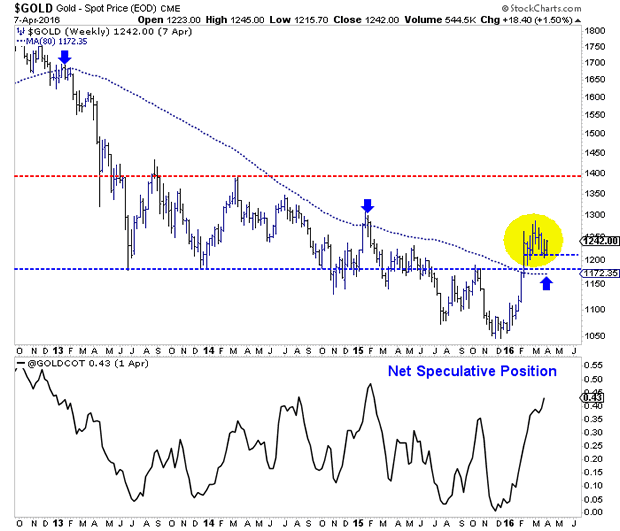

Turning to Gold, we see that it has stabilized in the mid $1200s within a larger range of $1210 to $1270/oz. With the miners breaking to the upside, Gold is very likely to follow to the upside. The current net speculative position of 43% is relatively high but we should note that from 2001 to 2012 it often peaked at 50% to 60%. Gold is weaker than the miners and may require a bit more consolidation. Nevertheless, weekly closes above $1262/oz and $1300/oz could send Gold on its way to $1400/oz.

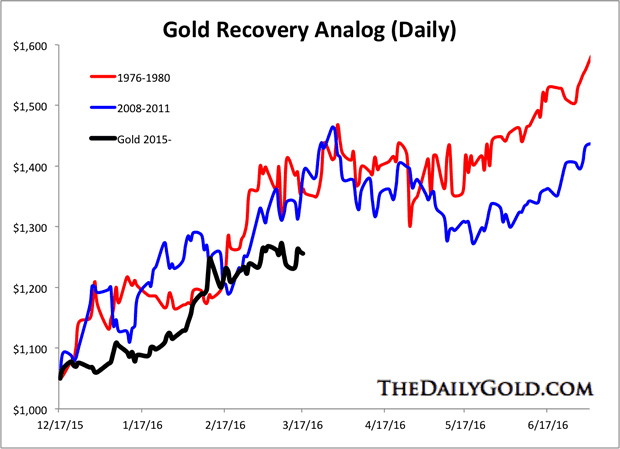

A move in Gold to $1400/oz would fall in line with history. In the chart below we compare the current rebound in Gold to its rebounds following major lows in 1976 and 2008. If Gold rallies to $1400/oz in the next few months then its recovery would be in line with those previous two recoveries.

After consolidating in bullish fashion for a good five weeks the miners appear to be starting their next leg higher and this should eventually propel Gold higher. The toughest time to buy is after a market has already had a strong rebound, following a nasty bear market. Investors and pundits alike subconsciously refuse to believe a major change has taken place. Gold stocks endured the worst bear market in 90 years. Of course there will be fear that it could reassert itself at any time. However, the action of the market is clear. Gold stocks are breaking out and could be headed much higher in the near term.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.