SPX May be back in the Red for 2016 Before Long

Stock-Markets / Stock Markets 2016 Apr 05, 2016 - 03:29 PM GMT The SPX decline stopped so far at 2044.92, just a point above last Friday’s low at 2043.98 and the December 31 close at 2043.94. The bounce may challenge the trading channel trendline near 2057.00 before the next decline.

The SPX decline stopped so far at 2044.92, just a point above last Friday’s low at 2043.98 and the December 31 close at 2043.94. The bounce may challenge the trading channel trendline near 2057.00 before the next decline.

ZeroHedge reports, “"Still No Confidence In The Rally" - that's the title of the latest weekly BofA report looking at the buying and selling by its smart money clients (institutional clients, private clients and hedge funds), which finds that not only were sales by this group of clients last week the largest since September, and the fifth-largest in our data history, but this was the 10th consecutive week of selling as absolutely nobody believed this fakest of fake "rebounds" in recent history.”

Another “must read” from ZeroHedge is entitled, “Why Traders Are Angry: “The Fed Is Modeling Distortions It Helped To Create.”

The VIX is now on an aggressive buy signal. Additional confirmations will come at higher elevations, but the declining trading channel has been broken.

The NYSE Hi-Lo is in decline. It may give an aggressive sell signal once it crosses its 50-day Moving Average at 4.54. This is a lagging indicator, but still a good one.

I changed the chart style for the Hi-Lo since the prior one wasn’t giving good signals. This is clearer and more definite.

Crude oil has halted its decline today and may test Intermediate-term resistance at 36.28. There do not seem to be any substantial bounces in store until the end of April, so crude remains on a sell signal.

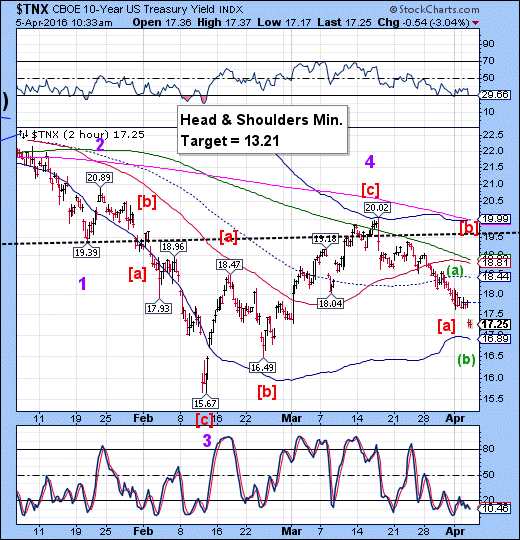

TNX continues to support a “risk off” environment. That may still hold true in the event of a bounce. Bloomberg reports, “Risk assets have rallied and the U.S. dollar has sold off since Federal Reserve Chair Janet Yellen struck a dovish chord in her Mar. 29 speech.

Investors can be forgiven for having a certain sense of déjà vu—they saw this play in October.

In a note to clients, Societe General Global Strategist Kit Juckes highlighted this burgeoning disconnect between U.S. equities and three-month Eurodollar futures, as well as the U.S. dollar taking place once again:”

Bloomberg may be implying that this disconnect may halp the rally further, but I disagree. The Cycles have become very stretched and the snap-back may be violent.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.