Stock Market Fear Building as Investors Rush for the Exit

Stock-Markets / Financial Crash Jul 15, 2008 - 05:16 PM GMTBy: Brian_Bloom

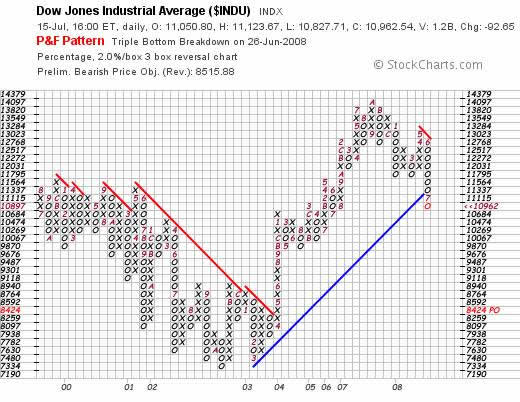

The chart below shows a serious breakdown, but the horizontal count target has already been met. The chart should pull back up before finally making up its mind

The chart below shows a serious breakdown, but the horizontal count target has already been met. The chart should pull back up before finally making up its mind

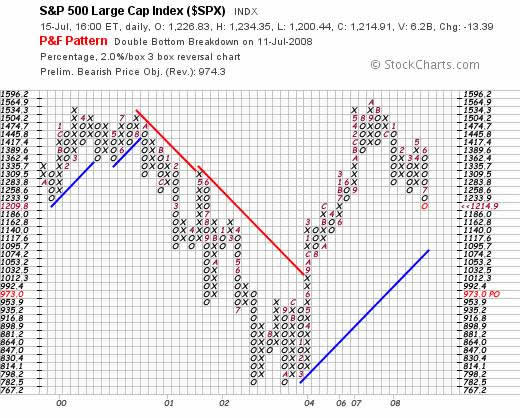

Unfortunately, this prognosis is not confirmed by the $SPX – which is less easy to “manage”

Horizontal downside count only partially met here. Could be one more feint – just to suck more short sellers in.

Both of these charts are looking very unhappy.

The oil price is far from its moving average – which implies it should pull back sharply if the industrial markets keep heading south – or consolidate if the industrial markets consolidate. My “guess” is that the oil price will pull back, Given that diesel can be synthetically produced from coal at less that $50 a barrel, the current price is off the wall. Certainly not defensible on fundamental grounds.

Gold looking very strong

Based on the chart below, a 27% fall might be considered “normal” – given the 973 target shown on the Point and Figure chart above

Overall Conclusion

Fear is building. If there’s a rush to the exits, this could turn ugly. Mitigating factor is the volume of shorts. History says most of these need to be taken out first. There may be a savage up-move first – which would serve to broaden the damage. One would have to be extraordinarily brave or extraordinarily foolish to try and “trade” this market. Cash and gold.

By Brian Bloom

My novel, Beyond Neanderthal, is now available to be ordered via www.beyondneanderthal.com and will soon be available via Amazon. Via its entertaining storyline, it attempts to inject some sanity and level headedness into what is emerging as a hysterically fearful environment. Things are not as bad as they seem. There are practical solutions as well as theoretical solutions.

Copyright © 2008 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.