Gold Firms Up On Dovish Yellen Commentary

Commodities / Gold and Silver 2016 Mar 31, 2016 - 12:36 PM GMTBy: AnyOption

Precious metals prices have been on a tear higher since the outset of 2016 as concerns about the pace of US policy tightening combined with growing global uncertainty sent gold to the highest levels since February of 2015. Although commentary from more hawkish Federal Reserve members in the previous few weeks raised speculation that another US rate hike could come as soon as April, Chairwoman Janet Yellen extinguished those expectations with her more dovish tone. Citing the downside risks to the current pace of global economic expansion combined with reduced confidence in the outlook for monetary policy normalization, Yellen sent the US dollar tumbling with investors embracing gold, driving the precious metal nearly 1.65% higher over the session. A crumbling outlook combined with a drive towards data dependency in decision-making has seen hawkish sentiment shift more neutral, benefiting precious metals near-term.

Precious metals prices have been on a tear higher since the outset of 2016 as concerns about the pace of US policy tightening combined with growing global uncertainty sent gold to the highest levels since February of 2015. Although commentary from more hawkish Federal Reserve members in the previous few weeks raised speculation that another US rate hike could come as soon as April, Chairwoman Janet Yellen extinguished those expectations with her more dovish tone. Citing the downside risks to the current pace of global economic expansion combined with reduced confidence in the outlook for monetary policy normalization, Yellen sent the US dollar tumbling with investors embracing gold, driving the precious metal nearly 1.65% higher over the session. A crumbling outlook combined with a drive towards data dependency in decision-making has seen hawkish sentiment shift more neutral, benefiting precious metals near-term.

Accommodation Prevails For Now

In spite of multiple comments from key Fed policymakers including Presidents Charlie Evans and Dennis Lockhart supporting higher interest rates based on the uptick in inflation, Chair Janet Yellen was quick to dispel any notion of an April shift in monetary policy. In her remarks presented before the Economic Club of New York, Yellen stressed caution, stating “I consider it appropriate for the committee to proceed cautiously in adjusting policy.” The emphasis on caution, external risks, and data dependency were enough to give risk assets a boost and deliver a blow to the US dollar which had recently experienced a sustained rally higher. The dollar weakness sent gold prices higher on the back of renewed perception of enduring accommodation over the near-term until the trajectory of the economy becomes clearer.

From a data dependency point of view, US employment continues to receive positive mention in most policymaker remarks, however, the inflation outlook remains a source of contention amongst committee members. Stronger than anticipated fourth quarter GDP growth combined with rising core inflation have been overshadowed largely by the turbulent state of global trade. If the Federal Reserve would have to reverse course to accommodate for this factor, recent momentum higher in gold prices could be at the very early stages. Nevertheless, prices will remain dependent on the evolution of the situation over the medium-term. Should risks come unhinged, the stage is set for a rapid appreciation in gold prices. Rebounding inflation could add to gold’s upward price momentum, especially if no attempt is made to temper rising consumer prices with higher rates, eating away purchasing power and adding to the appeal of a precious metals inflationary hedge.

Technically Speaking

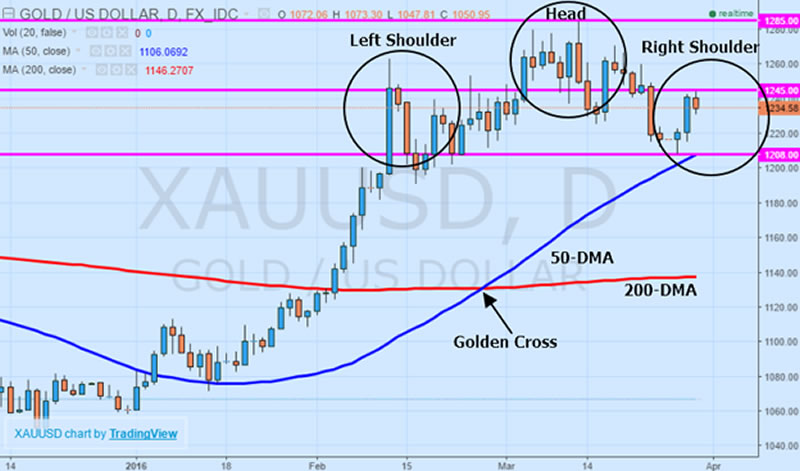

While the conditions that sent gold prices higher might be easing to a degree, from a technical perspective, gold is at a critical juncture as far as price momentum is concerned. Current price action does indicate the potential for a deeper correction following the move higher since the outset of the year. Pullbacks have been limited, so the potential for additional downside is there. Additionally, the emergence of a head and shoulders bearish pattern could see a renewed round of selling near the right shoulder line sitting at $1245 per troy ounce. If using the pattern as the means to form a strategy, investors would be encouraged to initiate positions near the right shoulder resistance at $1245 targeting the neckline support at $1208. This level coincides with the 50-day moving average, meaning the level will be strong and likely prevent a breakout below.

Moreover, because both the medium and long-term moving averages are trending higher, the crossover of the 50-day moving average above the 200-day moving average back in February sets the stage for the “golden cross” pattern which is typically accompanied by substantial bullish momentum higher. Even though gold prices could retreat over the near-term, especially if Fed policymakers offset Yellen’s dovish comments with more hawkish attitudes, support at $1208 might provide the perfect entry point for investors anticipating gold prices will snap back to the upside over the medium-term after undergoing a period of correction lower. A move above $1245 would indicate a breakdown in the head and shoulders pattern and pave the way back towards 2016 highs of $1285. A move above this level would indicate a resumption of the prevailing medium-term uptrend which is in the midst of a pullback and open up territory towards $1307.

Conclusion

Although the future of monetary policy in the United States hangs in the balance, Janet Yellen’s more dovish stance towards interest rates comes at a delicate time for the domestic and global financial environment. Rising inflation in the US and improving employment contrast sharply with other advanced and emerging economies which have had to embark on a prolonged period of accommodation. While the dollar has benefited greatly from more hawkish sentiment amongst some market participants and policymakers, Yellen gives pause for caution. Expectations of an imminent rate hike in the upcoming meeting have been severely reduced, paving the way for a temporary rebound in gold on the prospect of rates remaining low. However, while near-term prices could retreat, any prolonged postponing of policy normalization alongside emerging technical factors could very well contribute to sustained price momentum higher in gold over the medium-term.

Anyoption™ is the world's leading binary options trading platform. Founded in 2008, anyoption was the first financial trading platform that made it possible for anyone to invest and profit from the global stock market through trading binary options.

Our goal here at Market Oracle is to provide readers with valued insights and opinions on market events and the stories that surround them.

Website anyoption.com

© 2016 Copyright Anyoption - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.