Gold Stocks Correcting Through Time Not Price

Commodities / Gold and Silver Stocks 2016 Apr 02, 2016 - 12:27 PM GMTBy: Jordan_Roy_Byrne

Gold Stocks enjoyed a fabulous, near vertical rebound into March yet were in extreme overbought territory. We and many others called for a correction. In recent weeks those other voices have worried excessively about the alleged bearish construction of the CoT. Although Gold and Silver have essentially consolidated with a little weakness, the gold stocks have continued to hold above even initial support. Over the past month they have corrected through time rather than price. The longer gold stocks hold above initial support, the greater the chance they are building a bullish flag consolidation.

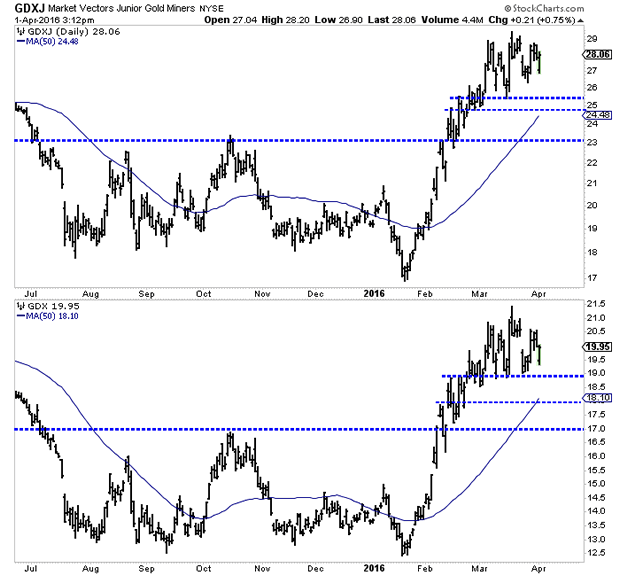

Below we plot the daily bar charts of GDXJ and GDX. A month or so ago we noted upside targets of $28 for GDXJ and $21 for GDX. Since the miners achieved those targets, they have digested and consolidated gains while holding above initial support targets. Both GDXJ and GDX are holding above their 50-day moving averages as well as the 38% retracement of the very strong rebound. The distance between the miners and their 50-day moving averages reflects an overbought condition that still presides.

Every time the miners have threatened initial support, they have bounced in strong fashion. Over the past month GDXJ has bounced thrice from $25.50 to $26.00 while GDX has thrice bounced from $19.00. Miners opened much lower today due to the jobs report yet that weakness has been reversed completely. In short, all weakness continues to be bought.

As long as the gold stocks continue to hold support for another week or two then the near term outlook is bullish. A bull flag is a consolidation pattern that separates two strong moves. It could be developing in the miners. There is logical reason to be cautious if not bearish at this point. The metals look okay at best while the miners remain somewhat overbought. However, the action in the miners, if it continues for another few weeks is telling us what could be ahead.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.