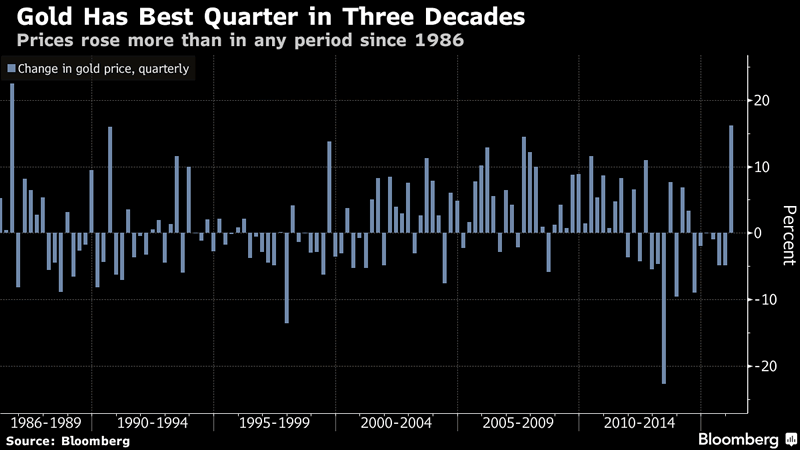

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Commodities / Gold and Silver 2016 Apr 01, 2016 - 03:08 PM GMTBy: GoldCore

– Gold prices gained 16% in Q1 – best quarterly performance since 1986

– Gold prices gained 16% in Q1 – best quarterly performance since 1986

– Gains due to increasing global financial, macroeconomic and monetary risk

– Stocks come under pressure – Flat in U.S.; Falls in Europe and Asia

– Sterling fell 20% on BREXIT concerns and the euro fell 11% against gold

– Canadian dollar fell 10%, Aussie dollar fell 9% & Swiss franc fell 12% against gold

– Outlook positive as gold and silver remain undervalued

– Reasserted role as safe haven in Q1

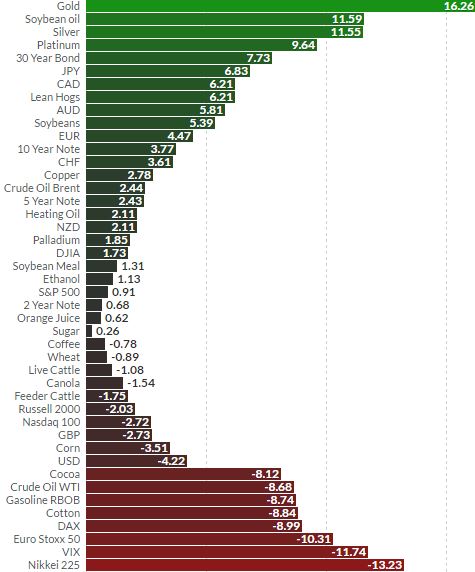

Year To Date Relative Performance (Finviz)

Gold prices gained 16% in the first quarter and had their best quarterly performance since 1986. Gold made gains due to continuing ultra loose monetary policies, diminished U.S. rate-increase expectations, worries about global economic growth, both U.S. and global geopolitical concerns and turmoil in markets.

Most of the gains came in the first six weeks of the year when market turmoil was at its worst and sharp falls were seen in stock markets. For the quarter, the S&P recovered from losses and eked out a 0.9% gain, the DJIA was 1.7 percent higher while the Nasdaq 100 fell 2.7% on concerns of a new tech bubble.

Bloomberg

European stocks had a torrid quarter with the EuroStoxx 50 shedding 10.3 percent and the DAX down 9%. The Nikkei crashed 13.2% in the quarter as the Japanese economy showed little signs of recovery and indeed looks on the verge of a depression.

The dollar logged its worst quarterly performance since 1990 as the Federal Reserve slowed the expected pace of interest rate hikes, citing worries about the potential domestic impact of very weak global growth.

Sterling was the weakest major currency in the world and the British pound weakened 2.5% against the dollar and 20% against gold over the course of the quarter as worries about a possible U.K. exit from the European Union led to traders selling sterling aggressively.

All currencies fell in gold terms even ones that were stronger than the dollar. The yen was the strongest major currency in the world despite the struggling Japanese economy. While it rose 7.1% against the dollar, it was 9% lower versus gold.

Sterling fell 20% and the euro fell 11% against gold. The Canadian dollar fell 10%, the Aussie dollar fell 9% and the Swiss franc fell 12% against gold.

Gold started the year at $1,062, €974 and £716 per ounce and finished the quarter at $1,233, €1,080.69 and £860.20 per ounce.

Geopolitical risk intensified with the risk of terrorism and war ever present and gold continued to act as an important hedge against geopolitical risk and indeed currency devaluations.

Further correction and consolidation remains a possibility given the strong gains in the quarter. However, we expect currencies to continue to fall in value versus gold in 2016 and competitive currency devaluations and currency wars are set to return.

Even after recent gains, gold remains 35% below the nominal high in August 2011 and silver some 70% below its nominal high in April 2011. In inflation adjusted or real terms, prices remain even more undervalued. This is especially the case given the negative interest rate monetary backdrop and other significant economic and geopolitical risks.

Gold reasserted its role as a hedging instrument and an important safe haven asset in the quarter. Exactly when investors needed gold to perform, as stocks and currencies lost value in the quarter, gold outperformed. Once again, it enhanced returns and reduced volatility for those with diversified portfolios.

Gold Prices (LBMA)

01 April: USD 1,232.10, EUR 1,080.69 and GBP 860.20 per ounce

31 Mar: USD 1,233.60, EUR 1,085.50 and GBP 857.62 per ounce

30 Mar: USD 1,238.20, EUR 1,094.12 and GBP 860.23 per ounce

29 Mar: USD 1,216.45, EUR 1,087.71 and GBP 853.04 per ounce

24 Mar: USD 1,216.45, EUR 1,088.75 and GBP 861.89 per ounce

Silver Prices (LBMA)

01 April: USD 15.38, EUR 13.48 and GBP 10.76 per ounce

31 Mar: USD 15.38, EUR 13.52 and GBP 10.68 per ounce

30 Mar: USD 15.38, EUR 13.58 and GBP 10.68 per ounce

29 Mar: USD 15.06, EUR 13.44 and GBP 10.56 per ounce

24 Mar: USD 15.28, EUR 13.70 and GBP 10.82 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.