The Boomer Retirement Meme Is A Big Lie

Politics / Demographics Apr 04, 2016 - 02:29 PM GMTBy: James_Quinn

As the labor participation rate and employment to population ratio linger near three decade lows, the mouthpieces for the establishment continue to perpetuate the Big Lie this is solely due to the retirement of Boomers. It's their storyline and they'll stick to it, no matter what the facts show to be the truth. Even CNBC lackeys, government apparatchiks, and Ivy League educated Keynesian economists should be able to admit that people between the ages of 25 and 54 should be working, unless they are home raising children.

As the labor participation rate and employment to population ratio linger near three decade lows, the mouthpieces for the establishment continue to perpetuate the Big Lie this is solely due to the retirement of Boomers. It's their storyline and they'll stick to it, no matter what the facts show to be the truth. Even CNBC lackeys, government apparatchiks, and Ivy League educated Keynesian economists should be able to admit that people between the ages of 25 and 54 should be working, unless they are home raising children.

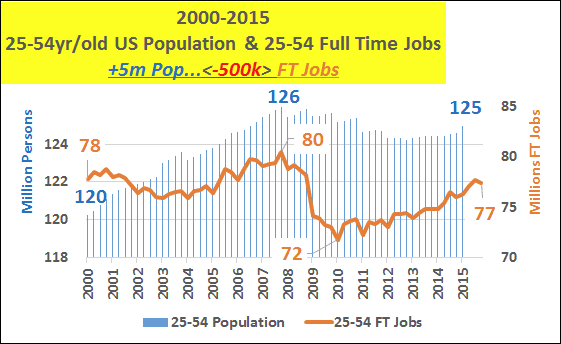

In the year 2000, at the height of the first Federal Reserve induced bubble, there were 120 million Americans between the ages of 25 and 54, with 78 million of them employed full-time. That equated to a 65% full-time employment rate. By the height of the second Federal Reserve induced bubble, there were 80 million full-time employed 25 to 54 year olds out of 126 million, a 63.5% employment rate. The full-time employment rate bottomed at 57% in 2010, and still lingers below 62% as we are at the height of a third Federal Reserve induced bubble.

Over the last 16 years the percentage of 25 to 54 full-time employed Americans has fallen from 65% to 62%. I guess people are retiring much younger, if you believe the MSM storyline. Over this same time period the total full-time employment to population ratio has fallen from 53% to 48.8%. The overall labor participation rate peaked in 2000 at 67.1% and stayed steady between 66% and 67% for the next eight years. But this disguised the ongoing decline in the participation rate of men.

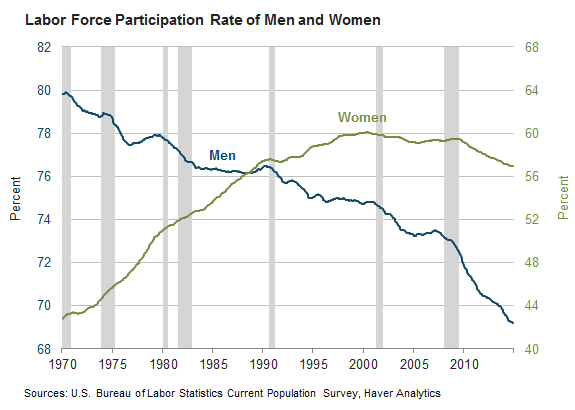

In 1970, the labor participation rate of all men was 80%, while the participation rate of women was just below 43%. Then Nixon closed the gold window, setting in motion a further debasing of the currency, unleashing politicians to promise voters goodies without consequences, and giving Wall Street bankers and Madison Avenue free rein to use propaganda to bury Americans in debt, while convincing them trinkets and baubles were actually wealth.

The relentless inflation released by Nixon and the Federal Reserve, and perpetuated by Washington D.C. politicians, forced more women into the workforce over the next 30 years, as families could no longer make ends meet with just the husband working. Over the next 30 years the labor participation rate of women soared to 60%, with the expected negative consequences from having tens of millions of children raised by strangers rather than their mothers. The resultant decline in the family unit and kids being brainwashed by government public school indoctrination has left generations of non-critical thinking zombies, easily manipulated by emotional appeals and false storylines.

As women entered the workforce in great numbers, the participation rate of men gradually declined from 80% to 75% by the 2000. It then began a rapid descent and accelerated after the Federal Reserve created 2008 financial disaster. It now stands at 69.3%, just above its record low in 2015. In the 1950's when 87% of men participated in the labor market, the country's economy grew strongly, we produced rather than consumed, we saved before we spent, the family unit was strong, and men's purpose in life was clear.

When over 30% of working age men aren't participating in the labor force, trouble is brewing. It's even worse when you consider the 25 to 54 year old male participation rate has declined from 97% in the 1950's and 1960's to below 88% today. Much of the anger building in this country is the result of men in their prime earning years seeing their jobs shipped overseas, outsourced, or taken by HB1 workers. The backlash against illegal immigrants is understandable.

Then there are the young men aged 16 to 24, who have seen their participation rate fall from over 70% in the early 1990's to below 51% today. The 70% participation rate was consistent from the mid 1970's through 2000. The precipitous decline is not due to mass enrollment in college, as college students worked when I was their age. There is nothing more volatile than millions of unemployed young men, an imploding economy, growing wealth inequality, and porous borders allowing millions of illegals to invade the country, taking jobs and straining the already bankrupt social welfare net.

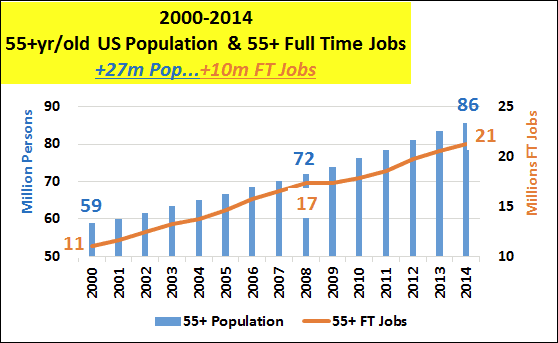

The facts obliterate the false storyline of Boomers retiring as the primary cause for the labor participation rate plummeting to three decade low levels. In fact, the number of full-time workers over the age of 55 numbered only 11 million in 2000, representing 18.6% of the over 55 population. Today, over 21 million full-time employed over 55 year olds, represent close to 25% of the rapidly growing over 55 year old category.

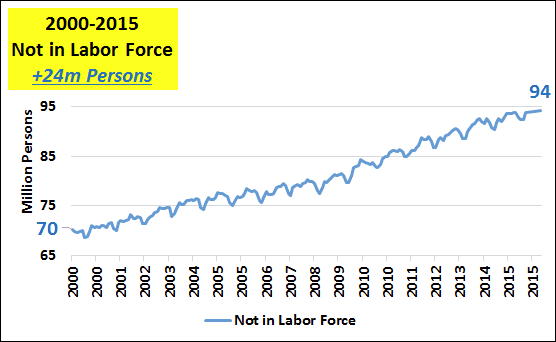

The overall labor force participation rate of the over 55 population, which had lingered in the 30% range from the mid 1980's until the mid 1990's, now stands just above 40% at levels last seen in the early 1960's. The Boomer retirement meme, peddled by the corporate media, is pure propaganda designed to obscure the fact millions of people, especially men, in their prime working years are not working. The fact is there are 253 million working age Americans and 102 million of them are not working.

Of the 151 million working Americans, only 123 million are employed full-time (now 35 hours, then 40 hours), 10 million are self-employed, 7 million work multiple jobs, and 21 million produce nothing as they work for the government. The strong and growing job market mantra being sold to the American people is a complete falsehood, and average Americans know it.

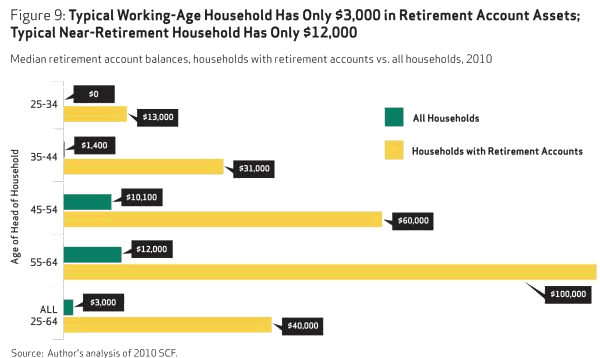

We know 10,000 Americans per day are turning 65 and will be for decades to come. Some of them are retiring as they had planned for the last 40 years to do. The fact is very few planned. They were sucked into the easy debt vortex sold by the establishment and lived in the present, never planning for the future. When 50% of all households over the age of 55 have $12,000 or less in retirement savings, they aren't retiring. When even the over 55 households that did save only have $100,000 of retirement savings, they aren't retiring. That will last them a couple years at most, when their life expectancy is 20 to 30 years. Very few households can survive on their Social Security pittance, as Yellen and her band of merry men provide 0.25% returns on savings and the cost of food, rent and healthcare surge ever higher.

Boomers aren't retiring en mass because they can't afford to retire. The labor participation rate of the younger generations is being negatively impacted by the non-retirement of Boomers. This is called the trickle down effect from unintended consequences. The establishment has strip mined the wealth of the country, leaving a barren wasteland in its wake, creating a seething populace, seeking perpetrators to blame. The populist uprising which propels Trump and Sanders has been spurred by the destruction of the working middle class as the corporate fascists, global elite, and banking cabal have pushed their game of financialization roulette to its limit.

The corporate mainstream media machine, whose job is to keep the establishment in power, scorns Trump when he references a true unemployment rate above 20%, while the BLS reports a beyond laughable rate of 5%. In fact, 24% of all Americans between the ages of 20 and 54 are not working. In fact, 18% of all American men between the ages of 20 and 54 are not working. What are these 13 million men doing on a daily basis? They aren't retired. A large percentage have been screwed over by a system designed to enrich the few at the expense of the many. Of the 35 million 20 to 54 year old Americans not working, many have found they can suckle more from the welfare and disability systems than they can by working. This generates animosity between the middle and lower classes, to the delight of the ruling class, as it takes the focus off their never ending criminal activities.

The Big Lie can work for longer than rational people might think, but eventually the revelation of its falsehood leads to revolutionary change. The average person in middle America is waking up to the lies of the establishment. They know the unemployment rate is closer to 20% than 5%. They know their own personal inflation rate is 5% to 10%, and not the reported 1% to 2%. They know the banker bailout, TARP, ZIRP, QE, and trillion dollar budget deficits weren't designed to benefit Main Street USA. They know the media is in the back pocket of the establishment. They are sick and tired of getting screwed by a system designed by a wealthy elitist class to shake them down at every opportunity. They are starting to get up out of their chairs and yelling:

I'm as mad as hell and I'm not going to take this anymore!!!

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.