Gold Price Testing Key Technical Support – Is There More Downside Ahead?

Commodities / Gold and Silver 2016 Apr 07, 2016 - 04:35 AM GMTBy: Jason_Hamlin

The gold price advanced sharply during the first three months of 2016 (+16%), marking its best quarter in 30 years. However, it corrected from a high around $1,287 to $1,200 over the past few weeks. There was a nice bounce yesterday, but gold has once gain dropped today, back below $1,220. With this latest pullback in the gold price, many investors are wondering if the 2016 rally was a false breakout or if the new gold bull market is just getting started.

The gold price advanced sharply during the first three months of 2016 (+16%), marking its best quarter in 30 years. However, it corrected from a high around $1,287 to $1,200 over the past few weeks. There was a nice bounce yesterday, but gold has once gain dropped today, back below $1,220. With this latest pullback in the gold price, many investors are wondering if the 2016 rally was a false breakout or if the new gold bull market is just getting started.

Admittedly, short-term price movements in the gold market are very difficult to predict. But we can get some idea of how deep the current correction might go by looking at the technical chart. This shows the uptrend that has been in place since December and the support this trend line offers at the $1,200 level. This level gets additional support from being a key point of resistance and support on several occasions over the past few years.

The RSI momentum indicator is not yet oversold and suggests there could be more downside ahead for gold in the short term. I believe another drop to test support at $1,200 is likely and if this fails, the next stop is at the confluence of the 100 and 200-day moving averages around $1,145.

So is there more downside ahead for gold?

I think so and I have resisted the urge to buy the dip or add on yesterday’s rebound. My medium-term and long-term sentiment remain very bullish, as I believe the odds that gold has bottomed have increased substantially over the past few months. If this is correct, the gold bull market is just getting going and the upside potential remains huge.

For those starting to doubt the sustainability of the gold rally, please keep in mind that these types of pullbacks are healthy for the longer-term uptrend in the gold price. A period of consolidation is normal after such a quick and powerful rally and helps to rest the bull and prepare for the next leg up.

Gold would need to drop below $1,200 and then fail to find support around $1,145 for us to turn bearish again.

One positive sign for gold bulls is that mining stocks have not led gold to the downside during the current pullback. In fact, since the top on March 10th, gold (via GLD) is down 2.2%, while mining stocks (via GDX) are actually up 2.6%.

Insiders remain buyers and have increased their bullish bets over the past month, according to Canadianinsider.com. Nearly twice as many insiders were buying versus selling this week (65 buying vs 36 selling), although it is down from 79 buying/36 selling yesterday.

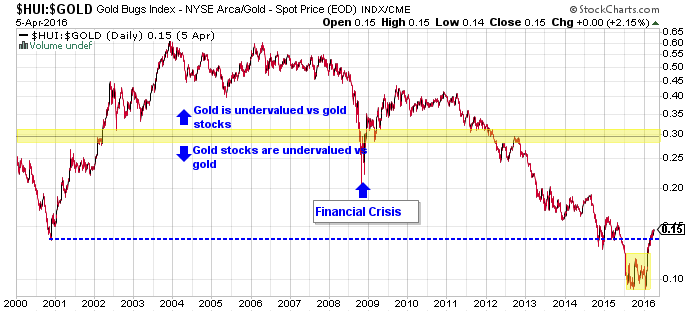

Mining stocks have been offering leverage of 3X the advance in the gold price year-to-date. You can see the bounce in the HUI/Gold index below, but mining stocks remain near the most undervalued levels of the entire bull market. They are even more undervalued today than they were at the depths of the 2008/09 financial crisis.

What does all of this mean for gold investors?

A little patience is warranted during this pullback given the technical signals, but the gold bull market that started in December of 2015 remains firmly intact. Those concerned that they have missed the train, should not worry. Although many gold stocks have doubled in the first few months of the year, mining stocks still remain near their most undervalued levels (relative to the metals) ever. Even the mining stocks that have doubled in 2016, would still need to climb another 5 to 10 times to reach their 2011 highs.

Gold most likely bottomed around $1,045, central bank demand and investment demand remain very robust, while global output is flat and the FED has walked back rate hike expectations significantly. Precious metals are one of the only asset classes that are undervalued at the current time. We believe that if stocks turn lower once again and investors flee the equity market, the enormity of funds rushing into the gold market will overwhelm the available supply. This is going to cause a rapid upwards revaluation of the gold price.

Furthermore, to whatever extent that the gold price has been manipulated and suppressed, the reality of price discovery moving to China (see China to Start Yuan-Based Gold Price Fix in April: Game Changer?) will likely reduce the ability of Western banks and government to hold down the gold price.

The bottom line is that I see this pullback as a buying opportunity, but believe buyers are likely to see better prices by waiting a bit longer. Over the next few years, I believe great amounts of wealth will be made by those picking up undervalued mining stocks near the bottom of this multi-year correction in precious metals. Will you be one of them?

You can sign up to receive our monthly Contrarian Gold Report, view the portfolio and get our weekly trade alerts for less than $1 per day. Click here to get started now!

By Jason HamlinJason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2016 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.