Negative Interest Rates Could Trigger Another Housing Market Bubble

Housing-Market / Global Housing Markets Apr 07, 2016 - 03:24 PM GMTBy: Sol_Palha

"From top to bottom of the ladder, greed is aroused without knowing where to find ultimate foothold. Nothing can calm it, since its goal is far beyond all it can attain. Reality seems valueless by comparison with the dreams of fevered imaginations; reality is therefore abandoned." ~ Emile Durkheim

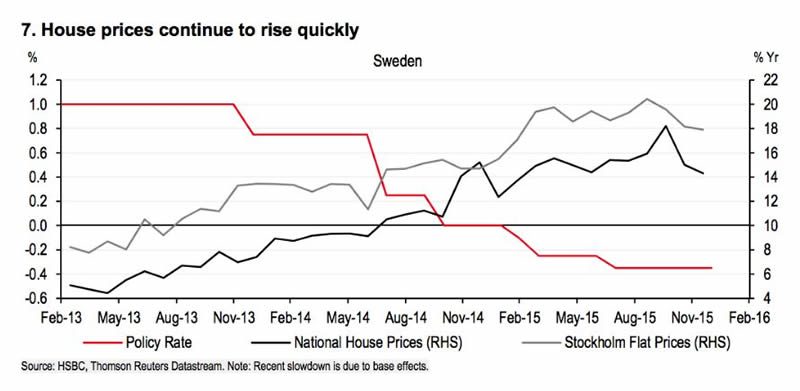

Sweden is already in the mature stages of experiencing a housing crisis. Take a look at the chart below. Home prices are surging simply because it is cheap to borrow money. The lower the interest payments, the more you can borrow. Hence, individuals throw caution to the wind and start chasing property because they believe prices will continue trending upwards. What they forget is that no market can trend upward forever.

More and more nations are embracing negative rates so as rates move into negative territory it will have the unintended consequence of fuelling another housing bubble, and suddenly property that appeared to be out of reach could be within reach, only because the monthly payment seems affordable. Eventually, the U.S is going to lower lending standards and when they do, expect the housing market to explode as there is a lot of pent-up demand. The public has been shut out of the markets for a long time, and when you give someone freedom after locking them up for a lengthy period, they go insane, and that is what lies in store for the housing market. The Fed has laid the path out, and this was planned years in advance. Take a look at the Swedish housing market as depicted in the chart below. The Chart for the US and UK housing markets will look 5 to 10 times worse.

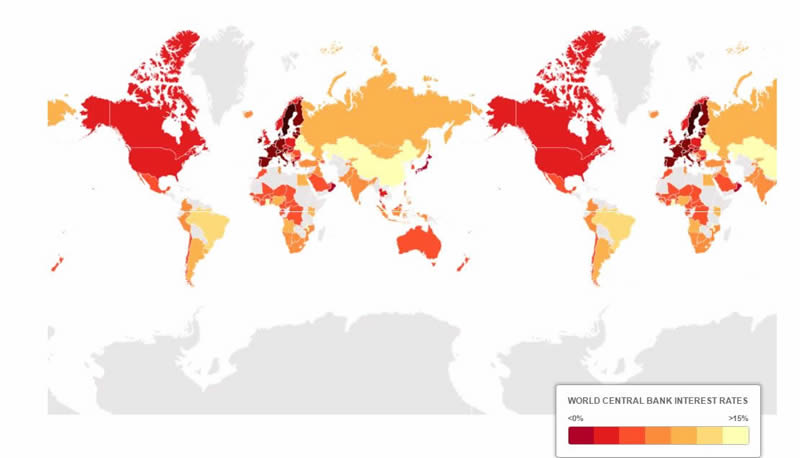

The map below illustrates that the war on interest rate is gathering momentum

Source: The Telegraph

Additional dangers of negative rates

As more nations embrace the era of negative rates, no nation is going will be in a position to resist. The slogan will be "surrender or die" and nations will opt for surrender as no one wants to die. Negative rates will also fuel a massive new round of share buybacks. The Fed is trying to put on a brave act, but you can already see them backtracking from the strong stance they took last year. Now they are stating that all is not well, and the economic outlook is weaker than expected. They will have no option but to join the rat pack; in this instance, resistance is futile.

The corporate world has gone a massive share buyback binge, and this binge is not showing any signs of letting up. It allows corporations to borrow money for next to nothing and then use these funds to buy back massive amounts of shares and in doing boost the EPS (Earnings per share). Negative rates will provide rocket fuel to the share buyback programs. Corporate debt will soar to insane levels; if you think today's levels are insane, you are in for a rude awakening as debt levels will soar beyond anyone's imagination.

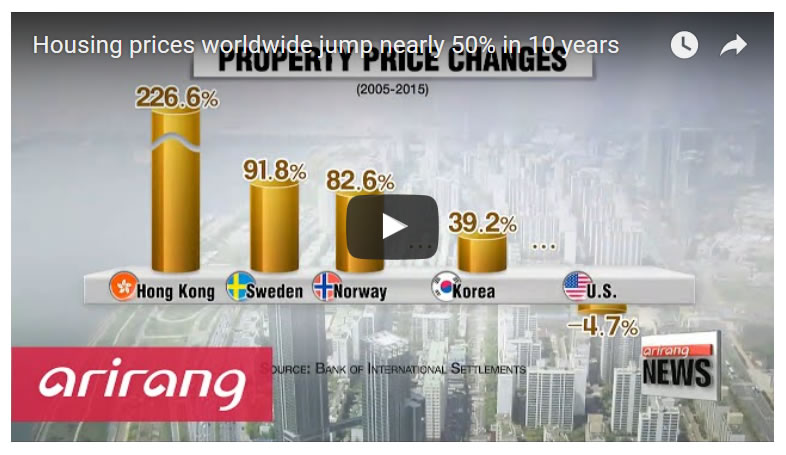

This video illustrates property prices surged an average of 50% in the past ten years; this how bubbles start

Suggested Plan of Attack

We live in a world of extreme greed, and our government seems to favour corporation fraud; against this backdrop, you need to do that which seems insane from a logical point of view. All strong Market corrections should be viewed as buying opportunities. From a mass psychology perspective, this is still the most hated bull market in history and until the masses embrace, it is destined to run a lot higher than most envision.

Additionally, it would be advisable to hold a core position in Gold; at some point in time Gold will start to react strongly to this massive form of currency debasement. Currencies are being destroyed on a global basis at a level never seen before. This will not end well, but as we have pointed out many times before, being right does not equate to market success. One has to look at the time factor, and most individuals do not have the staying power to bet against the Fed. Wall Street is full of tombstones of good men who were right but could not stay solvent long enough to benefit from their insights. Hence, we would not bet the house on Gold and nor should you. No matter how good an investment appears to be, one should never put all of one's eggs in one basket

"Avarice is the sphincter of the heart." ~ Matthew Green

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.