Cost Push Inflation is Another Keynesian Concept the Federal Reserve Believes In - They're Wrong

Economics / Inflation Apr 02, 2016 - 12:33 PM GMTBy: Gordon_T_Long

FRA Co-founder Gordon T. Long is joined by Christopher P. Casey in discussing the decrease in oil price and its potential effect on the global economy.

FRA Co-founder Gordon T. Long is joined by Christopher P. Casey in discussing the decrease in oil price and its potential effect on the global economy.

Mr. Casey is the Managing Director of WindRock Wealth Management, a registered investment advisor and wealth management firm that subscribes to the Austrian school of economics. Mr. Casey is a frequent speaker before a number of organizations and conferences, including USA Watchdog, GoldMoney, Freedom Fest, and various bar associations and radio shows, including weekly financial and economic commentary on The Edge of Liberty (WNJC 1360, Philadelphia). His writings have appeared in a variety of publications and websites including The Ludwig von Mises Institute, Zero Hedge, Family Business, Casey Research, and Laissez Faire Books. He is a board member of the Economics Development Council with the University of Illinois, a Policy Advisor for The Heartland Institute's Center on Finance, Insurance, and Real Estate, and a Chartered Financial Analyst charterholder (CFA®)

Cost Push Inflation

Cost push inflation is a Keynesian concept that was developed to explain inflation during inflation; if any important commodity's price rises, all other prices of goods and services rise. As we pay more, the standard of living would go down and inflation would creep in. But this actually puts downward pressure on other goods and services, so in the end the price level itself is largely unchanged.

"The price level is a function of the demand and supply of money itself, not of any individual commodity."

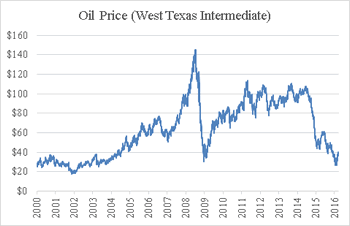

It used to be that minor shifts in the oil price had profound impact on the economy, but that isn't the case right now. Oil went from about $25 in 2003 to $140 in 2008, back down to $30 in late 2008, and $140 a couple of years ago. But have we ever seen a price level that rose or decreased according to the oil prices over the last fifteen years? The answer is no. The issue is that the Federal Reserve does believe in cost-push inflation, and they do think that deflation could be caused by lower oil prices.

"The great danger here is that they, in their mistaken belief that low oil prices could put a cap on any inflationary moves they do, as far as printing money, is that they could overshoot and end up causing more inflation than they intend."

Effect of Lower Oil Prices

"Lower oil prices are good for the economy, but not for the reasons people cite on mainstream media."

There's a possibility that this could spike interest rates, or mitigate a downfall in interest rates.

State of The Oil Markets

Lower energy prices used to be considered good for the economy, since people have more money to spend. But that's going toward servicing debt; it's not actually consumption, it's going toward debt payments. There are also some real dangers that aren't being discussed by mainstream media.

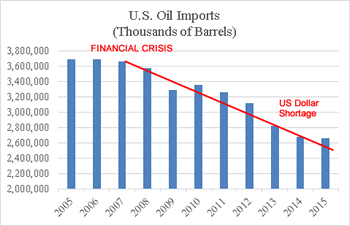

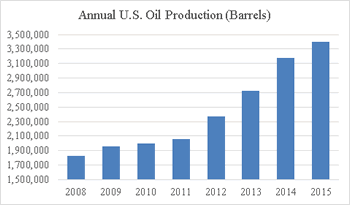

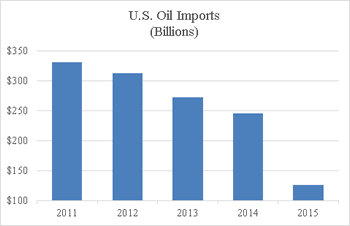

Oil production has increased about 85% since 2008, but what isn't mentioned is how oil imports have decreased. It's down from approximately 12% of total imports to 5% today, not just in Dollar terms but overall volume.

The price has dropped 60% in the last five years. Oil producing nations are making less Dollars from the US customer. This is a problem because there are limited options for what they can do with those Dollars, so the US' major trading partners and oil producing countries hold a massive amount of US treasuries. If they reduce their purchase of US treasuries, that could increase interest rates.

"Interest rates would have fallen further, but for the selling or lack of demand from these oil producing countries."

Saudia Arabia Peg

The Riyadh is pegged to the US Dollar at 3.75 Riyadh to the US Dollar, but their economy is under strain and their deficit is staggering. In any fixed exchange rate, the only way to keep it is through manipulation of the currency market by active buying and selling of Riyadh and US Dollars, but that is only making them go bankrupt faster. This could ultimately affect US interest rates as well.

Oil Supply & Demand

With multiple countries putting out as many barrels of oil a day as possible, there's pressure to keep the oil supply up and maybe keeping oil prices down. But if the world economy falls off significantly, there will be a decrease in demand and then cut backs and lots of capital not invested. Then if demand rises there won't be much capacity, which makes the market volatile. The banks are holding out in the hopes of a rebound, because they have so much debt outstanding to the oil industry. Eventually this will either create incredible inflation or a banking crisis.

"The banks cannot put up with this kind of strain . . . it's kind of like being a patient and your doctor, who would be the central bank, is subjecting you to stimulants and depressants whether its quantitative easing or negative interest rates."

Federal Reserve's Misconceptions

Regarding the nature of growth, history shows that the key is a high level of savings and decreasing government intervention. Another is the idea of deflation being bad; for example, the US experienced experienced two 30-40 year periods where the price level fell by half, but it was also the greatest period of growth in US history. The Federal Reserve also has misconceptions about inflation's impact on unemployment, and interest rates, which could cause a banking crisis.

Advice for Investors

If people believe that the oil market will create a banking crisis in the future, then they need to look at assets outside of the banking system. Gold and silver should absolutely be considered as part of their portfolio since it's much safer than a number of currencies, as it has alternative value. Farmland is also an excellent inflation hedge and pays a dividend, unlike precious metals.

"A lower oil price, although all things being equal is good, there are some real dangers: there is the danger it could increase interest rates, there is the danger it could increase inflation levels... and there is the danger it could induce a banking system crisis."

Abstract by: Annie Zhou:

Video Editing by: Min Jung Kim

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.