The UK Auto Market Is Booming, So Is It a Sign of Economic Recovery?

Economics / UK Economy Mar 29, 2016 - 06:53 PM GMTBy: Nicholas_Kitonyi

The UK has been one of those economies that cannot exactly be classified as recovering or struggling over the last couple of years. To put it clear, the UK economy has not been as good as the US economy in terms of growth amongst the developed countries or as bad as the Euro Zone.

The UK has been one of those economies that cannot exactly be classified as recovering or struggling over the last couple of years. To put it clear, the UK economy has not been as good as the US economy in terms of growth amongst the developed countries or as bad as the Euro Zone.

The UK economy has been more or less stuck in the past few years with no significant movement either side of the growth curve. Nonetheless, one of the country’s key performance indicators in the manufacturing industry has shown some significant improvement, and recent numbers suggest that things could even get better in 2016 and 2017.

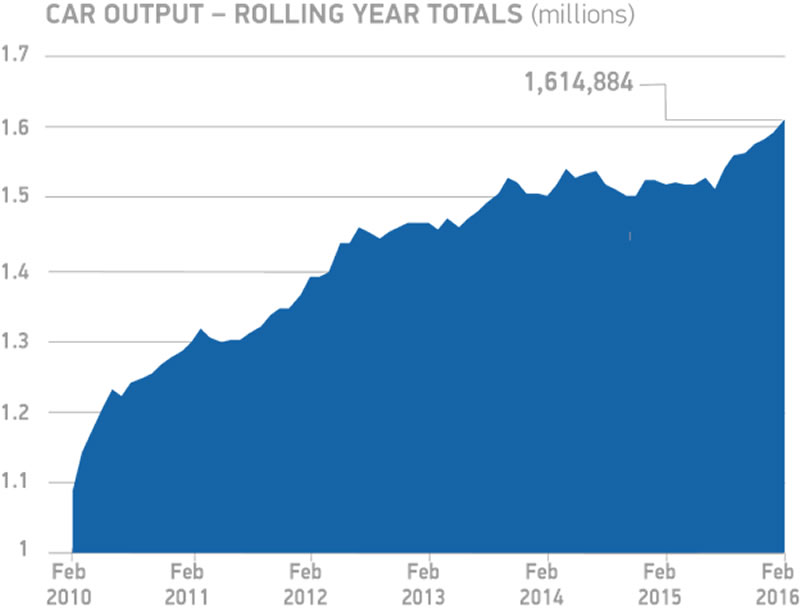

The UK car manufacturing output increased by 4% last year from 2014 and is now on course to post a double-digit growth for 2016 from the 2015 numbers. In February, the UK car manufacturing output jumped 13% from the same period last year while the year-to-date growth rate for the two months stood at 10%.

UK car market set to make history

According to the Society of Motor Manufactures and Traders, 146,955 cars were built in February, that is, 17,000 more than the number of cars built in February last year. This took the total number of cars built in the UK this year to 284,907. The number of cars sold last month meant that on paper, no inventory was left after exporting 104,880 and selling 42,075 in the domestic market for a total of 146,995.

Mike Hawes, SMMT chief executive, said: "The UK automotive industry's impressive growth continued into February, with demand from both domestic and overseas customers showing no signs of slowing. The outlook for the sector is bright, but much will depend on global political and economic conditions in the months and years to come."

Now, based on the current figures, the UK car automotive industry is on course to manufacture more than two million cars next year. This compares to about 1.6 million cars manufactured last year. The figure will also set a new record for the number of cars manufactured in the UK in a single year since the 1972 figure of 1.92 million.

Can UK car manufacturing numbers spur economic growth?

The overall UK economy relies on several factors, which means it would be naïve to assume that the current growth in car output could be mirroring the actual economic growth of the four member nations. Nonetheless, this could have a positive impact on other aspects of the economy. More sales means increased production, which in turn should create more employment opportunities and, or better wages.

In addition, this could also trigger a chain reaction whereby other companies like those involved in lending see increased activity. Cars play a major role in the lending industry in the UK as people use their logbooks to apply for credit. As such, elogbookloan a UK logbook loans company could see increased activity, which in turn could lead to an increment in private investments. Generally, when people borrow money to invest, this is likely to have a positive impact on the overall economy.

As of December 2015, the UK government had significantly reduced borrowing compared to the same period in the preceding fiscal year. However, with inflation still remaining low at about 0.3% below the target level of 2% and Bank of England base interest rate pegged at 0.50%, the credit market is still very attractive to borrowers.

Investors borrowing money now can easily invest it at attractive prices due to low inflation rates while the target of 2% level means that there is opportunity to gain massively should inflation rates reach that target.

The good news is that the car market appears to have set the stage for what is to come and given the fact that cars are seen as luxurious commodities even in the developed markets, the growth in the auto industry in the UK could be signaling a promising future for the overall economy.

Conclusion

Illustratively, the UK domestic car purchases numbers grew by nearly 25% in February, which compares to the car exports growth rate of about 9.1%. Again, this demonstrates that the UK car market could be set to start a chain reaction that could see the UK economic recovery reach another gear.

However, as mentioned, the UK car industry is just one fraction of a huge pie when it comes to factors that drive the UK economy. For instance, demand for clothing, which is part of the gigantic retail market in the UK fell by 0.4% sequentially last month while considerations for Brexit (Britain existing from the EU)could also cause a stutter in the UK economic recovery despite Moody’s ‘small impact prediction’.

By Nicholas Kitonyi

Copyright © 2016 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.