China Boasts Most Billionaires in the World and Makes For a Great Long Term Investment

Economics / Demographics Mar 29, 2016 - 08:53 AM GMTBy: Sol_Palha

"An ounce of patience is worth a pound of brains." ~ Dutch Proverb

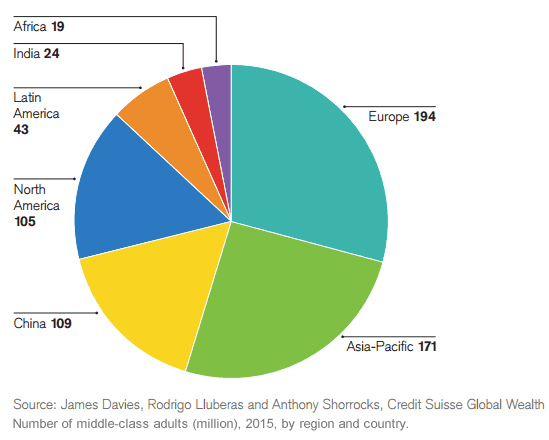

Our Asian edge Index and trend indicator clearly stated back in 2005, that China would lead the way in economic growth and eventually overtake the US in many areas. China now boasts the World's Largest Middle Class, and it is growing much faster than our Middle-Class.

According to Credit Suisse109 million, Chinese have savings network that ranges from $50,000 to $500,000. The momentum gained traction in 2000; since that time, China's Middle Class has grown at twice the U.S rate. To avoid changes such as unemployment, Credit Suisse, measured wealth rather than income. Hence, these numbers are quite shocking when you consider that the average worker in the U.S does not even have $5,000 in savings. Makes you wonder which country is 3rd world and which one is 1st world.

China accounts for a fifth of the World Population but accounts for 10% of the Global Wealth. In the years to come the pace will continue to increase, eventually propelling China to the number one place.

China has the World's second most Millionaires and is creating them at a faster rate than the U.S. Currently, China has more than one million millionaires. However, China now has the most billionaires In the World, and this means it's just a matter of time before they have the most millionaires too.

China added a stunning 242 billionaires in 2015, and if it maintains that pace, it could create even more this year. China now has 596 billionaires overtaking the U.S, which has 537 billionaires to take the top spot.

The Chinese are extremely adept at hiding their resources so that the actual billionaire count could be 2 or three times higher.

"Think of it like an iceberg, the tip of it is much smaller than the whole," he said. "We do our best to find [hidden money], but they go to such extraordinary lengths to hide it," lamented Rupert Hoogewerf.

The number of millionaires in China is projected to surge by over 70% and could top 2.3 million by 2020. A stunning new report from UBS and PricewaterhouseCoopers established that one new billionaire is being created every week. If that is not stunning then we don't know what is; note this is all going on during a supposedly strong recession.

Game Plan

If you are long term investor or someone with patience that can see the big picture, then the outlook is all but obvious. China is going to dominate the world for the next 100 years, and its markets will soar to heights that will appear insane by today's standards. At this point, it makes sense to compile a list of strong companies and slowly establish long term positions. Every emerging power ran into obstacles but in the long run, they prevailed. The trend is in place, long term China is destined to be the next superpower; it's not a question of if but when.

The Chinese also have a fondness for Gold, and as they also have the world's largest Middle class, expect demand for Gold to soar in the years to come.

"A mule will labor ten years willingly and patiently for you, for the privilege of kicking you once." ~ William Faulkner

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.