Big Banks, Hedge Funds Key Factors in 2016 Gold Price Surge

Commodities / Gold and Silver 2016 Apr 06, 2016 - 11:07 AM GMT Quietly though the advantage goes to private investors

Quietly though the advantage goes to private investorsI can remember only one other time when market factors lined up as favorably for gold as they do now and that was in the spring of 2008. There are a great many similarities to gold market dynamics between now and then, but there are also great differences. One of those differences is the huge influx of interest from institutional investors led by hedge funds and big banks. In 2008, institutional interest was light.

Now HSBC, JP Morgan Chase, Bank of America Merrill Lynch, ABN Amro, UBS and Deutsche Bank, PIMCO and Black Rock head a growing list of investment houses that view gold favorably. In what could turn out to be the first among many such announcements, Munich Re, the giant German reinsurer, said it was adding gold to its reserves in the face of negative interest rates. Chief Executive Nikolaus von Bomhard told a news conference, “We are just trying it out, but you can see how serious the situation is."

As we move into the second quarter of 2016, It is becoming increasingly clear that we are experiencing a tale of two gold markets. The one that ended December, 2015 and the one that began January, 2016 – the choppy market action visible on the near term gold chart and the trap door drops on the longer term chart.* Clearly, there was no opposition to the shorts in the paper market prior to January. Gold for the big banks and trading houses was a one-way trade.

Then the psychology at the zero-bound began to exert itself in the financial markets globally. Goldman Sachs has been every bit the naysayer on gold, but it finds itself pretty much a lonely bear. Gold’s choppy upward channel suggests that the bank and hedge fund bulls (and some other big traders) are taking positions on the other side of the market from Goldman. Still others are covering shorts. The battle lines, it seems, are drawn. The bulls for the moment have the ascendancy – all of which prompted me to dust-off an old jpeg some of you might recognize from days past (the golden bull, top of the page).

Reader note: If you appreciate the kind of gold-based analysis you are now reading, we invite you to sign-up for e-mail alerts on future releases. News & Views is a free service that now has 20,000+ subscribers – one of the best and most widely read newsletters in the field.

Now comes the stirrings of a new financial crisis. Japan and much of Europe have already adopted negative rates. As for the United States, in a speech before the Economic Club of New York Janet Yellen explained (as reported by Financial Times) that "the Fed had little scope to reverse course and stimulate the economy with rate cuts if the U.S. hit the buffers, underlying the need for a gradual tightening of policy. She homed in on risks still brewing in China and the oil market. . . ."

In other words, the Fed seemed prepared in December to start a fire in order to give itself the ability to some day put one out. And start a fire they did. The intense negative reaction on the part of emerging countries and global financial markets was enough to force the Fed into a hasty, poorly organized retreat. Out of sheer necessity, and in order to restore some semblance of order in global stock markets, it decided to maintain the status quo. In February, a chastened Janet Yellen testified at a Congressional hearing that the Fed was taking a look at negative rates.

Some strong advice for central banks and funds from the World Gold Council

The usually staid World Gold Council recently gave some strong advice on gold and very low to negative interest rates to global investors including central banks.

"We have entered a new and unprecedented phase in monetary policy. Central banks in Europe and Japan have now implemented Negative Interest Rate Policies (NIRP). The long term effects of these policies are unknown, but we see discouraging side effects: unstable asset price inflation, swelling balance sheets and currency wars to name a few. Amid higher market uncertainty, the price of gold is up by 16% year-to-date – in part due to NIRP. History shows that, in periods of low rates gold returns are typically more than double their long-term average.

Looking forward, government bonds are likely to have limited upside, due to their low-to-negative yields and, in our view, would be less effective than gold in mitigating risk, ensuring portfolio diversification, and helping investors achieve their long-term investment objectives. Portfolio analysis suggests that gold allocations in a low rate environment should be more than twice their long term average. We believe that, over the long run, NIRP may result in structurally higher demand for gold from central banks and investors alike."

The fact of the matter is that there is not enough gold in size available to accommodate a doubling of already strong central bank demand. At current prices, the availability of metal comes nowhere near matching the availability of capital. China, for example, is hoping against hope that it will have enough time to beef up its holdings sufficiently before the eventuality of a full-blown currency crisis. Barring a miracle on the supply side of the fundamentals ledger, the likelihood is that they will come up short.

This is a case where, for once, the private investor has the advantage. Individuals can still buy gold and silver in sufficient quantity to achieve their portfolio goals (and quickly if so required). What we do not know is how long under the circumstances that advantage will remain on the table.

* A note on price discovery in the paper gold market: Anyone who has spent time studying the gold market ultimately comes to the conclusion that the price is not determined in the physical market, but in London and New York's paper trade. Though physical trades are often hedged in the paper market, that activity makes up a very small portion of the overall volume. As a result, the effects of movements in the physical supply and demand on the price are indirect and often misunderstood. Sooner or later though, the trends in the physical market do manifest themselves in the paper market. That effect though is largely psychological and, by saying that, I do not mean to diminish in any way it importance. The profound change in sentiment resulting from the low to negative interest rate environment is an example of this principle in action.

Banks and hedge funds, unlike private, individual investors, trade at the commodity exchanges and ETFs when they take positions in the gold market. In the aggregate they bring substantial capital to the table – enough purchasing power to move the market in either direction. The important takeaway in a nutshell is that strong physical demand and the anticipation of future physical demand changed the psychology in the paper market at the start of the year. It attracted significant capital to the long side and pushed the price higher.

New physical demand will come on top of already elevated base

(Why 2016 is different from 2008)

Any new gold and silver physical demand entering the market relative to the interest rate environment will come on top of an already elevated base. That base was built in the period after the Lehman Brothers collapse and the big numbers never receded. Here for quick reference is an overview of the sources of that demand, its importance to the overall market, and the differences imposed on the market since the earlier breakdown. Worth noting: Insofar as their demand is for the actual physical metal, these three sectors will be in direct competition with each other.

• First, as pointed out in the previous issue of this letter, central banks, led by China and Russia, are already aggressive net buyers of gold. In 2008, they were still net sellers. "Central banks," says the World Gold Council, "have been accelerating the use of gold to diversify their reserves since the 2008-2009 financial crisis. In the second half of 2015 alone, central banks bought more than 336 tonnes of gold – the largest semi-annual total on record. The acceleration of such purchases, across a diverse range of countries, highlights the fact that diversification of foreign reserves remains a top priority for central banks. As foreign reserve managers all over the world continue to grapple with the challenges of negative nominal interest rates, we expect to see record amounts of central bank gold purchases in 2016 (and beyond)."

• Second, private investor volumes globally are considerably higher now than they were in 2008. In the years following the initial phase of the crisis, volumes for gold bullion coins went multiples pre-crisis levels and stayed there indicating the public concern about central banks ability to deal with the crisis and any further escalation. Investors need to take into account the potential for intermittent bottlenecks, outright shortages and escalating premiums on gold and silver coins and bars.

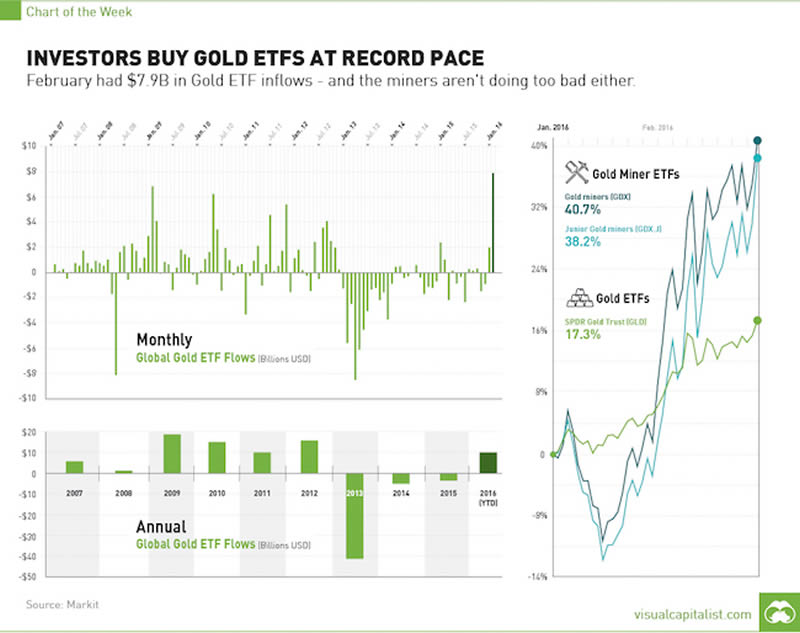

• Third, institutional investors, as covered in detail above, have returned to the gold market, and as a result volumes at gold ETFs are running at a record pace." Even though the ETFs for all intents and purposes are a paper position as far as most holders are concerned, these institutions must actually go out and procure the metal represented by sales of shares. I would not be surprised to learn of record volumes at both gold and silver ETFs now and as we move deeper into 2016.

Speculation on secret Shanghai Accord

“The dollar has taken a surprisingly big stumble in recent weeks, prompting traders to ask: What’s really driving the selloff? The answer some are coming up with smacks of conspiracy theory. Rumors are flourishing that global policy makers made a secret deal at the G20 meeting in Shanghai late last month. This ‘Shanghai Accord’ to weaken the greenback was aimed at calming the financial markets, which had gotten off to an awful start to the new year, according to the chatter." – Sarah Sjolin, CBS MarketWatch

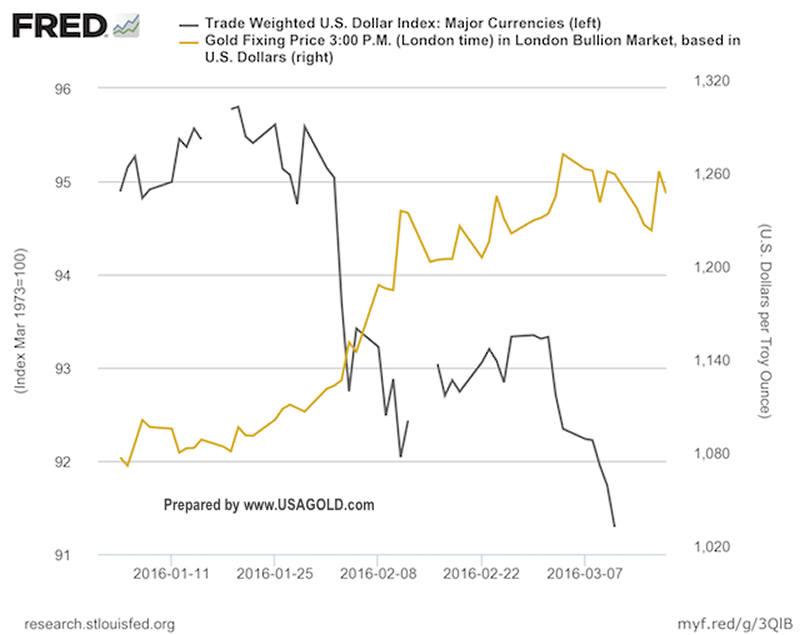

A G20 organized and implemented de facto dollar devaluation would explain the “mysterious” dovishness at the most recent Fed meeting, and subsequently Fed chair Janet Yellen's dovish tilt in a speech before the Economic Club of New York. It would also explain gold’s surprise rise – up 18% since the turn of the year. (See gold/dollar index overlay chart immediately below) Much of that rise, driven by bank trading desks, could well have been the result of leaks of the agreement.

If an accord has been reached, it bodes well for gold and silver as we move deeper into 2016. Worth Wray, chief economist and global macro strategist at STA Management and an expert on emerging markets, says such an accord would be a game changer. "No foreign-exchange pact," she says, "was announced at the February meeting of central bankers and policy makers from the 20 largest economies. That hasn’t stopped speculation that a plan of action was whipped up behind closed doors, as its supposed effects are beginning to emerge now: The greenback DXY has shaved off more than 3% since the gathering, sparking a rally in stocks, emerging markets assets and commodities.”

Rothschild - ". . .[W]e may very well be in the eye of the storm."

“In my half-yearly statement I sounded a note of caution, ending up by writing that ‘the climate is one where the wind may well not be behind us’; indeed we became increasingly concerned about global equity markets during the last quarter of 2015, reducing our exposure to equities as the economic outlook darkened and many companies reported disappointing earnings. Meanwhile central banks’ policy makers became more pessimistic in their economic forecasts for, despite unprecedented monetary stimulus, growth remained anaemic. Not surprisingly, market conditions have deteriorated further. So much so that the wind is certainly not behind us; indeed we may well be in the eye of a storm.” – Lord Jacob Rothschild, RIT Capital Partners (2015 Year End Report)

The Bank for International Settlements, the central bank for central banks, recently issued a similar warning rating the storm as “gathering” not fully imposed as Rothschild grades it. “The tension between the markets’ tranquillity and the underlying economic vulnerabilities had to be resolved at some point. In the recent quarter, we may have been witnessing the beginning of its resolution,” says Claudio Borio, the organization’s head. The word “turbulence” appears 17 times in the report ( I counted them). Please see “Uneasy calm gives way to turbulence.”

|

––––– INTERACTIVE LONG-TERM GOLD AND SILVER CHART –––––

USAGOLD TODAY!

|

Related reading: "Gold in a world of negative rates"/World Gold Council/March, 2016;

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.